As promised in my last post, I took some time to go through Alibaba's previously announced Ant Financial equity transaction. (i.e. Alibaba's newly formed Subsidiary ends up with a 33% ownership interest in Ant Financial in exchange for some Intellectual Property and the elimination of the 37.5% profit sharing agreement.)

So let's get to it!

The Actual Deal Headline from the Alibaba PR Department Press Release reads as follows:

A couple of the key statements in the press release are as follows:

Now, let's take a minute to deploy our wildly popular, patented, high-tech Dick Fuld Banker-Speak Translator (BST). As you know, the BST has long been powered by Alibaba AI and for security reasons, has recently been moved to the Alibaba Cloud. Let's see what the Headline should have been:

Alibaba Agrees to Transfer Fake Subsidiaries and Bad Assets in Exchange for a Boatload of Promises-to-Pay and a 33% Equity Stake In Ant Financial, to be held in yet another Fake Kick-back Subsidiary.... Paving The Way For Huge Future Fake Asset Write-Ups

You're probably wondering how the BST could possibly come up with such an outrageous analysis given the clarity of the press release. I agree. High Tech Artificial Intelligence can yield unpredictable results. But unfortunately, like Alibaba's AI powered search for fake goods in their ecosystem, the results are what they are.

Well, lets take a deep breath, strap on our green eye-shades and get ready for a long painful discussion of the actual, nearly unreadable, 86 page 6K filing. I'd advise that you put on a coffee, a clean yellow legal pad so you can make notes, relax, clear in your mind and reference the sections of the filing as needed and described below..

Moreover, as you might suspect from my tone, the details in the filing seem to deviate remarkably from the press release. To be honest, given Jay Clayton's relationship with Alibaba, as one of the primary architects of this mess, and his current role as the Regulator-In-Chief of same, I can't believe the SEC has actually made this document available to the public. Jay's public recusal should be expected, immediate and appropriate.

Who are the Buyers and Sellers?

If you recall in my last post I mentioned the parties involved. Luckily, as far as we can tell, only a few of the roughly 700 +/- consolidated/related entities participated in the transaction. Generally speaking "Alibaba" is the "Seller" and "Ant" is the "Buyer". To refresh your memory, here's the list.

Which Agreements Are Being Modified?

Here's the list as described and referenced throughout the document:

2011 Commercial Agreement,

Amended Shared Services Agreement,

Cooperation Agreement,

Cross-License Agreement,

Data Sharing Agreement,

Framework Agreement,

Offshore IP Transfer Agreement,

Offshore IP Transfer Agreement,

SME Loan Know-How License Agreements,

Subscription Agreement,

Technology Services Agreement,

Trademark Agreement

Other Agreements as needed.

That seems pretty straight forward. The above agreements simply need to be updated to reflect this transaction between the few dozen of the companies/subsidiaries involved.

What's being Sold?

Now that we know who the "Buyers" and "Sellers" are, as well as the agreements which must be modified to facilitate this simple transaction, let's take a look at what's being sold. The Transaction is described in Article II, Sec. 2.1 of the Agreement, beginning on page 20. Alibaba subsidiaries, as described, are selling "Equity" (Sec. 2.1(a)) and "Assets" (Sec. 2.1(b))

The Equity to be sold (Sec. 2.1(a)) is comprised of:

The Assets to be sold (Sec. 2.1(a)) are comprised of:

It's typical in these agreements not to specifically describe the IP or Assets involved in the transfer, but the following disclosures on page 9 of the filing, in light of the press release, seem to be, well, a bit inconsistent:

Additionally, we note the following on page 32 of the filing:

......Purchaser shall incur obligations to pay or cause to be paid to the persons specified below (or another person designated by the Seller) ....... in consideration of the Guarantee Company (F82) Transfer, RMB 422,619,540 to be paid to Alibaba.com China (B42) and RMB 181,122,660 to be paid to Zhejiang Taobao (T51);

...... in consideration of the Chongqing Loan Company (F51) Transfer, RMB 2,574,936,000 to be paid to Hangzhou Ali Venture Capital (A54); and.....

......in consideration of the Libra Capital (A22) Transfer, US$155,181 to be paid to the Seller (the amounts set forth in this clause (a) in the aggregate, the “Finance Business Consideration”).

.......Retained Business Payment. Upon and in consideration of the Alipay Singapore E-Commerce (B15) Transfer (the “Retained Business”), the Purchaser shall incur obligations to pay or cause to be paid to Silverworld Technology (B17) US$6,307,989 (the “Retained Business Payment”) at the times set forth in Section 2.6 (or at such earlier times as the Purchaser may elect in its sole discretion).

Oddly enough, as you recall, the press release stated that "There will be no cash impact to Alibaba following completion of the transaction."

When we add the payments due from Ant Financial described in red above, we calculate, at the current exchange rate (6.34:1) a payment due to Alibaba of US$ 2.433 Billion. for the Equities and Assets transferred. How can this be? I thought this was a non-cash transaction?

"Internal Financing"

The answer, as far as we can tell, lies somewhere in the "Funding" Section of the agreement. (Sec. 2.4 thru 2.9 of the agreement (page 32 thru 37)). There are all sorts of "Funding Methods" described as to how Ant is going to pay Alibaba the US$ 2.433 Billion for the above described Equities/Assets. Sec 2.6 (a)(i)(A thru F). Certain payments are made at certain times for certain things. The terms range from "due at closing" to "sometime in the future".....here are a few of the terms:

....Upon the earliest of (i) the second anniversary of the Closing, (ii) the Purchaser Qualified IPO and (iii) the Alipay Qualified IPO, the Purchaser shall pay any remaining amount of the Finance Business Consideration that has not been paid pursuant to the preceding sentence.

.....the “Funded Amount Shortfall”),which may be repaid by the Purchaser......as determined by mutual agreement of Purchaser and the Alibaba Independent Committee no later than the earlier of (i) the one (1) year anniversary of a Purchaser Qualified IPO and (ii) the five (5) year anniversary of the date of the incurrence of the Purchaser’s obligation to pay the Funded Amount Shortfall

Section 2.6(b) ends with the following:

For the avoidance of doubt, the list of funding methods set forth above is not intended to include all possible funding methods and the unavailability or lack of feasibility of one or more (including all) of the listed funding methods shall not relieve and shall not be deemed to relieve the Purchaser, in any respect, of its obligation to fund the Funded Amount.

That's comforting.....I'm glad they have this all figured out, are looking after US Shareholders and have eliminated any doubt(s).

If I were to guess, and really, that's all we can do, I'd guess that the US$2.4 Billion is somewhere around the book value of all of the "junk" assets transferred to Ant so Alibaba does not have to recognize a gain or loss on the transfer. The press release touted that there is no "cash impact" because the transaction is internally financed. Of course, this type of transaction screams for another deployment of the BST!......Here's what's the Alibaba Management Team is up to.

"We gotta get US$2.4 Billion of Bad Loans and Capitalized Intellectual property off the books before this blows up. This crap should have been expensed/written-off long ago but we didn't want it to hit the bottom line. Now we've came up with this cockamamie scheme to 'sell' this junk to Ant. Nobody would finance this mess so we are just taking back whatever cash we can scrape up and Ant's promise to pay at some point in the future. So we've converted US$2.4 Billion of financial vapor to a 'rock solid' commitment from a related piggy bank that US Shareholders know nothing about! Genius"

Issuance of Ant Financial Securities (the 33% Stake)

The issuance of the Ant Financial 33% stake to a newly formed "Seller Designated Investment Entity" is described in Sec. 2.3 (pages 27 thru 32). I'd assume that the "Seller Designated Investment Entity" would be wholly owned by Alibaba and a fully consolidated entity, but as we've seen in the past, all sorts of "surprise ownership" interests tend to pop up in these deals and the Agreement, unfortunately, is silent as to the ownership of this new Investment Entity. All we know for sure is that "within seventy-five (75) days following the Amendment Date, the Seller shall, and shall cause its Subsidiaries, to establish the Seller Designated Investment Entity" (page 31) Luckily, US shareholders are used to these "dilution-al" interests just popping up from time to time. so it's probably no big deal.

So let's take a look at where we're at so far....here's a very summarized chart of the transaction:

Summary of the transaction's Balance Sheet impact:

Note that the above transaction creates $4.8 Billion in new Balance Sheet book value. $2.4 Billion in Ant for the 33% Equity Issued and $2.4 Billion in the "New Entity". Interestingly, no additional economic value has been created and no outside funding or resources enter the picture. We're just moving journal entries around and creating "equity" and book value.

Ok?....so far so good? Let's Continue?

