Today, we're going to take a little time to try to tie the findings of a few of my favorite, very important documents together into one nice neat package. I've been following two (2) annual studies for years and I'm proud to say that there's a good chance I'm the only person on the planet who actually takes the time to read both of these tomes from cover to cover. Links to the most recent documents/reports are listed below.

They are:

I've described the ramifications of this mess in detail in my The Sum of all Fears post......

https://deep-throat-ipo.blogspot.com/2017/10/the-sum-of-all-fearsand-few-related.html

And....

The Financial Stability Board (FSB) - Global Shadow Banking Monitoring Report - 103 pages. (Published March of 2018 based on 2016 YE data)

http://www.fsb.org/wp-content/uploads/P050318-1.pdf

I've covered the relevant concepts ("Boomerang Money" & the build up of Chinese Controlled Off-Shore Assets) in my The New Phone Book's Here!.....(4/9/2018)

https://deep-throat-ipo.blogspot.com/2018/04/the-new-phone-books-herethe-new-phone.html

You might want to refresh your memory by re-reading this post as well, but it's not absolutely necessary. You'll get an idea as to where we're headed shortly.

By way of additional background, I've also included a link to a book that was recommended to me by several of my readers, which I really enjoyed. The book is "The Party" by Richard McGregor. I found it to be a fascinating, wonderfully written, historical account and analysis of the development and ascension of the Communist Party in China. Since the book was written in 2012, prior to the transition to the new CPC Financial Master-Plan and before the adoption of many of the mechanisms we've been discussion in this blog, it's also not absolutely necessary to read the The Party for a thorough understanding of today's discussion. Nonetheless it's a terrific, worthwhile read to get a perspective of the CPC philosophy, structure and political framework underpinning the transformation to what the world will have to deal with going forward.

Of course, the usual format applies: Read the "Red" Executive Summary to get a feel for the section/topic if you don't feel like reading the gory details. You can always skip ahead to the next section if pressed for time.

US Leadership Finally Seems to be "Getting It"....sort of...

Executive Summary: We analyze and describe both the progress and the shortcomings of the USCC Report to Congress. The Commission is vastly underestimating the impact Chinese investments have on the US Financial System. Chinese financial activity is the greatest "Pump and Dump" in history. Make sure to read the "Tweetable" summary of this post below.

I mentioned above that we were going to try to "tie some things together" in this post. To that end, I'd like to bring in yet another document that we've thus far, neglected to dissect in this blog. The document I'm referring to is the U.S.- China Economic and Security Review Commission (USCC) Annual Report to Congress.

2017 USCC Report - 657 Pgs. (Published November of 2017 - Based on 2016 data)

https://www.uscc.gov/sites/default/files/annual_reports/2017_Annual_Report_to_Congress.pdf

The report has been published annually since 2004. The original intent of the report was to provide analysis to US lawmakers regarding China's political, economic, military, trade and national security activities. The report has been increased in both scope and content over the years. It's been an excellent source of public information on what the US Government believes the CPC is actually up to.

Interestingly the 2017 Report (based on 2016 data) was the first report that addressed the increased presence of the CPC in US Financial Markets and investment in US Assets. Keeping in mind that the data in the report (along with the "most current" data in the the above described PBOC and FSB Reports) is roughly two years old now, we can nevertheless, note the following:

The most current, 2017 Report (2016 data), was remarkable in a number of ways. This is the first report report which actually:

1.) Mentioned Chinese listings (Alibaba, JD.com, etc.) on US Equity Markets and discussed the inherent structural risk(s) and problems, fraud and inability of US Investors and Regulatory Agencies to cope with same.

2.) Discussed Chinese FDI in US Assets.

3.) Attempted to describe and quantify Chinese penetration into US Financial Markets and the US Economy.

4.) Discussed Chinese monetary policy, noting concerns regarding the rapidly expanding money supply and resulting mainland credit bubble.

5.) Reversed the prior, long held position, from the 2016 Report (2015 data - Pg. 5 of the Executive Summary) that: "The Chinese government’s deliberate undervaluation of the renminbi makes U.S. products more expensive to Chinese consumers who therefore purchase fewer of them. Conversely, China’s undervalued currency also makes Chinese products cheaper in the United States, and therefore U.S. consumers purchase more of them." This thinking, though true a decade ago, always makes for great "save American jobs" political rhetoric, but based on the gigantic expansion of the Chinese money supply, this thinking is just plain wrong today and has been for quite some time. The (relatively) small annual US trade deficit with China is far eclipsed by the Trillions of dollars of Western Assets purchased using an OVER-valued (not undervalued) RMB. Undervalued currencies simply don't experience Capital Flight.

6.) For the first time, the Commission has begun to acknowledge the potential risk involved in the world's acceptance of a pegged or managed Renminbi (RMB). The report acknowledges the possibility of a "destabilizing devaluation" (Page 52) and generally describes the mechanisms that the PBOC is deploying to deal with their "Impossible Trinity" problem. i.e.) by limiting capital flows. As an aside, Steve Mnuchin just recently (October 10th) "warned" China against a currency devaluation in the face of the Yuan's recent fall. From my perspective this rhetoric is tantamount to threatening gravity after your parachute fails to open. A futile gesture proffered against an inevitable outcome. Economic forces and the certitude of math will always outlast disbelief, a rattling saber or a Twitter tantrum.

The above documents (along with 10's of thousands of pages of supporting documents and testimony) are the first steps in a road map describing what's happened thus far, and consequently, when properly analyzed, what's about to happen to the world's financial system(s). Not to get all "Nietzsche-ian" here, but the world's Central Bankers are staring into the abyss waiting for the abyss to wink back.

However, before we get into the nitty-gritty of these page-turners, if I've learned anything from our political leadership, it's that in today's social media driven environment, my findings absolutely must be "Tweetable". Sadly, It really doesn't matter if my work is cutting edge, accurate, intelligent or in fact makes any sense at all. Even the most brilliant work imaginable is worthless today if it doesn't get "eyeballs" and page views. To that end, I understand that today's most successful communication must be simple, direct, extremely controversial and filled with dramatic, emotional entertainment.

