Well, last week I took some valuable time out of my jam packed schedule to try to work with the Alibaba analysts in anticipation of the earnings call. What can I say, I like to help whenever duty calls. I'm a "giver". Anyway, I have to say, after a couple of reaching-out-hands-across-the-water efforts....it didn't seem as though they wanted my help at all. I was shocked....

Here's the email I sent in an effort to try to rev them up and point them in the right direction for the upcoming investor call. I'm no Tony Robbins, but hey, I gave it a shot:

From: DeepThroatIPO

Subject: Re: Upcomming BABA Investor Call

Hmmmm.....I've not heard back from any of you....that's strange......it's not like my work is a secret anymore. If you take a minute to Google "Alibaba 20-F" my work comes up 5th out of 43 million results......Wolf Richter put it out there....great guy...perhaps you know him?.

That said, perhaps:

1.) The Analysts got the email and chose not to read it? (Only Fan Liu & Chi Tsang emails were returned as undelivered.)

2.) Perhaps their company policy is not to respond? (Understandable...discussing non-public info prior to an earnings call is a problem. Which analysts are all well aware of....or at least should be.)

3.) Perhaps they got my email, looked it over and kicked it up to their respective bosses?

4.) Perhaps they read it with great interest and used it as the framework for their Investor Call Q&A?

Sadly, until and unless subpoenas are issued we'll never know what actually happened.

The Time Line

So now let's take a look at what happened once the YUGE! "61%" number hit the street at 7:30 AM on Thursday August 23rd. Pre-market (presumably neophytes vs. insiders) generally went nuts, pushing the opening number up $7.00, to $184.00 from the prior day close of $177.00. Once the market opened, BABA average daily volume (20 Million shares +/-) was traded in roughly the first hour of the trading day at about the $184.00 number, occasionally caressing $186.50 with 2x average daily volume traded by 11:00AM.

Here are the links to the foldurol that caused all of the initial hubbub....

Press Release:

https://www.alibabagroup.com/en/news/press_pdf/p180823.pdf

Webcast:

https://edge.media-server.com/m6/p/8atk8jbj

Presentation

https://www.alibabagroup.com/en/ir/presentations/pre180823.pdf

6-K (Filed with the SEC on 2018-08-23 16:29:54 - "end of day")

https://www.sec.gov/Archives/edgar/data/1577552/000110465918053369/a18-21099_1ex99d1.htm

Now, of course, once "professional" investors and commentators had a chance to analyze the presentation, and most importantly the Q&A of the investor call, we see that the mood, during the day, quickly evolved from euphoria to "what the hell?" and BABA eventually ended the day down $5.75......a $15.00 swing from top to bottom. For example, Clay Chandler (Time), and Tim Culpan (Bloomberg) both did a nice job of parsing through the numbers.

The reason that this happened (among other things) has to do with the difference between Professional investors and Amateur investors. A "Professional" investor is a savvy, intelligent person who is capable of reading between the lines and deciphering the difficult language and nuances of these investor calls. An Amateur Investor is, well, not so much...

I also want to acknowledge that the Analysts on the call did a fantastic job of probing the inner meaning and real implications of management's comments. Based on what's expected from analysts today, they did an AWESOME JOB of signaling the markets and Professional Investors as to what's actually going on!

First, not once (with the exception of Alicia Yap at Citi and her "congrats on 'solid' results" comment) did any analyst offer any orgasmic adulation regarding the quarterly results.....baby steps. (Note: In today's vernacular, the term "solid results" usually refers to a business teetering on bankruptcy which managed to somehow reduce the quarterly loss.)

Second, the Analysts bravely and cleverly walked, and never crossed, the ever-so-thin line between pissing management off, getting tossed off the call, risk being referred to as "that asshole analyst" on Twitter forever...... and actually doing their job. Bravo!

As you might suspect, the problem is, that we live in a world where everything is a "Strong Buy". Today, a "Strong Buy" can mean anything from "Hey....this stock is actually a strong buy! No kidding!" to "Geeezzz....run for the hills!". That said, it's become all the more important to understand the subtle nuances buried in the dialogue between the Analysts and management on these investor calls, to differentiate the levels and gradations of "Strong Buy".

To that end, I think it's only appropriate, as a public service to Amateur investors and the investing public at large, that we deploy my patented Dick Fuld Banker-Speak Translator (BST), to fully analyze the implications of the Analyst Q&A on the Alibaba Investor Call. The BST will read between the lines, probing what the analysts were "really" asking. As usual, management's responses were largely irrelevant, so we'll ignore them for now. Feel free to read the full text of the entire call courtesy of Seeking Alpha. I've posted the full text and the link to the transcript at the end of this post.

The eight (8) Analysts on the call with speaking parts in this awesome show of solidarity were:

Here are the Eight (8) hard hitting, laser focused Questions they asked:

From what I can see, "New Retail" means "No profit".....are you following the Amazon model where we can expect that you won't make any real money for a couple of decades?