Educated guesses....

$100 Billion valuation....Tha Alibaba P/R Department is once again working Overtime.

https://www.cnbc.com/2018/02/09/ant-financial-to-raise-5-billion-in-equity.html

So let's get to it!

The Actual Deal Headline from the Alibaba PR Department Press Release reads as follows:

Alibaba Group Agrees to 33% Equity Stake in Ant Financial

I'll bet Jack had a tough time negotiating with himself, managing all of the legal and accounting talent, hell bent to protect his interests on both sides of the transaction. Those long, grueling, stressful sessions in the board room, watching Jack manage cutthroat accountants and lawyers, who without his guidance, would have surely come to blows, must have been inspiring. I heard Jack drives a hard bargain, but they finally got this done. I hope he wasn't too hard on himself.A couple of the key statements in the press release are as follows:

- The parties have agreed to certain amendments to their 2014 transaction agreements to facilitate the transaction.

- There will be no cash impact to Alibaba following completion of the transaction.

- Alibaba will acquire newly-issued equity from Ant Financial in exchange for certain intellectual property rights owned by Alibaba exclusively related to Ant Financial.

- The companies will terminate the current profit-sharing arrangement under which Ant Financial pays royalty and technology service fees in an amount equal to 37.5% of its pre-tax profits to Alibaba.

Now, let's take a minute to deploy our wildly popular, patented, high-tech Dick Fuld Banker-Speak Translator (BST). As you know, the BST has long been powered by Alibaba AI and for security reasons, has recently been moved to the Alibaba Cloud. Let's see what the Headline should have been:

Alibaba Agrees to Transfer Fake Subsidiaries and Bad Assets in Exchange for a Boatload of Promises-to-Pay and a 33% Equity Stake In Ant Financial, to be held in yet another Fake Kick-back Subsidiary.... Paving The Way For Huge Future Fake Asset Write-Ups

You're probably wondering how the BST could possibly come up with such an outrageous analysis given the clarity of the press release. I agree. High Tech Artificial Intelligence can yield unpredictable results. But unfortunately, like Alibaba's AI powered search for fake goods in their ecosystem, the results are what they are.

Well, lets take a deep breath, strap on our green eye-shades and get ready for a long painful discussion of the actual, nearly unreadable, 86 page 6K filing. I'd advise that you put on a coffee, a clean yellow legal pad so you can make notes, relax, clear in your mind and reference the sections of the filing as needed and described below..

Moreover, as you might suspect from my tone, the details in the filing seem to deviate remarkably from the press release. To be honest, given Jay Clayton's relationship with Alibaba, as one of the primary architects of this mess, and his current role as the Regulator-In-Chief of same, I can't believe the SEC has actually made this document available to the public. Jay's public recusal should be expected, immediate and appropriate.

Who are the Buyers and Sellers?

If you recall in my last post I mentioned the parties involved. Luckily, as far as we can tell, only a few of the roughly 700 +/- consolidated/related entities participated in the transaction. Generally speaking "Alibaba" is the "Seller" and "Ant" is the "Buyer". To refresh your memory, here's the list.

Which Agreements Are Being Modified?

Here's the list as described and referenced throughout the document:

2011 Commercial Agreement,

Amended Shared Services Agreement,

Cooperation Agreement,

Cross-License Agreement,

Data Sharing Agreement,

Framework Agreement,

Offshore IP Transfer Agreement,

Offshore IP Transfer Agreement,

SME Loan Know-How License Agreements,

Subscription Agreement,

Technology Services Agreement,

Trademark Agreement

Other Agreements as needed.

That seems pretty straight forward. The above agreements simply need to be updated to reflect this transaction between the few dozen of the companies/subsidiaries involved.

What's being Sold?

Now that we know who the "Buyers" and "Sellers" are, as well as the agreements which must be modified to facilitate this simple transaction, let's take a look at what's being sold. The Transaction is described in Article II, Sec. 2.1 of the Agreement, beginning on page 20. Alibaba subsidiaries, as described, are selling "Equity" (Sec. 2.1(a)) and "Assets" (Sec. 2.1(b))

The Equity to be sold (Sec. 2.1(a)) is comprised of:

- Designated Alibaba Subsidiaries will transfer 100% of Guarantee Company (F82) to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Chongqing Loan Company (F51) to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Libra Capital (A22) to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Alipay Singapore E-Commerce (B15) to Ant Financial.

The Assets to be sold (Sec. 2.1(a)) are comprised of:

- Designated Alibaba Subsidiaries will transfer SME Loan Assets to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Onshore Stage 1a Retained IP to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Onshore Stage 1b Retained IP to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Offshore Stage 1a Retained IP to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Offshore Stage 1b Retained IP to Ant Financial.

- Designated Alibaba Subsidiaries will transfer 100% of Onshore Stage 1b Retained IP to Ant Financial.

It's typical in these agreements not to specifically describe the IP or Assets involved in the transfer, but the following disclosures on page 9 of the filing, in light of the press release, seem to be, well, a bit inconsistent:

“Offshore Stage 1a Retained IP Value” means an amount equal to RMB 11,459,466,000.00.

“Offshore Stage 1b Retained IP Value” means an amount equal to RMB 2,436,200.00.

“Onshore Stage 1a Retained IP Value” means an amount equal to RMB 741,834,000.00.

“Onshore Stage 1b Retained IP Value” means an amount equal to RMB 56,000.00.

Additionally, we note the following on page 32 of the filing:

......Purchaser shall incur obligations to pay or cause to be paid to the persons specified below (or another person designated by the Seller) ....... in consideration of the Guarantee Company (F82) Transfer, RMB 422,619,540 to be paid to Alibaba.com China (B42) and RMB 181,122,660 to be paid to Zhejiang Taobao (T51);

...... in consideration of the Chongqing Loan Company (F51) Transfer, RMB 2,574,936,000 to be paid to Hangzhou Ali Venture Capital (A54); and.....

.......Retained Business Payment. Upon and in consideration of the Alipay Singapore E-Commerce (B15) Transfer (the “Retained Business”), the Purchaser shall incur obligations to pay or cause to be paid to Silverworld Technology (B17) US$6,307,989 (the “Retained Business Payment”) at the times set forth in Section 2.6 (or at such earlier times as the Purchaser may elect in its sole discretion).

As usual, there are all sorts of additional "expense", "tax" and transaction cost offsets described in the agreement. The agreement also makes it clear that all taxes (if any) associated with the transaction will be the responsibility of Ant Financial.

When we add the payments due from Ant Financial described in red above, we calculate, at the current exchange rate (6.34:1) a payment due to Alibaba of US$ 2.433 Billion. for the Equities and Assets transferred. How can this be? I thought this was a non-cash transaction?

"Internal Financing"

The answer, as far as we can tell, lies somewhere in the "Funding" Section of the agreement. (Sec. 2.4 thru 2.9 of the agreement (page 32 thru 37)). There are all sorts of "Funding Methods" described as to how Ant is going to pay Alibaba the US$ 2.433 Billion for the above described Equities/Assets. Sec 2.6 (a)(i)(A thru F). Certain payments are made at certain times for certain things. The terms range from "due at closing" to "sometime in the future".....here are a few of the terms:

....Upon the earliest of (i) the second anniversary of the Closing, (ii) the Purchaser Qualified IPO and (iii) the Alipay Qualified IPO, the Purchaser shall pay any remaining amount of the Finance Business Consideration that has not been paid pursuant to the preceding sentence.

.....the “Funded Amount Shortfall”),which may be repaid by the Purchaser......as determined by mutual agreement of Purchaser and the Alibaba Independent Committee no later than the earlier of (i) the one (1) year anniversary of a Purchaser Qualified IPO and (ii) the five (5) year anniversary of the date of the incurrence of the Purchaser’s obligation to pay the Funded Amount Shortfall

Section 2.6(b) ends with the following:

For the avoidance of doubt, the list of funding methods set forth above is not intended to include all possible funding methods and the unavailability or lack of feasibility of one or more (including all) of the listed funding methods shall not relieve and shall not be deemed to relieve the Purchaser, in any respect, of its obligation to fund the Funded Amount.

That's comforting.....I'm glad they have this all figured out, are looking after US Shareholders and have eliminated any doubt(s).

If I were to guess, and really, that's all we can do, I'd guess that the US$2.4 Billion is somewhere around the book value of all of the "junk" assets transferred to Ant so Alibaba does not have to recognize a gain or loss on the transfer. The press release touted that there is no "cash impact" because the transaction is internally financed. Of course, this type of transaction screams for another deployment of the BST!......Here's what's the Alibaba Management Team is up to.