All that said, here's what's going on in the complex world of international finance today in a "Tweetable" format. I'm not a big tweeter, I generally use it to see what other smart people are saying, but I'll tweet this post as soon as I finish proofing the rest of the numbers below. I think this nails it:

Today's Post in a Tweetable Format

First..... print boat loads of Money in the basement of the PBOC.....wire it all over the world to accounts controlled by Chinese political elite.....and make sure you keep the exchange rate constant....

The Nitty Gritty of the 2017 USCC Report

First, to be clear, I'm not going to discuss any of the military, political, national security, IP theft, hacking and human rights issues described in the report. I'm not going to discuss the "Trade War Folly" since I've covered it in prior posts. Though critically important, I believe that bringing in these topics would detract from the spirit and focus of this post, taking my (and your) eye off the ball, so to speak. I'm concentrating on China's money, banking system and economy here since, from my vantage, this is the most important, yet misunderstood global risk factor looming on the horizon today.

To be painfully blunt, this post is a humble plea to the USCC to dig a bit farther, talk to a few more experts and add some emphasis and clarity, to the long overdue position they've just begun to take.

In short, the US China Commission, though I'm sure well intentioned, has thus far missed the scope (badly) of the financial risk involved in the integration and assimilation of China's "investment" in Western Markets and Assets. Simply put, the CPC has a two pronged game plan. First, they are selling "fake" stocks/securities for "real" money. Second, they are buying "real" assets using "fake" money. I'll add further details shortly.

The CPC is either diabolically brilliant or the most disjointed economic hot mess the world has ever seen. Unfortunately US and EU policy has enabled them every step of the way.

First, let's take a look at what's really happening to China's money supply as per one of the more illustrative charts I've seen in a while. The chart below, from Crescat Capital, shows the remarkable growth of China's banking system assets or "money" in relation to the rest of the world. I've been able to publish directionally similar charts through FRED (St. Louis FED) data sets, but I've not seen a better representation of China's "money" as compared to the rest of the developed world.

As mentioned above, I've discussed this phenomenon in my The New Phone Book's Here! post in conjunction with my "Productive GDP" or PGDP definition. This meteoric rise in both Bank Assets as well as Shadow Bank (Off-Balance-Sheet) Assets is attributable to a half decade of "kicking the can down the road" and misdirected funding, rather than the conventional (lack-of) wisdom, that this level of "money" is needed to support China's (fake) burgeoning GDP growth.

To be painfully blunt, this post is a humble plea to the USCC to dig a bit farther, talk to a few more experts and add some emphasis and clarity, to the long overdue position they've just begun to take.

In short, the US China Commission, though I'm sure well intentioned, has thus far missed the scope (badly) of the financial risk involved in the integration and assimilation of China's "investment" in Western Markets and Assets. Simply put, the CPC has a two pronged game plan. First, they are selling "fake" stocks/securities for "real" money. Second, they are buying "real" assets using "fake" money. I'll add further details shortly.

The CPC is either diabolically brilliant or the most disjointed economic hot mess the world has ever seen. Unfortunately US and EU policy has enabled them every step of the way.

First, let's take a look at what's really happening to China's money supply as per one of the more illustrative charts I've seen in a while. The chart below, from Crescat Capital, shows the remarkable growth of China's banking system assets or "money" in relation to the rest of the world. I've been able to publish directionally similar charts through FRED (St. Louis FED) data sets, but I've not seen a better representation of China's "money" as compared to the rest of the developed world.

As mentioned above, I've discussed this phenomenon in my The New Phone Book's Here! post in conjunction with my "Productive GDP" or PGDP definition. This meteoric rise in both Bank Assets as well as Shadow Bank (Off-Balance-Sheet) Assets is attributable to a half decade of "kicking the can down the road" and misdirected funding, rather than the conventional (lack-of) wisdom, that this level of "money" is needed to support China's (fake) burgeoning GDP growth.

Here's what the PBOC says (per the 2017 PBOC Financial Stability Report, page. 48)

It is

important to remain committed to the decisions

of the CPC Central Committee and the State

Council with regard to the five priorities—

cutting overcapacity, reducing excess

inventory, deleveraging, lowering costs and

strengthening areas of weakness. The PBC

will continue to pursue a prudent and neutral

monetary policy that is neither too tight nor

too loose, conduct appropriate fine-tunings and

preemptive adjustments through flexible use of price-based and quantity-based monetary

policy instruments, polish the policy toolkit,

straighten out the transmission channels for

the monetary policy and provide a facilitating

monetary and financial environment for the

sustainable economic growth.

I'm not kidding, that's what it actually says. I'd ask you, in the context of the five fold (US$30 Trillion+) increase in mainland Bank Assets, in conjunction with the "newly discovered" (US$25 Trillion+ totaling US$32 Trillion) Off-Balance-Sheet Assets, could any economist, banker or even Finance 101 student possibly describe this as "prudent and neutral monetary policy that is neither too tight nor too loose"? Seriously?

As many economists and bankers have long opined, these odd, silly policy statements call into question the veracity of just about every piece of data released by the CPC.

As many economists and bankers have long opined, these odd, silly policy statements call into question the veracity of just about every piece of data released by the CPC.

So what exactly does the USCC report say that I fundamentally disagree with? Again, the report hits on the main issues, but, for reasons we'll discuss shortly, badly misses the scope and magnitude of the problem. The report fails to recognize the global scale of the "Ants Moving House" phenomenon, treating all Chinese off-shore/tax-haven money as independently managed, when, in reality the world should be treating these assets as one gigantic China Inc. "Blob" of PBOC/SOE directed Assets Under Management, subject to the will/whim of the CPC.

We must think of China Inc. as the equivalent of several thousand Warren Buffetts working in concert as a well-oiled machine. Could you imagine what might happen if the world gave this incredible team of brilliant Warren Buffetts the ability to print their own currency? Providing instant, virtually unlimited financing? And finally, what if the world's bankers based their participation and "partnering" with China, Inc. on ludicrous, incomplete, concocted and contrived financial information, in exchange for a small commission, just to get the deals done?