Mark Mahaney (BST) Translation: Geeezus Christ!....now I've gotta follow Tom's lead....I gotta let the market know that I don't want to talk about this mess.....maybe I should talk about Share Based Compensation (SBC), maybe it has decreased significantly in the quarter in a relentless effort to control costs?......Oh Crap!...outstanding shares have actually increased another 15 million shares (US$ 2.7 Billion @ $180/share)...I can't talk about that.....how about "digital media" and the World Cup?....yeah!....that's it....there are no actual numbers released and it's a touchy-feely topic. Everybody loves sports?...right? Oh wait.....Digital Entertainment Revenue only increased US$63 million (7%) since the March Quarter so the World Cup couldn't have had that much of a Revenue impact. Professional Investors will see what I'm doing....They will see that I'm signaling that this is a God-awful cluster-filing . I can't believe I'm in this mess. After that Facebook thing at Citi blew up I really needed this gig.....and now I'm stuck in the middle of this....

I was really expecting that an International Fashion Icon listed in an SEC Filing from one of the largest businesses the world would be up on Fifth Ave over by Tiffany's, Prada and the Trump Tower....probably just that "new retail" concept kicking in.

Well Moschino is apparently selling lots of cute teddy-bear T-Shirts for US$307.48 each all over the world now. I think it would be really interesting to know how much volume MSM, Moschino and Giuseppe Zanotti are doing at these flagship stores since, by definition, it must be material as these businesses are listed in the filing. But sadly, it wasn't disclosed. Anyway, I don't see stuff like this when I google Prada or Armani, so I suppose it couldn't hurt to ask about it...

Q - Wendy Huang -

Q - Alex Yao - JP Morgan

Here's the email I sent in an effort to try to rev them up and point them in the right direction for the upcoming investor call. I'm no Tony Robbins, but hey, I gave it a shot:

From: DeepThroatIPO

Sent: Wednesday, August 22, 2018 12:22:47 AM

To: Fan Liu <fan.liu@ghsl.cn>; Alicia Yap <alicia.yap@citi.com>; Alex Yao <alex.yao@jpmorgan.com>; Wendy Huang <wendy.huang@macquarie.com>; Thomas Chong <thomas.chong@credit-suisse.com>; Eddie Leung <eddie.leung@baml.com>; Chi Tsang <chitsang@hsbc.com.hk>; Gregory Zhao <gregory.x.zhao@barclays.com>; Piyush Mubayi <piyush.mubayi@gs.com> Youssef.Squali@SunTrust.com; Grace.H.Chen@morganstanley.com; jerry.liu@ubs.com; mark.mahaney@rbccm.com; Anne Stevenson-Yang

To: Fan Liu <fan.liu@ghsl.cn>; Alicia Yap <alicia.yap@citi.com>; Alex Yao <alex.yao@jpmorgan.com>; Wendy Huang <wendy.huang@macquarie.com>; Thomas Chong <thomas.chong@credit-suisse.com>; Eddie Leung <eddie.leung@baml.com>; Chi Tsang <chitsang@hsbc.com.hk>; Gregory Zhao <gregory.x.zhao@barclays.com>; Piyush Mubayi <piyush.mubayi@gs.com> Youssef.Squali@SunTrust.com; Grace.H.Chen@morganstanley.com; jerry.liu@ubs.com; mark.mahaney@rbccm.com; Anne Stevenson-Yang

Subject: Re: Upcomming BABA Investor Call

Hmmmm.....I've not heard back from any of you....that's strange......it's not like my work is a secret anymore. If you take a minute to Google "Alibaba 20-F" my work comes up 5th out of 43 million results......Wolf Richter put it out there....great guy...perhaps you know him?.

Anyway, I was hoping for some insightful questions from at least a few of you.... or perhaps that you might at least send me the perfunctory "thanks for your interest" email response while kicking this up the food chain to your respective bosses for some guidance. That's probably what I would have done....while carefully documenting the communication(s).

I've also learned over the years that these career decisions are usually very difficult. Your life can change in the blink of an eye....for better or worse depending on your choices.

That said, I've also been in "Corporate America" long enough to have seen some really good people get unceremoniously thrown under the bus when big fat financial turds plop into the dumper. It's BS.....I know....it's not your fault...but it's the world we live in. Blame must be delegated. Isn't that right Mark?

By some odd twist of fate, you have all been charged with the daunting responsibility of analyzing this beast we call BABA. You are the point men/women at the epicenter of the most incredible financial fiasco in history.

But, from my vantage, and I don't mean to be so blunt, but as a casual observer, it looks like, collectively, you are all standing on the curb distracted, as the biggest financial Greyhound in history is hurtling toward your bus stop with no brakes. Sadly, there will always be folks in your organization(s), who are more than willing to give you a shove once the bus gets too close to them.....but you already knew that.

Hopefully, it will be a really informative and lively discussion on Thursday.

All the best.....

Well.....not that it was all that surprising, but I never heard back from anyone. I guess they were comfortable in forging ahead without my help, insight and guidance. I was at least hoping, during the Investor Call, they might have been a little more aggressive, bringing up some of the amazing accounting issues I've been discussing over the last few years. After all, you know you are on the right track when you get a Jeff Skilling "Asshole" response.....

That said, perhaps:

1.) The Analysts got the email and chose not to read it? (Only Fan Liu & Chi Tsang emails were returned as undelivered.)