"We gotta get US$2.4 Billion of Bad Loans and Capitalized Intellectual property off the books before this blows up. This crap should have been expensed/written-off long ago but we didn't want it to hit the bottom line. Now we've came up with this cockamamie scheme to 'sell' this junk to Ant. Nobody would finance this mess so we are just taking back whatever cash we can scrape up and Ant's promise to pay at some point in the future. So we've converted US$2.4 Billion of financial vapor to a 'rock solid' commitment from a related piggy bank that US Shareholders know nothing about! Genius"

Issuance of Ant Financial Securities (the 33% Stake)

The issuance of the Ant Financial 33% stake to a newly formed "Seller Designated Investment Entity" is described in Sec. 2.3 (pages 27 thru 32). I'd assume that the "Seller Designated Investment Entity" would be wholly owned by Alibaba and a fully consolidated entity, but as we've seen in the past, all sorts of "surprise ownership" interests tend to pop up in these deals and the Agreement, unfortunately, is silent as to the ownership of this new Investment Entity. All we know for sure is that "within seventy-five (75) days following the Amendment Date, the Seller shall, and shall cause its Subsidiaries, to establish the Seller Designated Investment Entity" (page 31) Luckily, US shareholders are used to these "dilution-al" interests just popping up from time to time. so it's probably no big deal.

So let's take a look at where we're at so far....here's a very summarized chart of the transaction:

Summary of the transaction's Balance Sheet impact:

- Alibaba exchanges $2.4 Billion of "Junk Assets" for an equal value of Cash and Obligations Receivable (C&OR) No change in total Balance Sheet valuation from this transaction.

- Ant Financial Exchanges $2.4 Billion for C&OR for an equal amount of "Junk Assets". No change in Ant's Balance Sheet from this transaction.

- Ant Financial exchanges 33% Ownership for C&OR. Balance Sheet increases by $2.4 Billion. Debit to C&OR, Credit to Capital.

- Alibaba exchanges $2.4 Billion C&OR for Interest in New Entity. No change in Balance Sheet value. Debit to "Investees" and Credit to C&OR.

- "New Entity" book value is $2.4 Billion. Debit to "Investees" and Credit to Capital.

Note that the above transaction creates $4.8 Billion in new Balance Sheet book value. $2.4 Billion in Ant for the 33% Equity Issued and $2.4 Billion in the "New Entity". Interestingly, no additional economic value has been created and no outside funding or resources enter the picture. We're just moving journal entries around and creating "equity" and book value.

Ok?....so far so good? Let's Continue?

The Accounting:

Although the above are just guesses as to what's going to be reflected on the next 6-K, I'm sure that a transaction of this magnitude was well thought through (or not) and the Alibaba Accounting Department has absolutely nailed down the exact valuations of the Intellectual Property to be transferred as well as the current book/carrying value of same. They've also undoubtedly established the value of their brand new 33% Interest in Ant Financial (Just like they eventually did with Alibaba Pictures, Alibaba Health, Cainiao and the other forty or so acquisitions where they booked huge gains, locked in Amber, in the dark of night on the Alibaba balance sheet.

Unfortunately, none of these values or the underlying methodology are fully discussed in the filing, so we'll just have to make some more educated guesses as to the impact on the financial statements, once the initial funding round(s) commence.

On the other hand, the Alibaba PR department is absolutely on top of their game and, as usual, way ahead of the Alibaba Accounting department, immediately leaking to CNBC and other outlets, through unnamed sources, that based on the next $5 Billion (5%) funding round, the valuation of Ant Financial will be roughly $100 Billion! Can you imagine the wealth that has been generated overnight because of this funding! Every Alibaba shareholder is destined to be rich beyond his/her wildest dreams.

Hypothetically, of course, here's how these "funding rounds" go. Analysis is again provided by the (BST).

What Are Ant Financial's Earnings?

Luckily since everything is absolutely accurate and transparent in Alibaba's SEC filings, even though they don't describe this expense/accrual in the quarterly 6-K's, we can easily scroll through the most recent 20-F and zero-in on the exact annual amount that Ant Financial is crediting to Alibaba for the 37.5% Profit Sharing Agreement (and thereby calculate the pre-tax income of Ant Financial):

(Conveniently located at F-90, on page. 323 of the filing)

22. Related party transactions (Continued) (i)

In 2011, the Company entered into an Intellectual Property License and Software Technology Services Agreement with Alipay whereby the Company licenses certain intellectual property and provides certain software technology services to Alipay in exchange for a royalty fee and software technology services fee in an amount equal to the costs incurred by the Company in providing the software technology services plus 49.9% of the consolidated pre-tax income of Alipay and its subsidiaries (Note 4(b)), effective from December 2011. In 2014, the Intellectual Property License and Software Technology Services Agreement was terminated and the Company entered into the amended Alipay IPLA with Ant Financial Services. Under the amended Alipay IPLA, the Company receives the Profit Share Payments amounting to the sum of an expense reimbursement plus 37.5% of the consolidated pre-tax income of Ant Financial Services, subject to certain adjustments (Note 4(b)), effective from August 2014.

Royalty fee and software technology services fee under the Intellectual Property License and Software Technology Services Agreement and the Profit Share Payments were recognized in consolidated income statements, net of the costs incurred for the provision of the software technology services reimbursed by Alipay. The amounts reimbursed by Ant Financial Services to the Company were RMB486 million, RMB274 million and RMB245 million for the years ended March 31, 2015, 2016 and 2017, respectively.

....Geeezzz......that's weird...nowhere in the 20-F do they come right out and say that the Profit Sharing Amount (37.5% of Ant Financial's Pre-Tax Income) paid to Alibaba is exactly $xxx.xx. That would have been really helpful and so easy to do. Everything Alibaba management seems to report is always hidden, questionable and subject to adjustments and offsets.

Here's the schedule that should have been produced and included in the 20-F....and every 6-K for that matter:

So, let's give Alibaba Management the benefit of the doubt. Alipay, with it's more than 900 million registered users (per Jack in his Lara Logan Interview in 2014), is the very definition of a monopolistic/mature business. Moreover, even though Joe Tsai makes interesting comments like "Alipay daily active users have more than doubled in the current quarter" (min 36:20 of the 2/1/18 investor call) it would have been nice to know what the number of Alipay users actually is what they've "doubled from". Let's say, simply for the sake of argument and by all anecdotal accounts that Alipay is indeed ubiquitous in China. Like a swarm of locusts, it's everywhere. Consequently, meteoric, start-up-like growth should be a distant glimmer in the rear view mirror and revenue and income growth, like any established financial firm, will be joined at the hip to the Chinese economy.

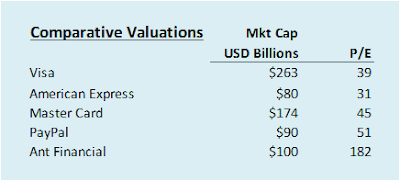

If we give management the benefit of the doubt and assume that all of the RMB1,841 is attributable to the 37.5% "Profit Sharing" which is absolutely not guaranteed given all of the evolving terminology, obfuscation, offsets, adjustments and weasel words described in the above footnotes #4 and #22, we can try to back into Ant's Before Tax Net Income ($714 Million), apply a tax rate (Alibaba's tax rate is 23%) to Calculate/Estimate "Earnings" ($549 Million) and a P/E. At a $100 Billion Market Cap we calculate a P/E of 182. Hmmmm.....seems a bit pricey to me.

When we compare Ant Financial's estimated P/E of 182 at a $100 Billion Market Cap to a few other prominent Payment Processors, we can conclude that the $100 Billion value might indeed be a tad steep. As described, even if we assign a historically high P/E of 30, that would peg the valuation at $16.6 Billion.....a far cry from the Alibaba PR Department's press release

As far as I can tell, the first representation, by Alibaba Management, as to the "notional value" of Ant Financial came via a schedule and footnote in the May 5th, 2016 Investor Presentation (Page 23) just last year. Footnote below:

http://www.alibabagroup.com/en/ir/presentations/pre160505.pdf

(3) Ant Financial valuation based on reported valuation of USD 60 billion in media; Alibaba Group receives 37.5% of Ant’s pre-tax income now, and if regulations allow, Alibaba Group is entitled to acquire up to a 33% equity interests in Ant Financial. For conservative purpose, 33% is used in calculating Alibaba Group’s economics in Ant Financial here.

As I mentioned at the time, this, I believe, was the first time in history that an SEC filing claimed that Bloomberg/"Media" was the source of a $60 Billion Asset valuation. Generally, since contra to popular opinion, news outlets don't just make things up, it would not be a reach to presume that these valuations are most likely the product of the Alibaba PR Machine, issued through anonymous, unnamed sources.