No need to imagine what might happen, it already has. The only thing to ponder is how the world will eventually recover from it.

The most important, brief, yet esoteric discussions in the USCC Report, which I believe none (if any) of the lawmakers copied on this report truly understand, are described on pages 42-53 & 76-101.

We must think of China Inc. as the equivalent of several thousand Warren Buffetts working in concert as a well-oiled machine. Could you imagine what might happen if the world gave this incredible team of brilliant Warren Buffetts the ability to print their own currency? Providing instant, virtually unlimited financing? And finally, what if the world's bankers based their participation and "partnering" with China, Inc. on ludicrous, incomplete, concocted and contrived financial information, in exchange for a small commission, just to get the deals done?

No need to imagine what might happen, it already has. The only thing to ponder is how the world will eventually recover from it.

The most important, brief, yet esoteric discussions in the USCC Report, which I believe none (if any) of the lawmakers copied on this report truly understand, are described on pages 42-53 & 76-101.

The Executive Summary of the entire report is on pg. 1, with the (rather frightening) Commission Recommendations on pg. 29 & 597. As I've said, I believe the Commission is finally focused on the right things, but is vastly underestimating the severity of the problem. If they don't recommend steps to immediately accomplish investor transparency, simultaneously addressing China's SAFE/Capital controls and their pegged/managed "dual" currency, the Commission's financial and market reform recommendations are the equivalent of band-aids on a gaping wound.

One of the more misguidedly-misleading charts appears on page 93 of the report. The report was produced by the Rhodium Group and included without fanfare. It describes the origin of Foreign Private Issuers (FPI's) on the NYSE. Chinese stocks come in a distant third, behind the UK, Canada and "Tax Havens". Don't get me wrong, the chart is not "wrong" per se, but like so many things emanating from Chinese data, it only tells part of the story and deserves a little more explanation.

One of the more misguidedly-misleading charts appears on page 93 of the report. The report was produced by the Rhodium Group and included without fanfare. It describes the origin of Foreign Private Issuers (FPI's) on the NYSE. Chinese stocks come in a distant third, behind the UK, Canada and "Tax Havens". Don't get me wrong, the chart is not "wrong" per se, but like so many things emanating from Chinese data, it only tells part of the story and deserves a little more explanation.

USCC Report pg. 92 - Since 2000, many FPIs listing in the United States have been

incorporated in offshore locations, where underdeveloped financial

standards and disclosure requirements allow issuers to operate with

relative anonymity and circumvent U.S. regulations. As of May

2017, tax havens like Switzerland, the Cayman Islands, and Luxembourg were home to 94 FPIs listed on the New York Stock Exchange

(NYSE)—21 percent of all FPIs listed on the NYSE—and boasted a

combined market capitalization of nearly $900 billion (see Figure

3). Tax havens are the third-largest source of FPIs listed on the

NYSE by total market capitalization, trailing the United Kingdom

($1.2 trillion) and Canada ($1.1 trillion). China, meanwhile, is the

fourth-largest source of FPIs, with a total market capitalization of

$742 billion.

USCC Report pg. 94 - As of July 2017, a total of 126 Chinese companies were listed on the NASDAQ, NYSE, and American Stock Exchange (AMEX), with a total market capitalization of $960 billion.

So in not so many words, the USCC is telling lawmakers that the total financial exposure in US Equity markets through China FPI's is roughly a Trillion dollars, give or take, or roughly 3% of the total US Stock Market Capitalization. Not so bad? Right? Chinese FPI stocks have about the same Market Cap as Apple or Amazon. So, by extension, if either of those businesses suddenly went bust it wouldn't be all that big of a deal to US Investors? Agreed?

Further note, as I mentioned, that the page 93 chart also lists an interesting figure, that the third largest issuer of FPI's is "Tax Havens". The "Tax Haven" FPI's listed have a Market Cap of roughly $900 Billion. So, humor me here, what if the lions share of this money is actually Chinese money anonymously invested in US Stocks and FPI's through "Tax Haven" Shell Corps.? So now we're talking about roughly $2 Trillion (Amazon AND Apple) worth of Chinese influence on US Stock Markets. Can we say that if $2 Trillion in Market Cap disappeared overnight, the equivalent of both Amazon and Apple going under simultaneously, it would be just a minor market hiccup....can we really say that?

Now let's take a look at this concept through the lens of one of the charts I had included in my analysis of the The Financial Stability Board (FSB) - Global Shadow Banking Monitoring Report covered in my The New Phone Book's Here! post, while simultaneously keeping in mind the meteoric increase in Chinese Bank Assets as depicted in the Crescat Capital Chart above.

Also, please bear in mind that this Tax Haven data is now nearly two (2) years old, but the growth trend over the last few years is un-mistakable, continuing and from my point of view.....frightening.

Nearly 1/3rd (US$104 Trillion) of the worlds US$340 Trillion Financial Assets are now held in China and the seven (7) Tax Havens. The Assets in these jurisdictions have grown 12% from 2015 to 2016 while GDP has remained about the same. We can see from the chart that combined "Tax Haven" and Chinese OFI Assets (Hedge Funds/Private Equity/Investment Funds) totaled $44 Trillion (44% of the World's $99 Trillion) up a whopping 24% from 2015. The point is that when we see YUGE! increases like this, mirroring the gigantic increases in mainland China's Bank Assets, while the rest of the world's Bank Assets are growing slowly (or in the case of the EU actually declining) it wouldn't be far fetched to conclude that the a large chunk of this "Tax Haven" funding is actually Chinese money anonymously and cleverly disguised as Tax Haven capital flight invested in US and European Assets.

This, because of the pegged exchange rate, is the "fake" money chasing "real assets I referred to earlier.