2.) Perhaps their company policy is not to respond? (Understandable...discussing non-public info prior to an earnings call is a problem. Which analysts are all well aware of....or at least should be.)

3.) Perhaps they got my email, looked it over and kicked it up to their respective bosses?

4.) Perhaps they read it with great interest and used it as the framework for their Investor Call Q&A?

Sadly, until and unless subpoenas are issued we'll never know what actually happened.

The Time Line

So now let's take a look at what happened once the YUGE! "61%" number hit the street at 7:30 AM on Thursday August 23rd. Pre-market (presumably neophytes vs. insiders) generally went nuts, pushing the opening number up $7.00, to $184.00 from the prior day close of $177.00. Once the market opened, BABA average daily volume (20 Million shares +/-) was traded in roughly the first hour of the trading day at about the $184.00 number, occasionally caressing $186.50 with 2x average daily volume traded by 11:00AM.

Here are the links to the foldurol that caused all of the initial hubbub....

Press Release:

https://www.alibabagroup.com/en/news/press_pdf/p180823.pdf

Webcast:

https://edge.media-server.com/m6/p/8atk8jbj

Presentation

https://www.alibabagroup.com/en/ir/presentations/pre180823.pdf

6-K (Filed with the SEC on 2018-08-23 16:29:54 - "end of day")

https://www.sec.gov/Archives/edgar/data/1577552/000110465918053369/a18-21099_1ex99d1.htm

Now, of course, once "professional" investors and commentators had a chance to analyze the presentation, and most importantly the Q&A of the investor call, we see that the mood, during the day, quickly evolved from euphoria to "what the hell?" and BABA eventually ended the day down $5.75......a $15.00 swing from top to bottom. For example, Clay Chandler (Time), and Tim Culpan (Bloomberg) both did a nice job of parsing through the numbers.

The reason that this happened (among other things) has to do with the difference between Professional investors and Amateur investors. A "Professional" investor is a savvy, intelligent person who is capable of reading between the lines and deciphering the difficult language and nuances of these investor calls. An Amateur Investor is, well, not so much...

I also want to acknowledge that the Analysts on the call did a fantastic job of probing the inner meaning and real implications of management's comments. Based on what's expected from analysts today, they did an AWESOME JOB of signaling the markets and Professional Investors as to what's actually going on!

First, not once (with the exception of Alicia Yap at Citi and her "congrats on 'solid' results" comment) did any analyst offer any orgasmic adulation regarding the quarterly results.....baby steps. (Note: In today's vernacular, the term "solid results" usually refers to a business teetering on bankruptcy which managed to somehow reduce the quarterly loss.)

Second, the Analysts bravely and cleverly walked, and never crossed, the ever-so-thin line between pissing management off, getting tossed off the call, risk being referred to as "that asshole analyst" on Twitter forever...... and actually doing their job. Bravo!

As you might suspect, the problem is, that we live in a world where everything is a "Strong Buy". Today, a "Strong Buy" can mean anything from "Hey....this stock is actually a strong buy! No kidding!" to "Geeezzz....run for the hills!". That said, it's become all the more important to understand the subtle nuances buried in the dialogue between the Analysts and management on these investor calls, to differentiate the levels and gradations of "Strong Buy".

To that end, I think it's only appropriate, as a public service to Amateur investors and the investing public at large, that we deploy my patented Dick Fuld Banker-Speak Translator (BST), to fully analyze the implications of the Analyst Q&A on the Alibaba Investor Call. The BST will read between the lines, probing what the analysts were "really" asking. As usual, management's responses were largely irrelevant, so we'll ignore them for now. Feel free to read the full text of the entire call courtesy of Seeking Alpha. I've posted the full text and the link to the transcript at the end of this post.

The eight (8) Analysts on the call with speaking parts in this awesome show of solidarity were:

Analysts

Eddie

Leung - Merrill Lynch

Alicia

Yap - Citigroup

Grace

Chen - Morgan Stanley

Thomas

Chung - Credit Suisse

Mark

Mahaney - RBC Capital Market

Gregory

Zhao - Barclays

Wendy

Huang - Macquarie

Alex

Yao – JPMorganHere are the Eight (8) hard hitting, laser focused Questions they asked:

Q

– Eddie Leung - Merrill Lynch

Good

evening. Thank you for taking my question. Could you share your thoughts first

on the e-commerce competitive landscape given the fast growth of some of your

peers in the lower price point market so to speak? Just -- many years ago, if

you remember, Taobao also started more in the lower price point market then

developed into today's scale. So just wondering, how you think about the

difference today versus many years ago? And then if you guys can -- could you

also comment a little bit on the outlook of your customer management business.

There has been a bit of deceleration, of course, we know there is a high base

affect. But any color going into second half of this year would be helpful.

Thank you.

Eddie's Question (BST) Translation: Hey guys, I don't mean to be so harsh here, but what the hell is going on with your margins? When I compare your operating metrics from a year ago by quarter, I see that you're operating margins have decreased from 38.8% all the way down to 12.5%....and since you don't break anything out by business segment I have no way of knowing what's going on.

Eddie's Question (BST) Translation: Hey guys, I don't mean to be so harsh here, but what the hell is going on with your margins? When I compare your operating metrics from a year ago by quarter, I see that you're operating margins have decreased from 38.8% all the way down to 12.5%....and since you don't break anything out by business segment I have no way of knowing what's going on.