Alibaba's Financial Statements After the "Funding Round"

So let's say, just for fun, that the US$5 Billion funding round happens in the next quarter. Let's say that somehow, Alibaba Management actually convinces PWC that the funding round actually meets IFRS Criteria for revaluation and write up. I smell a big accounting fee coming!

To that end, I've listed the proposed Journal Entry and revised Balance Sheet Below, all things being equal, as if the transaction had taken place in the last quarter. My hands were actually trembling from the absurdity as I was typing up the schedule:

Based on the above we see that back in 2014, after roughly fifteen years in existence, after all of that effort, Alibaba had accumulated only US$18 Billion in Book Value, had virtually no retained earnings to speak of ($190 Million) and, by all accounts, had maxed out their lines of credit. Simultaneously, by some fortuitous, amazing, happenstance, Alibaba Management hooked up with Jay Clayton, Sullivan & Cromwell, US & Swiss Investment Bankers and in less than four years, based on the above projections of the presumed re-valuation of Ant Financial, Alibaba will have created more than US$142 Billion in Book Value.

Further note that in a preemptive effort to cut off the trolls, I freely admit that I know absolutely nothing about Chinese Tax Law, so the $5 Billion Deferred Tax impact is purely a guess. The provision is for illustrative purposes only. For you Chinese Tax Pros out there, feel free to make that entry whatever you'd like it to be.

As we can see, most of the book value, will continue to be, as I've long opined, housed in opaque, overvalued "Questionable Assets" (Investments & Securities relating to "Investees". Intangibles, Goodwill & Land Use Rights), which, if Alibaba Management actually has the testicular fortitude to value Ant Financial at $100 Billion, would bring "Questionable Assets" up to US$89 Billion (63% of the balance sheet). Also keep in mind that the "Newly Formed Entity" will be written up as well based on the increase in the Ant Valuation. So, if they can actually pull this off, $66 Billion in additional Book Value (i.e. collateral) and $56 Billion of Additional "Equity" would be created as well. Also remember, when we write something up (e.g. Alibaba Pictures, Cainiao, Alibaba Health, etc.) we can always book valuation gains that hit the Income Statement. So income of $56 Billion would be created, out of thin air, overnight, as well!

Oddly, there is absolutely no change in the underlying businesses. The same fake goods are being sold and paid for via the same Alipay accounts. The same bad micro-loans and WMP's are being written and the same rapidly expanding credit risk continues to be hidden. Absolutely no new "Economic Value" has been created by the Alibaba/Ant "Acquisition" transactions.

I ABSOLUTELY LOVE IFRS ACCOUNTING!!

OPTIONAL READING: WHY JAY CLAYTON SHOULD PUBLICLY RECUSE HIMSELF FROM ANY ONGOING OR FUTURE ALIBABA INVESTIGATION.

Revisiting a Relevant Prior Post

Last week, a couple of my readers revisited a really fun, June 2016 post I had done (long before Jay Clayton was being considered for the SEC Chairmanship) and they called it to my attention. I had forgotten about its relevance for the most part until they reminded me of just how pertinent it has become in light of the silliness and possible financial misrepresentations that I've described above.

The post, in my humble opinion, took a light-hearted, humorous, yet moderately pissed-off look at the now presumably tainted relationship between Jay Clayton, who had been privy to and presumably instrumental in drafting/designing the Alibaba Responses to the SEC inquiries on the "Simon Xie "deals back in the day. ("Simon Xie" aka Xie Shihuang is one of the current "Framework Parties" in the Ant Deal.) Again, now that Jay is in charge of the regulation of this ticking time bomb, I felt that we should absolutely revisit same. When you click on the Alibaba Correspondence please note that Mr. Clayton is either the author of, or copied on, each ludicrous document/response.

******************************************************************

Link to the June 2016 Post - Go to "SEC Process". Relevant Text Below

https://deep-throat-ipo.blogspot.com/2016/06/follow-up-thoughts-on-i-would-never.html

SEC Process

These investigations, again, by their very nature are private matters. Both the SEC and the subject of the investigation normally make no public disclosures, nor do they have anything to gain by doing so. However, we might be able to shed some light on the process by combing through the correspondence leading up to the IPO. I've attached a few of the documents below for your review if you choose to take the time:

Example - 60 page SEC document Q&A 6/16/14 Response to 5/6/14 F1 fiing.

https://www.sec.gov/Archives/edgar/data/1577552/000119312514237452/filename1.htm

Example - 35 page SEC document Q&A 7/11/14 response to 7/3/14 Amended F1

https://www.sec.gov/Archives/edgar/data/1577552/000119312514266474/filename1.htm

Correspondence - 8/6/14

https://www.sec.gov/Archives/edgar/data/1577552/000119312514298625/filename1.htm

Correspondence - 8/12/16

https://www.sec.gov/Archives/edgar/data/1577552/000119312514306858/filename1.htm

Correspondence 8/22/14

https://www.sec.gov/Archives/edgar/data/1577552/000119312514318466/filename1.htm

Without getting into the gory details, I'll discuss the general format of the Q&A and then interpret some of my favorite interrogatories through the magic of my Dick Fuld Banker Speak Translator (BST) (patent pending):

Q&A Format:

SEC: "Dear Alibaba Management & Counsel, we see you've disclosed/described (Insert odd, unsupported metric here) which may or may not have a bearing on (Insert odd, unsupported additional metrics here).

BABA Respondent: "Thank you for the wonderful, insightful question" From this point the response takes one (or more) of the following three possible directions:

Now, as promised, lets run a few of my favorite interrogatories through the BST and see what we get:

This one addresses a US$1 Billion dollar "loan" of Alibaba funds to be made directly to Simon Xie, Jack's buddy for "strategic investment purposes". (Page 3 of the August 12th, 2014 Correspondence cited above)

SEC: We note the disclosure on page 226 regarding the RMB6.5 billion loan arrangement with Simon Xie. We also note that a company controlled by Jack Ma will serve as a general partner of the PRC partnership that will receive indirectly the proceeds of such loan. Please provide us with a detailed analysis of the nature of the loan and the extent to which the provisions of Section 13(k) of the Exchange Act are applicable to the loan. Your analysis should address both Mr. Xie and Mr. Ma.

SEC - BST - WTF??.....you are taking $1 Billion of Shareholder money and giving it to Jack's buddy? Is this thing Jack Ma's own personal piggy bank?

I'm not going to bother posting the entire Alibaba response. It's long winded and barely understandable. You can certainly muddle through the filing if you are so inclined. However, to keep things moving, here's the BST version of what they said:

Alibaba Respondent: - BST "Ohhhh!.....I see what you are getting at. You've got it all wrong. Here's what's really going on. The loan to Simon isn't a 13(k) 'personal' loan....it's a 'business' loan! See, even though the money is going to him, Simon is going to take the money and contribute it to a partnership that he and Jack have cooked up, and once the money is sufficiently laundered, the partnership is going to 'invest' it in Wasu Media, since Wasu media has a strategic relationship with Alibaba. Jack isn't getting the money (It's going to a partnership) so he's not in violation of 13(k) either! That's why we did it this way!....That way, Jack and Simon get a billion dollar loan, they can do whatever they want with the proceeds, maybe invest in Wasu, maybe not. Moreover Simon isn't a qualifying executive under 13(k)...he's not a director or 'senior' manager.....we just want to give him a BILLION DOLLARS since he's a good guy.....he's just one of five 'strategic' vice presidents! Who knows, if this works we might give all five of them a BILLION DOLLARS each! US Shareholders are really generous that way. That way all of the VP's can get access to Billions of US Shareholder Dollars, for 'strategic purposes', pay the interest from loan principal until the investments pay off (or not) and nobody is the wiser! Isn't this an AWESOME IDEA! If you guys sign off on this one we will be actively looking for homeless people to start partnerships with Jack. We understand that in America you can go to jail for things like this, but in China it's SOP. We're sure glad you understand how this works now. Thanks for asking about it."

Here's a follow up on pg 7 of the same August 12th, 2014 Document.

SEC: Please address in this risk factor any potential material conflicts of interest between you and Simon Xie and expand this risk factor to discuss any potential material conflicts of interest resulting from the manner in which you plan to invest in Wasu Media Holdings Co., Ltd. It appears that the disclosure required by Item 6.A of Form 20-F is applicable to Simon Xie. In this regard, we note your apparent dependence upon Mr. Xie based on his role as one of your founders and as a member of your management, as well as his equity interests in Alipay, your material VIEs, and the partnership through which you plan to invest in Wasu Media Holdings Co. Please provide the disclosure required by Item 6.A of Form 20-F and in doing so disclose Mr. Xie’s roles and responsibilities in your company and where Mr. Xie falls within your management structure.