In just one year, between 2015 and 2016, $8.4 Trillion moved into these Tax Havens. Substantially more than the roughly $960 Billion identified as invested in US Equity markets by the USCC. When we look at the Caymans the increase is remarkable. Other Financial Intermediaries (OFI) (i.e. Hedge Funds, etc.) Assets increased 23% to US$6.2 Trillion during the year. (Again emphasizing that we're looking at 2016, nearly two year old data) Now let's take a look at the composition.

One indicator of the true source of these funds is the Cayman Islands Monetary Authority (CIMA) Annual Investments Statistical Analysis. From my perspective, this report is a terrific example of accurate data presented to obscure the true, ugly underbelly of what's really happening in the Caymans. We'll start on page 13 with Figure 11. The truncated chart is intended to identify and describe the ownership jurisdiction of the funds under management. First, let's focus on the number of Cayman funds, which increased by more than 400, to 3,551 from 2015 to 2016. Contrast that with the number of Chinese funds, way down the list, with 247 designated as "owned" by a Chinese entity or person.

One indicator of the true source of these funds is the Cayman Islands Monetary Authority (CIMA) Annual Investments Statistical Analysis. From my perspective, this report is a terrific example of accurate data presented to obscure the true, ugly underbelly of what's really happening in the Caymans. We'll start on page 13 with Figure 11. The truncated chart is intended to identify and describe the ownership jurisdiction of the funds under management. First, let's focus on the number of Cayman funds, which increased by more than 400, to 3,551 from 2015 to 2016. Contrast that with the number of Chinese funds, way down the list, with 247 designated as "owned" by a Chinese entity or person.

When we examine Figure 9 on page page 10 (below), we see that the 3,551 Cayman Islands Funds hold Portfolio Assets of US$1.060 Trillion (an average of $300 million per fund). Since it's doubtful that the 60,000 permanent residents of the Cayman Islands are all multi-millionaires ($17.7 million for every man, woman and child on the Islands) who are setting up Investment funds at a record clip, we can focus on the more logical explanation, that the 10%+ "Legal Holders" of these funds are actually other Cayman Islands domiciled corporations, perhaps entities with monikers like Kung Fu Panda LTD, Wang-Chung-Big-Fun, Inc. or maybe Xi-mania Enterprises, LLC. But I digress....

Moreover, when we examine the 247 Chinese funds holding US$30 Billion in Portfolio Assets, and compare it to documents like, for instance, the Alibaba, JD.com, etc. 424(b)s, and 20-Fs , we can probably identify many of the 247 Caymans domiciled entities attributable to Chinese political elites. The point is that these Tax Haven entities are structured to mask ownership. These intentionally camouflaged ownership veils, combined with the misleading reporting conventions do exactly that.

There is also plenty of anecdotal evidence of the commitment Caymans Financial Planners, Trust Services and Administrators have in cultivating business from elite Chinese investors, many of the websites boast Hong Kong and Luxembourg offices as well as Chinese translators and website versions. Chinese investors are welcomed with open arms. They flock to the Caymans, the best, easiest and least cost path to anonymous ownership of (relatively) stable US Financial Assets.

My final commentary regarding the above would be, that if most of this Cayman Islands money didn't come from China, where in the name of J.P. Morgan did it come from?

One indicator of the true source of these funds is the Cayman Islands Monetary Authority (CIMA) Annual Investments Statistical Analysis. From my perspective, this report is a terrific example of accurate data presented to obscure the true, ugly underbelly of what's really happening in the Caymans. We'll start on page 13 with Figure 11. The truncated chart is intended to identify and describe the ownership jurisdiction of the funds under management. First, let's focus on the number of Cayman funds, which increased by more than 400, to 3,551 from 2015 to 2016. Contrast that with the number of Chinese funds, way down the list, with 247 designated as "owned" by a Chinese entity or person.

One indicator of the true source of these funds is the Cayman Islands Monetary Authority (CIMA) Annual Investments Statistical Analysis. From my perspective, this report is a terrific example of accurate data presented to obscure the true, ugly underbelly of what's really happening in the Caymans. We'll start on page 13 with Figure 11. The truncated chart is intended to identify and describe the ownership jurisdiction of the funds under management. First, let's focus on the number of Cayman funds, which increased by more than 400, to 3,551 from 2015 to 2016. Contrast that with the number of Chinese funds, way down the list, with 247 designated as "owned" by a Chinese entity or person.When we examine Figure 9 on page page 10 (below), we see that the 3,551 Cayman Islands Funds hold Portfolio Assets of US$1.060 Trillion (an average of $300 million per fund). Since it's doubtful that the 60,000 permanent residents of the Cayman Islands are all multi-millionaires ($17.7 million for every man, woman and child on the Islands) who are setting up Investment funds at a record clip, we can focus on the more logical explanation, that the 10%+ "Legal Holders" of these funds are actually other Cayman Islands domiciled corporations, perhaps entities with monikers like Kung Fu Panda LTD, Wang-Chung-Big-Fun, Inc. or maybe Xi-mania Enterprises, LLC. But I digress....

Moreover, when we examine the 247 Chinese funds holding US$30 Billion in Portfolio Assets, and compare it to documents like, for instance, the Alibaba, JD.com, etc. 424(b)s, and 20-Fs , we can probably identify many of the 247 Caymans domiciled entities attributable to Chinese political elites. The point is that these Tax Haven entities are structured to mask ownership. These intentionally camouflaged ownership veils, combined with the misleading reporting conventions do exactly that.

There is also plenty of anecdotal evidence of the commitment Caymans Financial Planners, Trust Services and Administrators have in cultivating business from elite Chinese investors, many of the websites boast Hong Kong and Luxembourg offices as well as Chinese translators and website versions. Chinese investors are welcomed with open arms. They flock to the Caymans, the best, easiest and least cost path to anonymous ownership of (relatively) stable US Financial Assets.

My final commentary regarding the above would be, that if most of this Cayman Islands money didn't come from China, where in the name of J.P. Morgan did it come from?