From what I can see, "New Retail" means "No profit".....are you following the Amazon model where we can expect that you won't make any real money for a couple of decades?

Q - Alicia

Yap - Citi

Hi,

good evening, management, Joe, Daniel and Maggie. Thanks for taking my

questions and congrats on solid results. I have some follow-up on these

combined online core commerce. So with GMV growth and commissions lightly to

experience potentially high base as well from last year, we see CMR also lapse

out a tough comp. I think management previously commented about the increasing

page view and time spent on the numbers of the recommended feed pagers. So are

we still on track to introduce new potential some additional add lows to those

second lending pages later this year? And also second question quickly is just,

can you reconcile -- help us reconcile the 34% physical GMV versus the 55%

commission revenue growth. Is that implying the take rate actually increasing?

Thank you.

Alicia's Question (BST) Translation: Even though you don't disclose GMV on a quarterly basis anymore, you put a growth rate in the press release (even though we don't know what it's grown from...) and for some reason Maggie talked about it growing 34%, so even though you've already told me in the dress rehearsal before the call that the take rate isn't actually increasing, I thought I'd go off the reservation and ask it again so you could again explain to the investing public how sales "commissions" apparently have no relationship to the amount of goods sold on the platform.

Alicia's Question (BST) Translation: Even though you don't disclose GMV on a quarterly basis anymore, you put a growth rate in the press release (even though we don't know what it's grown from...) and for some reason Maggie talked about it growing 34%, so even though you've already told me in the dress rehearsal before the call that the take rate isn't actually increasing, I thought I'd go off the reservation and ask it again so you could again explain to the investing public how sales "commissions" apparently have no relationship to the amount of goods sold on the platform.

Q - Grace

Chen - Morgan Stanley

My

question is about the New Retail business. Alibaba has been doing several

mergers and acquisitions, and also has been sending out Hema and partnerships

with various companies to lay out the foundations for the New Retail business.

So I'm wondering is there any -- is there still any missing parts in your

business portfolio to implement your New Retail strategy? And after the recent

merger and acquisitions, what is your critical next step to execute the New

Retail strategy? Thank you.

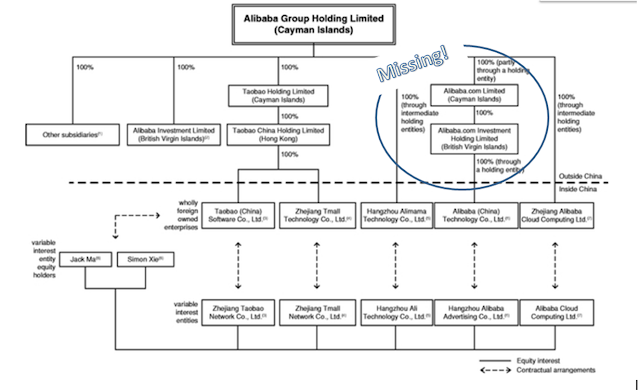

Graces's Question (BST) Translation: Hey, from the latest 20-F (page 118) we know that you've created about 600 new legal entities over the last two years under your "Enhancement" program, getting more friends, family and political cronies involved in the dilution of the Capital Structure. So, I guess my question is "how long is this bullshit going to go on?"

Graces's Question (BST) Translation: Hey, from the latest 20-F (page 118) we know that you've created about 600 new legal entities over the last two years under your "Enhancement" program, getting more friends, family and political cronies involved in the dilution of the Capital Structure. So, I guess my question is "how long is this bullshit going to go on?"

Q - Thomas

Chung -

My

question is about food delivery business. Can management comment about the

competitive landscape and our strategies and becoming the number one in this

segment? Thank you.

Thomas Chung (BST) Translation: Geezzz....I need to talk about something irrelevant so as not to tick off management, while at the same time, signal to the market that I don't want to talk about the financial results. I wish I never would have got that stupid email from DeepThroatIPO....what a pain in the ass that douche bag is. And now, my boss told me I couldn't call in sick so I actually have to ask a question on this fu@#!ing call. Let's see....Food delivery!....yeah! That's the ticket. Never mind that the Ele.me/Starbucks/Hema/Koubei thing is an insignificant part of their business, probably generating losses and is mentioned only in passing, without numbers on page 3 & 4 of the press release, and I only have one question to ask....FOOD DELIVERY! THAT'S WHAT I'M GOING TO GO WITH!

Thomas Chung (BST) Translation: Geezzz....I need to talk about something irrelevant so as not to tick off management, while at the same time, signal to the market that I don't want to talk about the financial results. I wish I never would have got that stupid email from DeepThroatIPO....what a pain in the ass that douche bag is. And now, my boss told me I couldn't call in sick so I actually have to ask a question on this fu@#!ing call. Let's see....Food delivery!....yeah! That's the ticket. Never mind that the Ele.me/Starbucks/Hema/Koubei thing is an insignificant part of their business, probably generating losses and is mentioned only in passing, without numbers on page 3 & 4 of the press release, and I only have one question to ask....FOOD DELIVERY! THAT'S WHAT I'M GOING TO GO WITH!