SEC - BST: "So you are making the loan to the partnership owned by Simon, Jack and Yuzhu Shi? The partnership is going to buy the stock of Wasu media? That's the same Yuzhu Shi, the guy who went bust trying to build the tallest skyscraper in China (that was never actually built) and then took a video game company, Giant Interactive public on the NYSE, raised $1 Billion on the IPO, milked it for all it was worth and took it private in China at a deep discount with US Shareholders left holding the bag?.......is that the same Yuzhu Shi that you are jumping into bed with on both Wasu and Yunfeng Capital?? And you don't see any conflict of interest here? Really?"

Here's the BST version of the Alibaba Response:

Alibaba Respondent: - BST "Wowww....you guys are really sharp! You've actually read through the whole filing and you know your securities law to boot! Ok, here's what's really going on. You think that Simon actually works here and that his employment would make him an employee 'upon whose work the company is dependent' as defined in Item 6.A of Form 20-F. Again, you've got it all wrong. Simon, is a peon, a nobody, he pushes a broom around and occasionally opens the mail....that's it! In fact, if you don't let us structure this deal this way we're going to fire his sorry ass so that there is absolutely no conflict under 13(k). Of course, we're still going to give him a Billion dollars, just 'cuz we want to and you can't stop us. Moreover, Yuzhu Shi is a wealthy visionary and great man. He was able to amass a tremendous fortune by creating fake businesses out of nothing, pulling all of the cash out of them and selling the decaying shells to suckers....uh....I mean fortunate investors. Anyway, all of these people are safe in China and you have no jurisdiction over them. So mind your own beeswax."

The May 26th, 2016 20-F

Fast forward to the 20F - pg 40. They did indeed "fire his sorry ass" to conform to 13(k) on this loan. I guess the other four "Strategic VP's" could easily pick up the slack. However, it looks like the actual structure of the deal has changed significantly. Per the recent 20-F, the RMB 6.9 Billion (US$1.06 Billion) loan was actually made to Simon by an unnamed PRC Bank. Alibaba pledged RMB 7.3 Billion (US$1.12 Billion) of "Wealth Management Products" which are presumably carried on their balance sheet somewhere to guarantee the loan. Alibaba also set up a RMB 2.0 Billion (US$ 300 Million) Credit Facility to Simon so he can afford to pay the substantial interest on the bank loan.

Here are a couple of questions I might ask about this reconstituted transaction if I were one of the SEC attorneys investigating this mess:

Note: Wasu is a public company on the Shanghai Stock exchange. On the date of the SEC Correspondence (August 12th, 2014) it was trading at $29/share. It hit a high of $59/share in June of 2015 (Before the crash) and it's trading at $19/share today (a 33% haircut from August 2014). The Market Cap today is about $4 Billion (Down from $6 Billion). We don't know anything about the financial prospects of Wasu or the Ma, Xie, Shi partnership. The only things we are certain of :

**************************************************************************

To cap off the Simon Xie discussion, one of my well informed readers also posted:

BREAKING NEWS!

Dateline 2/20/18 - Guangzhou - Today, it was announced by unnamed sources familiar with the deal that Alibaba (NYSE:BABA), along with a consortium of unnamed investors, has entered into a definitive agreement in principle to acquire "Germany". The deal will be accomplished through multiple funding rounds where the first such transaction is structured to be completed by the end of 2019. The company is expected to purchase 0.001% of Germany for US$1 Billion, valuing the German economy at US$100 Trillion, which will be immediately reflected in the Alibaba financial statements regardless of whether the deal actually closes or not. Joe Tsai was heard to say, again through unnamed sources, that:

"Germany will be an integral part of Alibaba's eCommerce ecosystem. If all goes as expected with our Germany acquisition, we fully anticipate moving ahead, acquiring and integrating Australia into our 'New Retail' model sometime prior to 2025."

BABA's stock was up $35.00 in active trading on the announcement. Angela Merkel was unavailable for comment.

******************************************************************************

Additional Reading

$60 Billion Valuation - Forbes, April 2014

https://www.forbes.com/sites/annrutledge/2016/04/27/the-case-for-valuing-ant-financial-at-usd-60-billion/#4b22602b218a

Bloomberg Article, June 2017 - Ant worth $74.5 Billion using the RMB 2,086 "Profit Sharing Figure" Alibaba Management - "No Comment".

https://www.bloomberg.com/news/articles/2017-06-22/jack-ma-s-ant-financial-nearly-doubles-profits-amid-deal-push

$100 Billion valuation as of 2/9/18....The Alibaba P/R Department is once again working Overtime.

https://www.cnbc.com/2018/02/09/ant-financial-to-raise-5-billion-in-equity.html

Financial Times Analysis - Alibaba/Ant Deal

https://www.ft.com/content/6e3c2c1a-0769-11e8-9650-9c0ad2d7c5b5

The 86 page, February 1st, 2018 "Amendment to Share and Asset Purchase Agreement" filing.

Although the above are just guesses as to what's going to be reflected on the next 6-K, I'm sure that a transaction of this magnitude was well thought through (or not) and the Alibaba Accounting Department has absolutely nailed down the exact valuations of the Intellectual Property to be transferred as well as the current book/carrying value of same. They've also undoubtedly established the value of their brand new 33% Interest in Ant Financial (Just like they eventually did with Alibaba Pictures, Alibaba Health, Cainiao and the other forty or so acquisitions where they booked huge gains, locked in Amber, in the dark of night on the Alibaba balance sheet.

Unfortunately, none of these values or the underlying methodology are fully discussed in the filing, so we'll just have to make some more educated guesses as to the impact on the financial statements, once the initial funding round(s) commence.

On the other hand, the Alibaba PR department is absolutely on top of their game and, as usual, way ahead of the Alibaba Accounting department, immediately leaking to CNBC and other outlets, through unnamed sources, that based on the next $5 Billion (5%) funding round, the valuation of Ant Financial will be roughly $100 Billion! Can you imagine the wealth that has been generated overnight because of this funding! Every Alibaba shareholder is destined to be rich beyond his/her wildest dreams.

Hypothetically, of course, here's how these "funding rounds" go. Analysis is again provided by the (BST).

- Jack & Joe call some of their buddies (Softbank, CITC, Temasek, Sequoia, Tencent, Evergrande, Wanda, etc.....the "usual suspects") and make the pitch...."Hey we have this amazing opportunity for you to get in on the ground floor of this once in a lifetime deal....yadayadayada.... We want to sell you 5% of Ant Financial at a really inflated price and we'll make it worth your while. We will 'lever up' and book some big time 'valuation gains' that those dopey US Investors won't understand because they are all wrapped up in ARPU's, AMU's, RUAMFR's and FU's."

- The "Usual Suspects" as always, respond...."tell me more!"

- Again, hypothetically of course, Jack and Joe respond by offering.... "Here’s the deal…. just provide a note payable (no cash required), we will sell you the equity (5%) and put some sort of a great, totally unrelated kickback scheme in place. Maybe we’ll do a funding round for you or pay you for some Intellectual Property (there certainly is a lot of intellectual property floating around all of a sudden) or some other device to loot all of that Ant/Money Market cash that is actually the property of the hard working Chinese people!

- The "Usual Suspects" ponder this difficult decision for about a millisecond and whammo! Ant Financial is immediately worth $100 Billion!

What Are Ant Financial's Earnings?

Luckily since everything is absolutely accurate and transparent in Alibaba's SEC filings, even though they don't describe this expense/accrual in the quarterly 6-K's, we can easily scroll through the most recent 20-F and zero-in on the exact annual amount that Ant Financial is crediting to Alibaba for the 37.5% Profit Sharing Agreement (and thereby calculate the pre-tax income of Ant Financial):

March 31st, 2017 YE 20-F

(Conveniently Located on Pg. 193 of the filing, which ties to the Income Statement)

In fiscal years 2015, 2016 and 2017, under the Alipay IPLA, we recognized royalty and software technology services fee income, net of costs incurred by our company, amounting to RMB1,667 million, RMB1,122 million and RMB2,086 million (US$303 million), respectively, as other income.

....There you have it....37.5% of Ant Financials Pre-Tax Income is $303 Million.....But wait.....this figure combines both the IPLA and the 37.5% "Royalty" profit sharing agreement and is "net of costs".....lets go further...