So now let's take a look at another Tax Haven, most specifically, Luxembourg. Although the Caymans model is generally the blueprint for the China Inc.'s global effort, i.e.) set up Offshore Shell Corps. and "buy cool assets", the scale of what's gone on in Europe is incredible as well. A few years ago (2014) PWC issued a document entitled Where Do You Renminbi?, which I've referenced in prior posts, promoting Luxembourg as "the" EU financial center for Chinese Investors. More recently (2017) PWC issued a follow up report, Luxembourg-A location Ideally Suited to Chinese Investors, again intended as a marketing piece to attract Chinese money to Luxembourg.

When we look at where we are today we can see that PWC and the government of Luxembourg were remarkably successful and prophetic in their projected appeal of Luxembourg to Chinese Investors. The flow of funds into Luxembourg is described in the FSB Report. OFI Assets have increased to $14.6 Trillion in 2016, up 46% from 2015. An astonishing rate of growth given the relatively stagnant European economy. Again, there is no data or source I am aware of which would describe the origin of the gigantic increases in these assets, but, based on what we've seen in the Caymans, it wouldn't be much of a stretch to think that a big chunk of this increase was from Chinese funding as well.

However, one prognostication that PWC missed badly on in their initial 2014 Report was that the Renminbi would quickly become a global currency. Here are a few of the quotes from page 29.

"In a recent study, 69% of high net worth individuals predicted that the RMB will be one of the three strongest currencies in the world throughout the next 30 years..."

"Within the next 5 to 10 years 39% of the European Central Bank Reserve Managers would consider investing in the RMB"

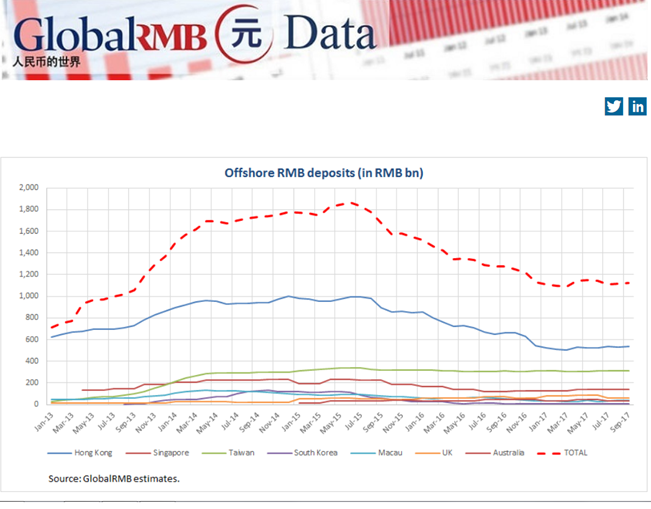

By almost any/every measure, the Internationalization of the RMB hasn't happened and isn't going to. China Inc. is hoarding and building up FOREX denominated investments off-shore while propping up the mainland economy, spinning plates, kicking cans and plugging holes with a rapidly expanding on-shore money supply. Inflation is funneled into property bubbles and bad-loan refinancing, preventing mainland defaults, protecting offshore asset prices and exchange rates. Supporting the currency and preventing its collapse has become the primary CPC directive. The chart below shows how off-shore RMB balances ("usable" supply) has actually been decreasing over the last few years. If the RMB were truly moving in the direction of a convertible, international currency, you'd expect the opposite.

The video clip below is a nice little summary which describes how Chinese Political Elite accomplish capital flight, you can insert a Cayman/Luxembourg Shell Corp. as an apparatus that could be used to facilitate every one of these examples/mechanisms.

We can assume that the big Chinese fish are moving money off shore with CPC permission and/or by directive, the rest of the capital flight is attributable to the frightened, littler fish trying to avoid the inevitable RMB devaluation that the rest of the world seems to be either in denial of or ambivalent to.

So coming full circle to the USCC report, when we look at the total amount, US$44 Trillion of Tax Haven OFI "Shadow"Assets (Per the FSB Report) we can conclude with some level of certainty that at least some significant portion of these investments are actually Chinese funds pouring into Western assets. Oddly enough, the USCC was aware of the FSB Report (they cited same in an obscure reference to "Fintech and Financial Innovation" in the footnotes found on page 150) but they've apparently not connected the dots.

Contrary to the $960 Billion in ADR/FPI risk that the USCC has indeed identified (i.e. "Fake" Chinese Companies sold for "Real" money), I'd suggest that the real valuation risk is closer to that US$2 Trillion in US stock markets as well as some percentage of US$44 Trillion (i.e. "Fake" money used to buy "real" assets, driving up asset prices) from these anonymous, disguised funds. So another US$5 Trillion?......US$10 Trillion? invested in US Stocks? Bonds? Real Estate? All owned by anonymous Chinese Shells or both "little fish" and "big fish"? My thesis, to be tested over time, is that the USCC and consequently, our legislators and regulators have all vastly underestimated the risk of what's going on.

This is an incredible mess.

Executive Summary: In this section we explore the relationship between Tax Haven Assets and skyrocketing residential real estate values in selected hot markets, as well as some of the causes for same.

This is a tough one. Because of our awesome American investment bankers, lawyers, regulators and lobbyists and the willful ignorance driven by the wonderful fees associated with these anonymous "Tax Haven" machines, we apparently have no way of knowing for sure. When we look at the composition of the Caymans funds it can, however, provide some additional insight. CIMA Report pg. 5

When we look at the allocations it's pretty much as you might expect. NAV is spread out over Equities and Bonds (long/short) as well as a few more exotic asset classes. There is also a significant allocation (US$1.254 Trillion) to Master Funds.....another layer of anonymity. Total Leverage of 2:1 ($7.108T/$3.592T) doesn't seem all that aggressive, but like so many of these devices, the amount of leverage isn't nearly as important as who's doing the levering and what's being levered....

Again, because of the anonymity, it's impossible to know for sure, but if I had to bet, I'd think that there is significant money going into US Real Estate. Could Master Fund allocations be moving into REITs? We will, of course, never know for sure....until it's too late to do anything about it.