Q

– Mark Mahaney - RBC

I

wanted to ask about the sustainability of the digital media revenue growth. It

seems like you had a nice impact from World Cup there. Could you talk about

whether some of the newer customers or some of the newer business that came out

of that event whether that looks like its sustainable, whether you -- those are

new customers that will stay with the service. Anything you can tell about what

their activity has been like post the World Cup? Thank you very much.Mark Mahaney (BST) Translation: Geeezus Christ!....now I've gotta follow Tom's lead....I gotta let the market know that I don't want to talk about this mess.....maybe I should talk about Share Based Compensation (SBC), maybe it has decreased significantly in the quarter in a relentless effort to control costs?......Oh Crap!...outstanding shares have actually increased another 15 million shares (US$ 2.7 Billion @ $180/share)...I can't talk about that.....how about "digital media" and the World Cup?....yeah!....that's it....there are no actual numbers released and it's a touchy-feely topic. Everybody loves sports?...right? Oh wait.....Digital Entertainment Revenue only increased US$63 million (7%) since the March Quarter so the World Cup couldn't have had that much of a Revenue impact. Professional Investors will see what I'm doing....They will see that I'm signaling that this is a God-awful cluster-filing . I can't believe I'm in this mess. After that Facebook thing at Citi blew up I really needed this gig.....and now I'm stuck in the middle of this....

Q - Gregory

Zhao - Barclays

My

first question is about your international -- some international brands, which,

during the quarter, more international brands coming on to your Tmall

marketplace. So how shall we expect the advertising and the commission revenue

contribution from these new players? And how shall we expect growth trends

going forward? And very quick follow-up is on your 88 VIP. So how do we expect

the membership to integrate your existing services and improve user engagement?

And can you share some initial metrics of the business? Thank you.

Greg's Question (BST) Translation: Ok....US Shareholders should love it when we talk about "international shit" that they understand. I'm really hoping, even though there's very little in the press release talking about International Brands, that maybe management will talk about something interesting. Maybe they'll disclose some of the sales of the brands listed in the TMall "Luxury Pavilion". They mentioned household names like MCM, Moschino and Giuseppe Zanotti in the filing. Of course, I'm not a fashionista, but I have no idea who these retailers are. I tried to look these companies up in Wikipedia, but the Wikipedia pages indicated that "This article contains content that is written like an advertisement. which usually means that there's some sort of issue verifying the veracity and background of these International Fashion Icons. When I go to the websites, Moschino.com (an Italian designer that's a public company listed in Hong Kong?) and GiuseppeZanotti.com (which oddly enough has a few storefronts scattered all over the world but only three in Italy) they look a little...well....funny. I'm sure everything's Ok though, It would be really weird if Alibaba Management allowed fake businesses to be listed in an SEC filing. Here's the T-Mall Luxury Pavillion page for Moschino (below).

Greg's Question (BST) Translation: Ok....US Shareholders should love it when we talk about "international shit" that they understand. I'm really hoping, even though there's very little in the press release talking about International Brands, that maybe management will talk about something interesting. Maybe they'll disclose some of the sales of the brands listed in the TMall "Luxury Pavilion". They mentioned household names like MCM, Moschino and Giuseppe Zanotti in the filing. Of course, I'm not a fashionista, but I have no idea who these retailers are. I tried to look these companies up in Wikipedia, but the Wikipedia pages indicated that "This article contains content that is written like an advertisement. which usually means that there's some sort of issue verifying the veracity and background of these International Fashion Icons. When I go to the websites, Moschino.com (an Italian designer that's a public company listed in Hong Kong?) and GiuseppeZanotti.com (which oddly enough has a few storefronts scattered all over the world but only three in Italy) they look a little...well....funny. I'm sure everything's Ok though, It would be really weird if Alibaba Management allowed fake businesses to be listed in an SEC filing. Here's the T-Mall Luxury Pavillion page for Moschino (below).

Oh Man.....I know why I've never heard of Moschino.....they really don't have much of an International presence at all.....per their website they only have two stores in the US. Their store in LA at 8933 Beverly Blvd West Hollywood, Los Angeles United States, and their flagship store in New York at 73 Wooster Street, New York, New York, United States. Geeezzz ....no wonder I've never heard of these guys....when I look at Google Maps the flagship store on a NYC side street looks, well, kinda small and empty.....

Then when I use Google street view to look across the street, the neighborhood looks, well, kind of dumpy....

I was really expecting that an International Fashion Icon listed in an SEC Filing from one of the largest businesses the world would be up on Fifth Ave over by Tiffany's, Prada and the Trump Tower....probably just that "new retail" concept kicking in.

Well Moschino is apparently selling lots of cute teddy-bear T-Shirts for US$307.48 each all over the world now. I think it would be really interesting to know how much volume MSM, Moschino and Giuseppe Zanotti are doing at these flagship stores since, by definition, it must be material as these businesses are listed in the filing. But sadly, it wasn't disclosed. Anyway, I don't see stuff like this when I google Prada or Armani, so I suppose it couldn't hurt to ask about it...