(Conveniently located at F-40, on page. 287 of the filing)

4. Significant equity transactions, restructuring transactions, mergers and acquisitions and equity investments (Continued)

(b) Restructuring of Payment Services (Continued)

In connection with the 2014 SAPA, the Company also entered into an amended intellectual property license agreement with Alipay ("amended Alipay IPLA"), pursuant to which the Company licenses certain intellectual property and provides certain software technology services to Alipay and the Transferred Business. Under the amended Alipay IPLA, the Company will receive royalty streams and a service fee (collectively, the "Profit Share Payments") which will be paid at least annually, amounting to the sum of an expense reimbursement plus 37.5% of the consolidated pre-tax income of Ant Financial Services, subject to certain adjustments. In addition, if the Company acquires any equity interest in Ant Financial Services, the Company will transfer an agreed portion of the underlying intellectual property to Ant Financial Services at the time of such equity issuance. At the same time, the Profit Share Payments will also be reduced in proportion to such equity issuances made to the Company.

Income in connection with the royalty fee and software technology services fee under the Intellectual Property License and Software Technology Services Agreement and the Profit Share Payments, net of costs incurred by the Company, of RMB1,667 million, RMB1,122 million and RMB2,086 million were recorded in other income, net in the consolidated income statements for the years ended March 31, 2015, 2016 and 2017, respectively (Note 22).

(Conveniently Located on Pg. 193 of the filing, which ties to the Income Statement)

In fiscal years 2015, 2016 and 2017, under the Alipay IPLA, we recognized royalty and software technology services fee income, net of costs incurred by our company, amounting to RMB1,667 million, RMB1,122 million and RMB2,086 million (US$303 million), respectively, as other income.

....There you have it....37.5% of Ant Financials Pre-Tax Income is $303 Million.....But wait.....this figure combines both the IPLA and the 37.5% "Royalty" profit sharing agreement and is "net of costs".....lets go further...

(Conveniently located at F-40, on page. 287 of the filing)

4. Significant equity transactions, restructuring transactions, mergers and acquisitions and equity investments (Continued)

(b) Restructuring of Payment Services (Continued)

In connection with the 2014 SAPA, the Company also entered into an amended intellectual property license agreement with Alipay ("amended Alipay IPLA"), pursuant to which the Company licenses certain intellectual property and provides certain software technology services to Alipay and the Transferred Business. Under the amended Alipay IPLA, the Company will receive royalty streams and a service fee (collectively, the "Profit Share Payments") which will be paid at least annually, amounting to the sum of an expense reimbursement plus 37.5% of the consolidated pre-tax income of Ant Financial Services, subject to certain adjustments. In addition, if the Company acquires any equity interest in Ant Financial Services, the Company will transfer an agreed portion of the underlying intellectual property to Ant Financial Services at the time of such equity issuance. At the same time, the Profit Share Payments will also be reduced in proportion to such equity issuances made to the Company.

Income in connection with the royalty fee and software technology services fee under the Intellectual Property License and Software Technology Services Agreement and the Profit Share Payments, net of costs incurred by the Company, of RMB1,667 million, RMB1,122 million and RMB2,086 million were recorded in other income, net in the consolidated income statements for the years ended March 31, 2015, 2016 and 2017, respectively (Note 22).

....Rats, that's still the combined figure ........lets continue...

(Conveniently located at F-90, on page. 323 of the filing)

22. Related party transactions (Continued) (i)

In 2011, the Company entered into an Intellectual Property License and Software Technology Services Agreement with Alipay whereby the Company licenses certain intellectual property and provides certain software technology services to Alipay in exchange for a royalty fee and software technology services fee in an amount equal to the costs incurred by the Company in providing the software technology services plus 49.9% of the consolidated pre-tax income of Alipay and its subsidiaries (Note 4(b)), effective from December 2011. In 2014, the Intellectual Property License and Software Technology Services Agreement was terminated and the Company entered into the amended Alipay IPLA with Ant Financial Services. Under the amended Alipay IPLA, the Company receives the Profit Share Payments amounting to the sum of an expense reimbursement plus 37.5% of the consolidated pre-tax income of Ant Financial Services, subject to certain adjustments (Note 4(b)), effective from August 2014.

Royalty fee and software technology services fee under the Intellectual Property License and Software Technology Services Agreement and the Profit Share Payments were recognized in consolidated income statements, net of the costs incurred for the provision of the software technology services reimbursed by Alipay. The amounts reimbursed by Ant Financial Services to the Company were RMB486 million, RMB274 million and RMB245 million for the years ended March 31, 2015, 2016 and 2017, respectively.

....Geeezzz......that's weird...nowhere in the 20-F do they come right out and say that the Profit Sharing Amount (37.5% of Ant Financial's Pre-Tax Income) paid to Alibaba is exactly $xxx.xx. That would have been really helpful and so easy to do. Everything Alibaba management seems to report is always hidden, questionable and subject to adjustments and offsets.

Here's the schedule that should have been produced and included in the 20-F....and every 6-K for that matter:

So, let's give Alibaba Management the benefit of the doubt. Alipay, with it's more than 900 million registered users (per Jack in his Lara Logan Interview in 2014), is the very definition of a monopolistic/mature business. Moreover, even though Joe Tsai makes interesting comments like "Alipay daily active users have more than doubled in the current quarter" (min 36:20 of the 2/1/18 investor call) it would have been nice to know what the number of Alipay users actually is what they've "doubled from". Let's say, simply for the sake of argument and by all anecdotal accounts that Alipay is indeed ubiquitous in China. Like a swarm of locusts, it's everywhere. Consequently, meteoric, start-up-like growth should be a distant glimmer in the rear view mirror and revenue and income growth, like any established financial firm, will be joined at the hip to the Chinese economy.

When we compare Ant Financial's estimated P/E of 182 at a $100 Billion Market Cap to a few other prominent Payment Processors, we can conclude that the $100 Billion value might indeed be a tad steep. As described, even if we assign a historically high P/E of 30, that would peg the valuation at $16.6 Billion.....a far cry from the Alibaba PR Department's press release

As far as I can tell, the first representation, by Alibaba Management, as to the "notional value" of Ant Financial came via a schedule and footnote in the May 5th, 2016 Investor Presentation (Page 23) just last year. Footnote below:

http://www.alibabagroup.com/en/ir/presentations/pre160505.pdf

(3) Ant Financial valuation based on reported valuation of USD 60 billion in media; Alibaba Group receives 37.5% of Ant’s pre-tax income now, and if regulations allow, Alibaba Group is entitled to acquire up to a 33% equity interests in Ant Financial. For conservative purpose, 33% is used in calculating Alibaba Group’s economics in Ant Financial here.

As I mentioned at the time, this, I believe, was the first time in history that an SEC filing claimed that Bloomberg/"Media" was the source of a $60 Billion Asset valuation. Generally, since contra to popular opinion, news outlets don't just make things up, it would not be a reach to presume that these valuations are most likely the product of the Alibaba PR Machine, issued through anonymous, unnamed sources.

Alibaba's Financial Statements After the "Funding Round"

So let's say, just for fun, that the US$5 Billion funding round happens in the next quarter. Let's say that somehow, Alibaba Management actually convinces PWC that the funding round actually meets IFRS Criteria for revaluation and write up. I smell a big accounting fee coming!

To that end, I've listed the proposed Journal Entry and revised Balance Sheet Below, all things being equal, as if the transaction had taken place in the last quarter. My hands were actually trembling from the absurdity as I was typing up the schedule:

Further note that in a preemptive effort to cut off the trolls, I freely admit that I know absolutely nothing about Chinese Tax Law, so the $5 Billion Deferred Tax impact is purely a guess. The provision is for illustrative purposes only. For you Chinese Tax Pros out there, feel free to make that entry whatever you'd like it to be.

As we can see, most of the book value, will continue to be, as I've long opined, housed in opaque, overvalued "Questionable Assets" (Investments & Securities relating to "Investees". Intangibles, Goodwill & Land Use Rights), which, if Alibaba Management actually has the testicular fortitude to value Ant Financial at $100 Billion, would bring "Questionable Assets" up to US$89 Billion (63% of the balance sheet). Also keep in mind that the "Newly Formed Entity" will be written up as well based on the increase in the Ant Valuation. So, if they can actually pull this off, $66 Billion in additional Book Value (i.e. collateral) and $56 Billion of Additional "Equity" would be created as well. Also remember, when we write something up (e.g. Alibaba Pictures, Cainiao, Alibaba Health, etc.) we can always book valuation gains that hit the Income Statement. So income of $56 Billion would be created, out of thin air, overnight, as well!