Again, because of the anonymity, it's impossible to know for sure, but if I had to bet, I'd think that there is significant money going into US Real Estate. Could Master Fund allocations be moving into REITs? We will, of course, never know for sure....until it's too late to do anything about it.

Photograph: Jimmy Jeong/Reuters

To get an anecdotal idea as to what might be going on we only have to look at the headlines. When we see one cockroach we almost have to assume there are more hiding in the walls. Remember those awesome Mortgage Backed Securities (MBS) we had a little problem with a few years ago? There are lots of articles out there now on how Chinese buyers are snapping up real-estate everywhere. You'd think from the press clippings that the Chinese were buying up nearly all of San Francisco, Dallas, NYC, Vancouver (I know Vancouver is in Canada ....but humor me.), etc. You'd think that local buyers getting priced out of housing markets like these, given the relatively steady (some might say sluggish) wage growth after all of those years of near-ZIRP would be unlikely. But it seems that Chinese buyers, funded by "fake" money are driving up prices beyond the reach of US home buyers who are forced to try to pay for the home with "real" money, unless they choose to take on an "unconventional" mortgage. Quite a dilemna.

To get an anecdotal idea as to what might be going on we only have to look at the headlines. When we see one cockroach we almost have to assume there are more hiding in the walls. Remember those awesome Mortgage Backed Securities (MBS) we had a little problem with a few years ago? There are lots of articles out there now on how Chinese buyers are snapping up real-estate everywhere. You'd think from the press clippings that the Chinese were buying up nearly all of San Francisco, Dallas, NYC, Vancouver (I know Vancouver is in Canada ....but humor me.), etc. You'd think that local buyers getting priced out of housing markets like these, given the relatively steady (some might say sluggish) wage growth after all of those years of near-ZIRP would be unlikely. But it seems that Chinese buyers, funded by "fake" money are driving up prices beyond the reach of US home buyers who are forced to try to pay for the home with "real" money, unless they choose to take on an "unconventional" mortgage. Quite a dilemna.

To get a feel for what's going on at street level, so to speak, we need look no farther than.....drum roll....Quontic Bank in Queens NY! For years Chinese home buyers were showing up in NYC and buying homes and apartments in all cash deals. Those "Crazy Rich Asians! But once the CPC put the clamps on capital flight after the 2015 RMB hiccup, clever Chinese buyers were forced to start looking at alternatives to get the deals done. From The Real Deal:

"As a result, the Chinese investment market in New York City, which for years was defined by splashy all-cash purchases, has morphed into one grounded by more traditional financing. The shift offers a growing opportunity to a handful of lenders such as Quontic, HSBC, Guardhill Financial, Cathay Bank and Abacus Federal Savings Bank."

"As a result, the Chinese investment market in New York City, which for years was defined by splashy all-cash purchases, has morphed into one grounded by more traditional financing. The shift offers a growing opportunity to a handful of lenders such as Quontic, HSBC, Guardhill Financial, Cathay Bank and Abacus Federal Savings Bank."

Because of the ever creative US Banker and the ability to package and securitize mis-rated risk, the deals didn't slow down. According to the National Association of Realtors, Chinese individual purchasers remained the #1 foreign purchaser of US residential real estate in 2018.

NAR’s 2018 survey results suggest that Chinese buyers were not as adversely affected by rising prices and dwindling inventory when compared with other foreign buyers. Note, that the NAR survey includes individual purchases only and does not include "Shell Corp" purchases, the preferred structure for more expensive deals. Here are a few of my favorite lines from the March 2017 "The Real Deal" article along with a pithy Banker-Speak-Translation (BST). I'd invite you to read the entire article:

NAR’s 2018 survey results suggest that Chinese buyers were not as adversely affected by rising prices and dwindling inventory when compared with other foreign buyers. Note, that the NAR survey includes individual purchases only and does not include "Shell Corp" purchases, the preferred structure for more expensive deals. Here are a few of my favorite lines from the March 2017 "The Real Deal" article along with a pithy Banker-Speak-Translation (BST). I'd invite you to read the entire article:

BST Comment: That's just what I'd want to hear right before I make someone a loan.

BST Comment: Yup....totally agree....just another example of government red tape keeping really smart business people from making a buck.

Astoria-based Quontic will finance 65 percent of a purchase if the buyer has a green card. Without a green card or passport, the figure drops to 50 percent and the bank requires employment documentation and proof of local funds. To mitigate the bank’s risk, Quontic also requires foreign buyers to open an account holding at least six months worth of mortgage payments. Ho said he recently had a client who was prepared to pay more than $700,000 for an apartment in Flushing, but had to slash her budget by $200,000. She still wound up borrowing 60 percent. “She wasn’t able to get that much [money] over, so getting a mortgage was her option,” he said. “Unfortunately, it was her only option.”BST Comment: This is an outrage!.....bankers are forced do extra paperwork to make six figure loans to illegal aliens? (no passport or green card)....and they must ask if they have a job and/or any money in America? I had no idea that mortgages were so tough to get and that bankers were under such duress. Things have changed a lot since I got my last mortgage....I thought it was a moral victory when I was able to negotiate my way out of the cavity search,

BST Comment: Absolutely right again. It is "a tremendous thing"....people will always pay....until, of course, they can't/don't/won't.....I'm getting pretty scared right now.

Andrew Rice at New York Magazine put together a prophetic report on Manhattan real estate describing the emerging tsunami.

"According to data compiled by the firm PropertyShark, since 2008, roughly 30 percent of condo sales in large-scale Manhattan developments have been to purchasers who either listed an overseas address or bought through an entity like a limited-liability corporation, a tactic rarely employed by local homebuyers but favored by foreign investors."

Ryan Cooper followed up with an Op-Ed piece in The Week in November of 2017.

"The flood of outside cash rolling into New York real estate has numerous downsides. Most obviously, it drives up prices for actual New Yorkers who are looking to buy. But it also drives up rents, by keeping many perfectly good apartments empty. Many foreign investor properties are rented out, but many are not. Per the New York article: "The Census Bureau estimates that 30 percent of all apartments in the quadrant from 49th to 70th Streets between Fifth and Park are vacant at least 10 months a year." ....... a great many of the foreign investors and associated shell companies are laundering money."