Q - Wendy Huang -

Two

very quick questions. The first, your revenue growth is very strong yet the

adjusted EBITDA growth was only the 13% this quarter. And given that you've

mentioned the New Retail's margin was structurally different from previous. So

should we expect the EBITDA growth to stay at the current level for extended

period of time? And second, very quickly, on your overseas strategy so there

has been some new reports talking about US$5 billion investment in the Indian

market, in the Reliance Retail. So can you give us update on your overseas

expansion and investment? Thank you.

Wendy's Question (BST) Translation: Hey guys I want to elaborate on Eddie's question above re: the erosion of margins, but I'm going to coyly rephrase it as a reduction in EBITDA growth. How long is this going go on and how bad will the margins eventually get? I also know that you don't have any interest in Reliance India but since your PR department keeps releasing these little nuggets to generate enthusiasm from Amateur US Investors, I at least want to hear you deny it in the Investor Call. (Note: Wendy clearly went off the grid on this one. She wasn't copied on my email, is new to the group, and most likely won't be invited back for the next call. It's a shame, we'll miss her. Let's wish her all the best wherever her career takes her.)

Wendy's Question (BST) Translation: Hey guys I want to elaborate on Eddie's question above re: the erosion of margins, but I'm going to coyly rephrase it as a reduction in EBITDA growth. How long is this going go on and how bad will the margins eventually get? I also know that you don't have any interest in Reliance India but since your PR department keeps releasing these little nuggets to generate enthusiasm from Amateur US Investors, I at least want to hear you deny it in the Investor Call. (Note: Wendy clearly went off the grid on this one. She wasn't copied on my email, is new to the group, and most likely won't be invited back for the next call. It's a shame, we'll miss her. Let's wish her all the best wherever her career takes her.)

Q - Alex Yao - JP Morgan

Okay.

So number one, for the formation of the local service holding company, why do

you want to seek external investors and the funding source? Number two, in

light of the consolidation of Koubei, and more investment in Ele.me, can you

talk about the financial impact in FY 2019 from this local service holding

company? Thirdly, in addition to investments in Ele.me, are there any other

areas that you think it will worth investing in terms of the local delivery?

Thank you.

Alex's Question (BST) Translation: Yet another "Enhancement"? Are you kidding me? Softbank AGAIN? Other than the future write-ups and associated/expected future valuation gains, why do you need to get Softbank Involved on a deal like this? I know Masa Son's.... ummm..."advice" will add all sorts of valuable insight to the transaction. He's done an amazing job personally redesigning Sprint's 5G Network on the back of a napkin, refrained from self immolation in public forums and no longer lies about his golf score, but that doesn't make him an indispensable part of this fire drill. This type of consultation is, of course, not unprecedented. It happens all the time in China. As I recall, as a parallel to Western financial transactions, Al Capone routinely sought the counsel and input from both the Gambino and the Genovese crime families before ordering a "hit". It's important, in business, to look at transactions from different angles and build a consensus.

So....What Happened Next?

As I mentioned earlier, it was a wild ride once investors started to decipher the Analyst-speak and take a look at the numbers. As furious as the buying was when the market opened, the momentum reversed abruptly. Of the 990 prior trading days since the IPO, Thursday, August 23rd, at almost 78 million shares, was the fifth highest volume day on record.

September 19th 2014, of course, was the date of the IPO. Here are the bullet points describing briefly what transpired during the other four (4) highest volume days.

Presumably, with US$ 14 Billion in shares traded in one day, last Thursday, people who knew what they were doing must have made a lot of money. Again, those who didn't know what they were doing....didn't.

Of course the SEC has all sorts of tools to monitor "suspect" trading activity, but even the most sophisticated software would most likely fail to detect a coordinated, whack-a-mole, offshore effort, funded by at least US$3 Trillion of CCP money through thousands of various legal entities, protected by Caymans Banking/Privacy laws. I'm guessing that "Hey I've got a hunch" wouldn't be probable cause for a Caymans/BVI Banker or CIMA Official to hand over records. The SEC might have been able to track and figure out what Bud Fox was doing with Blue Star, but I doubt they would get very far with Alibaba.

We also learned another thing, as I've opined in previous posts, since, when you are trading BABA stock and the Chinese Communist Party (CCP) has the other side of your trade, Thursday August 23rd has established and confirmed a benchmark. We now understand that the CCP, through Cayman's and BVI Shell Corporations, will have no problem, going forward, supporting a share price on volumes of at least 80 million shares or US$14 Billion, on any particular trading day. My guess would be, since this is a brilliantly diabolical CCP plan, that they have developed and maintain some sort of model that determines how many shares of BABA "they" own collectively throughout their Caribbean Professional Investor ecosystem. They will keep supporting the share price as long as they (in aggregate) can continue to generate enthusiasm from US Investors through their PR effort. They can "sell high" and "buy it back" at a lower price. If there ever comes a point where US Investors aren't participating at acceptable levels, the CCP will most likely cash out.

We can expect an increasing number of fantastic, incredible take-your-breath-away, not-to-be-believed-for-a-second press releases and statements from richly compensated interviewees extolling the virtues of Alibaba and the China dream, when, in reality, this is the greatest wealth grab and tool for capital flight/conversion in history.