Oddly, there is absolutely no change in the underlying businesses. The same fake goods are being sold and paid for via the same Alipay accounts. The same bad micro-loans and WMP's are being written and the same rapidly expanding credit risk continues to be hidden. Absolutely no new "Economic Value" has been created by the Alibaba/Ant "Acquisition" transactions.

I ABSOLUTELY LOVE IFRS ACCOUNTING!!

OPTIONAL READING: WHY JAY CLAYTON SHOULD PUBLICLY RECUSE HIMSELF FROM ANY ONGOING OR FUTURE ALIBABA INVESTIGATION.

Revisiting a Relevant Prior Post

Last week, a couple of my readers revisited a really fun, June 2016 post I had done (long before Jay Clayton was being considered for the SEC Chairmanship) and they called it to my attention. I had forgotten about its relevance for the most part until they reminded me of just how pertinent it has become in light of the silliness and possible financial misrepresentations that I've described above.

The post, in my humble opinion, took a light-hearted, humorous, yet moderately pissed-off look at the now presumably tainted relationship between Jay Clayton, who had been privy to and presumably instrumental in drafting/designing the Alibaba Responses to the SEC inquiries on the "Simon Xie "deals back in the day. ("Simon Xie" aka Xie Shihuang is one of the current "Framework Parties" in the Ant Deal.) Again, now that Jay is in charge of the regulation of this ticking time bomb, I felt that we should absolutely revisit same. When you click on the Alibaba Correspondence please note that Mr. Clayton is either the author of, or copied on, each ludicrous document/response.

******************************************************************

Link to the June 2016 Post - Go to "SEC Process". Relevant Text Below

https://deep-throat-ipo.blogspot.com/2016/06/follow-up-thoughts-on-i-would-never.html

SEC Process

These investigations, again, by their very nature are private matters. Both the SEC and the subject of the investigation normally make no public disclosures, nor do they have anything to gain by doing so. However, we might be able to shed some light on the process by combing through the correspondence leading up to the IPO. I've attached a few of the documents below for your review if you choose to take the time:

Example - 60 page SEC document Q&A 6/16/14 Response to 5/6/14 F1 fiing.

https://www.sec.gov/Archives/edgar/data/1577552/000119312514237452/filename1.htm

Example - 35 page SEC document Q&A 7/11/14 response to 7/3/14 Amended F1

https://www.sec.gov/Archives/edgar/data/1577552/000119312514266474/filename1.htm

Correspondence - 8/6/14

https://www.sec.gov/Archives/edgar/data/1577552/000119312514298625/filename1.htm

Correspondence - 8/12/16

https://www.sec.gov/Archives/edgar/data/1577552/000119312514306858/filename1.htm

Correspondence 8/22/14

https://www.sec.gov/Archives/edgar/data/1577552/000119312514318466/filename1.htm

Without getting into the gory details, I'll discuss the general format of the Q&A and then interpret some of my favorite interrogatories through the magic of my Dick Fuld Banker Speak Translator (BST) (patent pending):

Q&A Format:

SEC: "Dear Alibaba Management & Counsel, we see you've disclosed/described (Insert odd, unsupported metric here) which may or may not have a bearing on (Insert odd, unsupported additional metrics here).

BABA Respondent: "Thank you for the wonderful, insightful question" From this point the response takes one (or more) of the following three possible directions:

- "I'm sorry, it appears that you just don't understand what we are doing in our business model. You must understand, in China, eCommerce, financial reporting, mathematics perhaps even the laws of physics are totally different than they are in the US. Let us try to help you get past your ignorance. After all, the Chinese people invented mathematics well before Capitalism even existed. Don't worry, we'll get you through this. Please see the attached additional odd, unsupported, made-up, metrics."

- "I'm sorry, what you are asking us for is impossible. Because of our laws in China we simply can't comply with your request. Selling fake tchotchkes on the Internet is a highly guarded State Secret and the politburo will not allow us to discuss the matter. Let's just move on and call it a day. Once again, we'd love to help out, but our hands are tied, our deepest regrets. I'm sure you understand."

- "I'm sorry, we've been advised by our Public Accountants, Investment Bankers and our Legal Counsel that we don't have to give that to you. We don't think it's necessary and you don't need it. You wouldn't know what to do with the information, or understand it anyway. So that's that. Next question please."

Now, as promised, lets run a few of my favorite interrogatories through the BST and see what we get:

This one addresses a US$1 Billion dollar "loan" of Alibaba funds to be made directly to Simon Xie, Jack's buddy for "strategic investment purposes". (Page 3 of the August 12th, 2014 Correspondence cited above)

SEC: We note the disclosure on page 226 regarding the RMB6.5 billion loan arrangement with Simon Xie. We also note that a company controlled by Jack Ma will serve as a general partner of the PRC partnership that will receive indirectly the proceeds of such loan. Please provide us with a detailed analysis of the nature of the loan and the extent to which the provisions of Section 13(k) of the Exchange Act are applicable to the loan. Your analysis should address both Mr. Xie and Mr. Ma.

SEC - BST - WTF??.....you are taking $1 Billion of Shareholder money and giving it to Jack's buddy? Is this thing Jack Ma's own personal piggy bank?

I'm not going to bother posting the entire Alibaba response. It's long winded and barely understandable. You can certainly muddle through the filing if you are so inclined. However, to keep things moving, here's the BST version of what they said:

Alibaba Respondent: - BST "Ohhhh!.....I see what you are getting at. You've got it all wrong. Here's what's really going on. The loan to Simon isn't a 13(k) 'personal' loan....it's a 'business' loan! See, even though the money is going to him, Simon is going to take the money and contribute it to a partnership that he and Jack have cooked up, and once the money is sufficiently laundered, the partnership is going to 'invest' it in Wasu Media, since Wasu media has a strategic relationship with Alibaba. Jack isn't getting the money (It's going to a partnership) so he's not in violation of 13(k) either! That's why we did it this way!....That way, Jack and Simon get a billion dollar loan, they can do whatever they want with the proceeds, maybe invest in Wasu, maybe not. Moreover Simon isn't a qualifying executive under 13(k)...he's not a director or 'senior' manager.....we just want to give him a BILLION DOLLARS since he's a good guy.....he's just one of five 'strategic' vice presidents! Who knows, if this works we might give all five of them a BILLION DOLLARS each! US Shareholders are really generous that way. That way all of the VP's can get access to Billions of US Shareholder Dollars, for 'strategic purposes', pay the interest from loan principal until the investments pay off (or not) and nobody is the wiser! Isn't this an AWESOME IDEA! If you guys sign off on this one we will be actively looking for homeless people to start partnerships with Jack. We understand that in America you can go to jail for things like this, but in China it's SOP. We're sure glad you understand how this works now. Thanks for asking about it."

Here's a follow up on pg 7 of the same August 12th, 2014 Document.

SEC: Please address in this risk factor any potential material conflicts of interest between you and Simon Xie and expand this risk factor to discuss any potential material conflicts of interest resulting from the manner in which you plan to invest in Wasu Media Holdings Co., Ltd. It appears that the disclosure required by Item 6.A of Form 20-F is applicable to Simon Xie. In this regard, we note your apparent dependence upon Mr. Xie based on his role as one of your founders and as a member of your management, as well as his equity interests in Alipay, your material VIEs, and the partnership through which you plan to invest in Wasu Media Holdings Co. Please provide the disclosure required by Item 6.A of Form 20-F and in doing so disclose Mr. Xie’s roles and responsibilities in your company and where Mr. Xie falls within your management structure.

SEC - BST: "So you are making the loan to the partnership owned by Simon, Jack and Yuzhu Shi? The partnership is going to buy the stock of Wasu media? That's the same Yuzhu Shi, the guy who went bust trying to build the tallest skyscraper in China (that was never actually built) and then took a video game company, Giant Interactive public on the NYSE, raised $1 Billion on the IPO, milked it for all it was worth and took it private in China at a deep discount with US Shareholders left holding the bag?.......is that the same Yuzhu Shi that you are jumping into bed with on both Wasu and Yunfeng Capital?? And you don't see any conflict of interest here? Really?"

Here's the BST version of the Alibaba Response:

Alibaba Respondent: - BST "Wowww....you guys are really sharp! You've actually read through the whole filing and you know your securities law to boot! Ok, here's what's really going on. You think that Simon actually works here and that his employment would make him an employee 'upon whose work the company is dependent' as defined in Item 6.A of Form 20-F. Again, you've got it all wrong. Simon, is a peon, a nobody, he pushes a broom around and occasionally opens the mail....that's it! In fact, if you don't let us structure this deal this way we're going to fire his sorry ass so that there is absolutely no conflict under 13(k). Of course, we're still going to give him a Billion dollars, just 'cuz we want to and you can't stop us. Moreover, Yuzhu Shi is a wealthy visionary and great man. He was able to amass a tremendous fortune by creating fake businesses out of nothing, pulling all of the cash out of them and selling the decaying shells to suckers....uh....I mean fortunate investors. Anyway, all of these people are safe in China and you have no jurisdiction over them. So mind your own beeswax."