Now let's take a look at the concentration. The New York Times graphic below illustrates where identifiable Chinese buyers are putting their cash.

https://iiusa.org/blog/wp-content/uploads/2017/12/Navigating-EB-5-Visa-Usage-Statistics2C-A-Historical-and-Current-Perspective.pdf

We can see from the chart above that roughly 50,900 visas were issued through 2017. If we add the projected 6,000 for FY2018 we get a total on 56,900 issued to Chinese Investors since the inception of the program. If we apply an average $750,000 Investment per application, we can calculate an EB-5 Investment, inception to date, of $42.5 Billion from Chinese Investors. Of course, this doesn't sound like all that much when compared to the US$44 Trillion of OFI Shadow Assets, but to put it in perspective, as an example, the total value (Market Cap) of Ford Motor Company is $38 Billion. Or, to frame it another way, the Market Value of all of the residential real estate in the Cleveland, Ohio Metro Area is $37 Billion. Simply put, Chinese Investors could have paid cash for either the 2nd largest US Car Maker or every house in the Cleveland Ohio Metro Area using the EB-5 Visa Program.

Could you imagine what Chinese Investors could do with US$44 Trillion?

My Favorite Building!

I visit Chicago often, and I have to say that one of my favorite places to have a beer is on the 16th floor Terrace of 401 N. Wabash. Great views of the city and they have this large format, pear flavored Weiss beer (I can't remember the name of it...a few of my friends refer to it as "girly beer"). I like to pound down a few on a nice summer day...or any season really. Since this is one of my favorite buildings in Chicago I thought I'd take a look at how the EB-5 Program might have impacted the financing of this project. So I went to the Cook County Assessors Office to see what I might come up with.

401 N. Wabash is a 92 story luxury hotel complex which is home to 487 very cool Condominium Residences (floors 29 thru 85 with some really expensive penthouses on floors 86 thru 89) , a 339 room hotel (floors 12 thru 27), a Conference Center and all kinds of amenities that the world's rich and famous would find appealing.....like pear flavored Weiss beer.

Interestingly, the Cook County records seem to be incomplete. Of the 486 Residential Units, only 197 are listed on the Assessors Office, along with 203 parking spaces owned by building residents. I've got an email request out the the Assessors office to see why the ownership records of 289 of the units don't appear on the website. Here are the bullet points of what I can make out of the records provided.

As a financial person, I've always felt that the asking price should be somewhere close to "where demand actually exists"....but hey, that's just me.

As all mortgage bankers are well aware, in a hard market, it's really important to loosen up underwriting guidelines in order to keep getting the deals done, the pipeline filled and the business rolling in. A guy's gotta make a buck! In another recent The Real Deal article (August 2018), Meenal Vamburkar describes the wonderful accommodations bankers are beginning to extend in order to continue to make loans to new, inexperienced millennial buyers. As every realtor knows, millennials, particularly those working in banking, finance and technology, are particularly attractive targets, since they believe they are invincible, have never been through a bear market and believe that if they "lose everything" a couple of times that they are still young enough to recover. Besides, the property they're bidding on is sure to double in value in five years so it doesn't matter how much equity they have. The important thing is to get the deal done.....at least that's what their realtor and banker are telling them. (For you Chinese Bankers out there, reading this blog for the first time, this last paragraph was, what we refer to in America, as "dripping with sarcasm")

(Referring to stock options included in the denominator of the debt/income ratio) The most important consideration is whether a borrower can liquidate the asset and how quickly, said mortgage broker Melissa Cohn.

Pithy BST Commentary: Yes.... that's exactly what young millennials should do to start their professional lives off on the right foot, take on a seven figure loan, based on a the inflated value of stock options that could vaporize overnight. New buyers need to be able to quickly monetize (cash out) all of their other assets in order to make their mortgage payments on a condo that's under water. Luckily, the market will come back...it always does. What could possibly go wrong?

A Little Out Of Step with the Big Picture...

Executive Summary: We discuss how US Investment Banks are continuing full speed ahead in global underwriting efforts, specifically the "Dollar Bond" market, despite the concerns of the USCC. We discuss the likely outcomes of a deleveraging in Dollar Bonds and the probability of a "Gap Up" in interest rates.

Years ago when I was a younger man just cutting my teeth in finance, a crotchety old treasurer, (who I really miss now that he's left this world) often recited a variation of:

"If they can't or won't pay you back, terms and interest rates are irrelevant...."

Apparently the big US Investment Banks haven't got the message or haven't been following the tone of the USCC Report. It looks like they've been full speed ahead, making sure that blue chip, or any fake foreign business for that matter, has access to cheap US capital. JP Morgan, Goldman, Citi, Morgan Stanley, Bank of America, etc. have all been developing global Dollar Bond Markets at a head spinning pace, for some handsome fees, of course.

For those of you unaware of the magnitude of this operation, over the last few years Chinese businesses and even the Chinese government (as well as businesses and governments all over the world) have been borrowing money (issuing bonds) denominated in US Dollars, paying interest denominated in US dollars, and eventually, these same businesses will have to pay off (or refinance) these bonds/ debts in US dollars. Last July Bloomberg published a nice little piece discussing the $500 Billion Market that the World Never Thought it Would See... The piece chronicles the development of the Dollar Bond Market since the financial crisis and describes the fake/silly reasons, posed by biased industry experts, that cash strapped mainland property developers, with no discernible need for dollar financing, are finding it advantageous to issue Dollar Bonds. I guess if you are going to default, you might as well default on a bondholder who will have a tough time collecting.

Wolf Richter also did a nice analysis entitled "De-Dolarization Not Now" on the topic a year ago (October of 2017) describing the phenomenon. I want to take a minute to re-post a chart I thought was relevant at the time and even more so now.