To make a comparison, from a global financial perspective, this is the equivalent of and in some aspects, even worse than, the Cuban Missile Crisis. Weapons of Mass Destruction are parked just a few miles off shore in the Caribbean, except (thank goodness) there are no missiles. The Chinese Government chose to use Shell Corporations, and a pegged/fake RMB to accomplish their mission. In one respect, it's actually worse than the Cuban Missile Crisis, as thus far, our government doesn't seem to understand or acknowledge the existence of the threat.

The "Open Letter"

Finally, I promised an open letter to all my Securities Lawyer Friends out there. Of course, you all know, I'm not a lawyer and I don't play one on TV. I've listed a few things that you might want to think about as you follow this saga through to its logical, inevitable conclusion You all know how I enjoy bullet points by now..... so here you go:

1.) You should be actively looking for lead plaintiffs for your class actions now. The members of the class(es) will include all investors who were directly harmed by the collapse of Alibaba. You might include interest holders of Altaba, Softbank, EFT's, Mutual Funds, Pensions, etc. In short, just about everyone.

2.) You might consider working on your complaint/filing immediately. You'll want to be the first to file in your respective jurisdictions. The first pig to the trough always gets the best/most slop!

3.) Your complaint will be a professional liability claim based on the willful ignorance of professional standards, lack of due diligence and "what a normal standard of care would require a professional adviser to know or should have known". You should all know your particular statutes, procedures and jurisdictions and can decide when and how you want to file.

4.) Surprisingly enough, the target(s) of your law suit(s) won't be Alibaba or Alibaba's management. You'd be wasting your time. If you went that direction you might win a judgement or two, but you won't get a big pay day. Alibaba and their/your money will be safely untouchable off-shore. The targets of your suits will actually be the above listed co-conspirator Banks promoting this mess and putting their quarterly stamps of approval on this disaster. (Merrill Lynch, Citigroup, Morgan Stanley, Credit Suisse, RBC Capital Market, Barclays, Macquarie, JPMorgan and of course PWC Hong Kong.)

5.) If you folks are capable of generating civil fines and settlements against Wells Fargo for some mortgage mis-rep ($2.09 Billion) and some bad insurance sales practices ($1 Billion) can you imagine what you might be able to do with material like this? You would be front and center in a "known or should have known" conspiracy which destroyed the Western Financial system. That should be a YUGE! pay day for you. Of course, US Taxpayers would end up, as always, footing the bill, but it would be well worth it to send a message that a "strong buy" recommendation, no matter what the Investor Call "signals", on every piece of dog-shit that somehow gets listed on an Exchange, will no longer be tolerated.

Well, that's about it folks.....we'll see where this thing goes from here. As I've said for a while now. This is going to be an incredible ride..... Strap yourselves in, hang on and as always, practice safe investing.

Additional Reading

Alex's Question (BST) Translation: Yet another "Enhancement"? Are you kidding me? Softbank AGAIN? Other than the future write-ups and associated/expected future valuation gains, why do you need to get Softbank Involved on a deal like this? I know Masa Son's.... ummm..."advice" will add all sorts of valuable insight to the transaction. He's done an amazing job personally redesigning Sprint's 5G Network on the back of a napkin, refrained from self immolation in public forums and no longer lies about his golf score, but that doesn't make him an indispensable part of this fire drill. This type of consultation is, of course, not unprecedented. It happens all the time in China. As I recall, as a parallel to Western financial transactions, Al Capone routinely sought the counsel and input from both the Gambino and the Genovese crime families before ordering a "hit". It's important, in business, to look at transactions from different angles and build a consensus.

So....What Happened Next?

As I mentioned earlier, it was a wild ride once investors started to decipher the Analyst-speak and take a look at the numbers. As furious as the buying was when the market opened, the momentum reversed abruptly. Of the 990 prior trading days since the IPO, Thursday, August 23rd, at almost 78 million shares, was the fifth highest volume day on record.

September 19th 2014, of course, was the date of the IPO. Here are the bullet points describing briefly what transpired during the other four (4) highest volume days.

- November 30th 2015 - 98 Million shares - no news - (up 3.3%)

- June 8th 2017 - 81 Million shares - Volume was the result of an increased sales forecast press release. (up 13%)

- May 31st 2016 - After close of market that day Softbank announced a "fake" sale of BABA shares. BABA dropped 6% the next day. It's really surprising how much volume was traded just prior to an announcement like that! I'll bet some Professional Investors were involved!

- January 29th 2015 - 77 Million shares - Disappointing Quarterly Earnings Announced before market open. (down 9%) Interestingly, volume was a robust 42 Million shares the day prior to the earnings release as well. More Professional Investor involvement?

Presumably, with US$ 14 Billion in shares traded in one day, last Thursday, people who knew what they were doing must have made a lot of money. Again, those who didn't know what they were doing....didn't.

Of course the SEC has all sorts of tools to monitor "suspect" trading activity, but even the most sophisticated software would most likely fail to detect a coordinated, whack-a-mole, offshore effort, funded by at least US$3 Trillion of CCP money through thousands of various legal entities, protected by Caymans Banking/Privacy laws. I'm guessing that "Hey I've got a hunch" wouldn't be probable cause for a Caymans/BVI Banker or CIMA Official to hand over records. The SEC might have been able to track and figure out what Bud Fox was doing with Blue Star, but I doubt they would get very far with Alibaba.