The May 26th, 2016 20-F

Fast forward to the 20F - pg 40. They did indeed "fire his sorry ass" to conform to 13(k) on this loan. I guess the other four "Strategic VP's" could easily pick up the slack. However, it looks like the actual structure of the deal has changed significantly. Per the recent 20-F, the RMB 6.9 Billion (US$1.06 Billion) loan was actually made to Simon by an unnamed PRC Bank. Alibaba pledged RMB 7.3 Billion (US$1.12 Billion) of "Wealth Management Products" which are presumably carried on their balance sheet somewhere to guarantee the loan. Alibaba also set up a RMB 2.0 Billion (US$ 300 Million) Credit Facility to Simon so he can afford to pay the substantial interest on the bank loan.

Here are a couple of questions I might ask about this reconstituted transaction if I were one of the SEC attorneys investigating this mess:

- Where was the money that required the pledge/guarantee of Alibaba assets actually invested? did it all go to Wasu or did Simon or Jack skim a bit off the top for vacation homes in the Adirondacks and/or Caymans?....Hey, don't get upset....I'm just asking a question.

- Where did the "Wealth Management Products" come from? What are they? How did they come about and where are they on the balance sheet? Did Alibaba buy a bunch of wonderful small business loans (aka non-performing) from ANT/Alipay using US Shareholder Money? Is that the collateral pledged for the loan to Simon? After all, it's a BILLION dollars

- What is the interest rate on the PRC Bank Loan to Simon? What are the terms of this loan? Which Bank is it? They won't even disclose which banker was dumb enough to do this deal?

- Does Simon really need a $300 Million Credit facility to pay interest on a billion dollar loan? Even at 10% Simple Interest that's 3 years of Interest payments. So whatever the hell the terms of the "investment" was in Wasu, it isn't flowing any cash?

- WTF???....(This last question is just rhetorical and would add no value to the investigation).

Note: Wasu is a public company on the Shanghai Stock exchange. On the date of the SEC Correspondence (August 12th, 2014) it was trading at $29/share. It hit a high of $59/share in June of 2015 (Before the crash) and it's trading at $19/share today (a 33% haircut from August 2014). The Market Cap today is about $4 Billion (Down from $6 Billion). We don't know anything about the financial prospects of Wasu or the Ma, Xie, Shi partnership. The only things we are certain of :

- The value of the collateral (Wasu) underlying Simon's margin loan has declined substantially and is most likely under water.

- Based on the structure, Alibaba (and consequently US Shareholders) have credit risk by virtue of the pledge of (quite possibly dog-shit) "Wealth Management Products" to an unnamed PRC Bank, if for some reason Wasu stumbles into some cash flow or collateral valuation problems. Apparently they already have since there is now a magical Alibaba credit facility in place to pay Simon's Interest on the PRC Bank "loan".

**************************************************************************

To cap off the Simon Xie discussion, one of my well informed readers also posted:

MungerFanFebruary 14, 2018 at 3:55 PM

One more thing, a paragraph from the 2014 SEC correspondence regarding Simon Xie that you translated to BST:

"With regard to the language of Item 6.A of Form 20-F requiring disclosure of certain information concerning “employees such as scientists or designers upon whose work the company is dependent,” the Company respectfully submits that this requirement applies to employees whose specific skills or technical expertise make them indispensable to a company’s operations and where the loss of such an employee (who, by the nature of his skills and expertise, is not readily replaceable) would materially affect a company’s ability to engage in its core business. A plain reading of the language of Item 6.A, which refers to scientists and designers as the representative examples of such employees, as well as a review of past comment letters issued by the Staff in other transactions confirms this view. The functions Mr. Xie serves cited by the Staff, including his function as a minority VIE equity holder, are roles that could be filled by any trusted long-time employee, and these are not roles, such as those of a key scientist, engineer or designer, that involve a unique skillset or high level of training that render the Company “dependent” upon such employee. As one of five vice presidents involved in domestic China investments, his role is to identify and execute investments, but he cannot be called someone upon whom the Company is dependent."

Note the last sentence. I think this important point was lost in your still excellent BST translation. How can a man who was one of Alibaba's 18 founders and whose "ROLE IS TO IDENTIFY AND EXECUTE INVESTMENTS" NOT be someone on whom the company is dependent? Does Alibaba not depend on the success of Xie's investments?

If we take Alibaba at their word, Xie's investment abilities are so run-of-the-mill that he could be replaced by a monkey and Alibaba would be no worse for wear. If this is true, what does this tell us about the quality of Alibaba's investments in China that so many BABA "investors" are so willing to believe are phenomenal even in the absence of coherent financial statements (Xie "serves as a vice president on the Company’s domestic China investment team and is involved in projects related to the Company’s domestic China acquisition and investment activities.")? And if it's not true that Xie could be replaced by a monkey (or more realistically a janitor as you suggested), why isn't this a violation of the law?

"With regard to the language of Item 6.A of Form 20-F requiring disclosure of certain information concerning “employees such as scientists or designers upon whose work the company is dependent,” the Company respectfully submits that this requirement applies to employees whose specific skills or technical expertise make them indispensable to a company’s operations and where the loss of such an employee (who, by the nature of his skills and expertise, is not readily replaceable) would materially affect a company’s ability to engage in its core business. A plain reading of the language of Item 6.A, which refers to scientists and designers as the representative examples of such employees, as well as a review of past comment letters issued by the Staff in other transactions confirms this view. The functions Mr. Xie serves cited by the Staff, including his function as a minority VIE equity holder, are roles that could be filled by any trusted long-time employee, and these are not roles, such as those of a key scientist, engineer or designer, that involve a unique skillset or high level of training that render the Company “dependent” upon such employee. As one of five vice presidents involved in domestic China investments, his role is to identify and execute investments, but he cannot be called someone upon whom the Company is dependent."

Note the last sentence. I think this important point was lost in your still excellent BST translation. How can a man who was one of Alibaba's 18 founders and whose "ROLE IS TO IDENTIFY AND EXECUTE INVESTMENTS" NOT be someone on whom the company is dependent? Does Alibaba not depend on the success of Xie's investments?

If we take Alibaba at their word, Xie's investment abilities are so run-of-the-mill that he could be replaced by a monkey and Alibaba would be no worse for wear. If this is true, what does this tell us about the quality of Alibaba's investments in China that so many BABA "investors" are so willing to believe are phenomenal even in the absence of coherent financial statements (Xie "serves as a vice president on the Company’s domestic China investment team and is involved in projects related to the Company’s domestic China acquisition and investment activities.")? And if it's not true that Xie could be replaced by a monkey (or more realistically a janitor as you suggested), why isn't this a violation of the law?

Yes that appears to be the case. Not comforting.

And sorry to blow up the comments, but another infuriating blip of information:

Just one month, ONE MONTH, after Alibaba submitted those answers about Xie to the SEC, arguing that he is a nobody (in a letter cc'd to future SEC Chairman Jay Clayton), Reuters ran this article:

https://www.reuters.com/article/alibaba-group-ipo-xie/insight-simon-xie-jack-mas-unassuming-lieutenant-at-alibaba-idUSL1N0RC0A820140914

Excerpt: "But for investors in Alibaba Group Holding Ltd’s potentially record initial public offering, Simon Xie, a co-founder and vice president, represents one of the e-commerce company’s most important figures: he’s the only individual besides Executive Chairman Jack Ma who owns the domestic Chinese companies and holds the operating licenses that underpin Alibaba’s corporate structure.

Alongside Ma, who holds the lion’s share of those domestic firms, Xie wields full legal sway over the onshore entities and the critical contracts that link them with the New York-listed vehicle.

Yet much remains unknown about Xie, and the unusual shareholding arrangement has puzzled even high-level insiders. Some employees, said a former executive who worked closely with Xie, jokingly refer to the unassuming 45-year-old as shoufu - or “top millionaire” - even though he is not among the very top Alibaba shareholders."...

“Simon Xie is clearly the most important person in Alibaba who is not part of the steering committee,” said Fredrik Oqvist, the Beijing-based founder and CEO of ChinaRAI, a consulting firm that advises hedge and mutual funds. “He pops up everywhere, yet he’s elusive.”