We also learned another thing, as I've opined in previous posts, since, when you are trading BABA stock and the Chinese Communist Party (CCP) has the other side of your trade, Thursday August 23rd has established and confirmed a benchmark. We now understand that the CCP, through Cayman's and BVI Shell Corporations, will have no problem, going forward, supporting a share price on volumes of at least 80 million shares or US$14 Billion, on any particular trading day. My guess would be, since this is a brilliantly diabolical CCP plan, that they have developed and maintain some sort of model that determines how many shares of BABA "they" own collectively throughout their Caribbean Professional Investor ecosystem. They will keep supporting the share price as long as they (in aggregate) can continue to generate enthusiasm from US Investors through their PR effort. They can "sell high" and "buy it back" at a lower price. If there ever comes a point where US Investors aren't participating at acceptable levels, the CCP will most likely cash out.

We can expect an increasing number of fantastic, incredible take-your-breath-away, not-to-be-believed-for-a-second press releases and statements from richly compensated interviewees extolling the virtues of Alibaba and the China dream, when, in reality, this is the greatest wealth grab and tool for capital flight/conversion in history.

To make a comparison, from a global financial perspective, this is the equivalent of and in some aspects, even worse than, the Cuban Missile Crisis. Weapons of Mass Destruction are parked just a few miles off shore in the Caribbean, except (thank goodness) there are no missiles. The Chinese Government chose to use Shell Corporations, and a pegged/fake RMB to accomplish their mission. In one respect, it's actually worse than the Cuban Missile Crisis, as thus far, our government doesn't seem to understand or acknowledge the existence of the threat.

The "Open Letter"

Finally, I promised an open letter to all my Securities Lawyer Friends out there. Of course, you all know, I'm not a lawyer and I don't play one on TV. I've listed a few things that you might want to think about as you follow this saga through to its logical, inevitable conclusion You all know how I enjoy bullet points by now..... so here you go:

1.) You should be actively looking for lead plaintiffs for your class actions now. The members of the class(es) will include all investors who were directly harmed by the collapse of Alibaba. You might include interest holders of Altaba, Softbank, EFT's, Mutual Funds, Pensions, etc. In short, just about everyone.

2.) You might consider working on your complaint/filing immediately. You'll want to be the first to file in your respective jurisdictions. The first pig to the trough always gets the best/most slop!

3.) Your complaint will be a professional liability claim based on the willful ignorance of professional standards, lack of due diligence and "what a normal standard of care would require a professional adviser to know or should have known". You should all know your particular statutes, procedures and jurisdictions and can decide when and how you want to file.

4.) Surprisingly enough, the target(s) of your law suit(s) won't be Alibaba or Alibaba's management. You'd be wasting your time. If you went that direction you might win a judgement or two, but you won't get a big pay day. Alibaba and their/your money will be safely untouchable off-shore. The targets of your suits will actually be the above listed co-conspirator Banks promoting this mess and putting their quarterly stamps of approval on this disaster. (Merrill Lynch, Citigroup, Morgan Stanley, Credit Suisse, RBC Capital Market, Barclays, Macquarie, JPMorgan and of course PWC Hong Kong.)

5.) If you folks are capable of generating civil fines and settlements against Wells Fargo for some mortgage mis-rep ($2.09 Billion) and some bad insurance sales practices ($1 Billion) can you imagine what you might be able to do with material like this? You would be front and center in a "known or should have known" conspiracy which destroyed the Western Financial system. That should be a YUGE! pay day for you. Of course, US Taxpayers would end up, as always, footing the bill, but it would be well worth it to send a message that a "strong buy" recommendation, no matter what the Investor Call "signals", on every piece of dog-shit that somehow gets listed on an Exchange, will no longer be tolerated.

Well, that's about it folks.....we'll see where this thing goes from here. As I've said for a while now. This is going to be an incredible ride..... Strap yourselves in, hang on and as always, practice safe investing.

Additional Reading

Alibaba

Group Holding Ltd. (BABA) CEO Daniel Zhang on Q1 2019 Results - Earnings Call

Transcript

Aug.

23, 2018 2:13 PM ET

|

About: Alibaba Group Holding Limited (BABA)

Q1:

08-02-18 Earnings Summary

EPS

of $1.22 beats by $0.01

Revenue

of $12.23B (+ 67.8% Y/Y) beats by $430M

Alibaba

Group Holding Ltd. (NYSE:BABA) Q1 2019

Earnings Call August 23, 2018 7:30 AM ET

Executives

Robert

Lin - Head of Investor Relations

Joe

Tsai - Executive Vice Chairman

Daniel

Zhang - Chief Executive Officer

Maggie

Wu - Chief Financial Officer

Analysts

Eddie

Leung - Merrill Lynch

Alicia

Yap - Citigroup

Grace

Chen - Morgan Stanley

Thomas

Chung - Credit Suisse

Mark

Mahaney - RBC Capital Market

Gregory

Zhao - Barclays

Wendy

Huang - Macquarie

Alex

Yao – JPMorgan

I'm told SeekingAlpha has a prohibition on posting full transcripts. I've removed the full text which had been previously posted. My bad....