We can see from the chart that, since the financial crisis, the "world" has created roughly US$6 Trillion of US Loans (Money) outside of the US Banking System. If you or I "print US money" in our basements it's a felony, but when Investment Banks "print US money" and loan it to anonymous foreign borrowers it's "globalization"...again, for a hefty commission.

Foreign borrowers, courtesy of the "good old American Ingenuity" of US Investment Banks have somehow created legal obligations (bonds) funded by (and eventually repayable in) US Dollars which in aggregate are now approaching the equivalent of US M3 (US$14 Trillion). To fully put this in perspective, as another point of reference, Total (Aggregate) US Commercial Bank Assets (loans) are now just about US$16 Trillion. (See below compared to China M3 of nearly US$26 Trillion at current exchange rates....note that pesky little "dip" that I referenced in the Crescat Capital Bank Asset chart earlier in this post.) In other words, loans (bonds), the equivalent of nearly the entire US Broad Money Supply have been sold, underwritten and must eventually be refinanced or repaid in US Dollars.

Now let's take a look at "the dip" in Chinese M3. Here's a close up of the FRED data above, focusing on M3 growth from January 2016 to current. The chart below shows PBOC reported M3 in terms of US$ (converted using the then current exchange rate). As we observe, China's money supply had been on a relentless upward trajectory peaking at nearly US$ 28 Trillion until, for the first time in more than a decade, it abruptly reversed course in April of 2018....when it began to "dip". Again, we'll discuss this "dip" shortly.....I just want to keep emphasizing the importance of "the dip" to build what I'll call "overly-dramatic economic suspense" culminating in my upcoming grand finale of monetary analysis. Your patience, as always, is appreciated.

Moving ahead, since Wolf's analysis is more than a year old, I thought I'd go back to the BIS Data (Bank of International Settlements) drill down and update key data relevant to China's contribution to the dollar bond phenomenon. The table below describes the US Dollar Bond Amounts and growth attributable to Chinese issuers. i.e.) Chinese Bonds issued, serviced and to be repaid in US Dollars.

https://www.bis.org/statistics/index.htm

http://stats.bis.org/statx/srs/table/c3?c=CN&p=20134

We note the following from the above:

Of course, US Investment Banks gotta' lend a helping hand to get this deal done.....

From a Finance 101 perspective, once the demand for an asset drys up (It's irrelevant whether the waning demand is caused by an inability to pay or a lack of enthusiasm for the asset class), be it a NYC (or Beijing) Condo, a house in Omaha, a new car, a yacht, fine art, a stock or a bond, the value of the asset declines along with perceived wealth of the holder/owner of the asset. An asset is only worth what you can sell it for.

When we add debt (leverage) to the cycle asset prices naturally increase along with the "ability to pay". When we "deleverage", removing the "ability to pay" i.e.) make fewer new loans and refuse to roll over "bad" loans the ability to pay is reduced (Note: "bad" is sometimes difficult to define, the line between investment and philanthropy often becomes blurred.)

In a deleveraging cycle, investors holding assets (loans) with "inability/unwilling to pay" characteristics begin to scramble. Bad loans "destroy" money. As more wealth (money) is destroyed, it becomes harder to get (tighter) and investors demand a higher yield since there's less money to go around. The perceived value (price) of a Bond (a financial asset) drops, that pesky "9%.Rule of Thumb" in action. The yield (interest rate return) demanded by investors increases. This is the "Gap Up" I had discussed in an interview with Tim Bergin, Treasury Fails Revisited....earlier this year.

The BIS data at the time of my Treasury Fails Revisited.... post (Q2 2017) showed roughly US$91 Trillion of rate sensitive securities out there …..$39T US issues, $12T Japan, $10T China & $30T for Europe and “everybody else”. Fast forward to the just released, most current September BIS data (Q1 2018) and we see that in just 9 months, total rate-sensitive securities (bonds) have ballooned to US$103.5 Trillion a whopping US$12.5 Trillion increase. The figures are now $40T in the US, $13.5T Japan, $12.5T China and $37.5T for Europe and "everyone else". Again, bear in mind that the BIS is reporting six month old data. Unfortunately for investors, bonds are priced in real time.

When we contemplate this US$103.5 Trillion in financial obligations (bonds are of course, a contractual obligation), many of which are included it the US$44 Trillion in Tax Haven money (much of it bonds/debt) with the above US$12 Trillion Dollar Bonds in circulation (albeit a portion would be potentially double-dipped) we might come up with a few concerns. Since nothing like this has ever happened before (I seem to be saying that a lot lately) and this analysis is slightly above my pay-grade, I'm wondering:

When will Xi hit the Sell button?....there's a good chance he might already be clicking away.....

Executive Summary: There's a good chance China's deleveraging has already begun. We describe the change in composition of onshore Asset growth (Rhodium Group Research) and discuss whether it's real and how rapid the deleveraging might be.

2.) Up to $960 Billion of Chinese FPI's (USCC Page 93)

3.) Up to $900 Billion of Tax Haven FPI assets (USCC Page 92)

4.) US Real Estate roughly $400 Billion (Not addressed in the USCC Report)

5.) Chinese Dollar Bonds - $960 Billion. (Not addresses in the USCC Report)

6.) Some portion of Tax Haven OFI Assets (up to $44 Trillion) (FSB Report)

Expected Consequences:

1.) The aforementioned "Gap Up" in interest rates. The US Treasury holds an auction..... like it did last week....and there's a painful lack of enthusiasm to support the funding of US budget deficits.

2.) With more than $103 Trillion of interest rate sensitive debt out there, it will have to be repriced and/or default. Money will get more expensive, as there will be less of it available after the write offs. Central Bankers will be working some OT.

3.) World stock markets are over $100 Trillion now, with the Shiller CAPE at 31.2 at the second highest level in history (It hit 44:5 during the dot.com bubble). Stock markets usually over correct to the historical average. The historical mean over the last 150 years is 16.58, so many of us (at least the investors who don't see this coming) can expect to lose about 2/3rds of our 401k equity allocations.

4.) Apple, depending on the level of supply chain disruption, will be a shell of what it once was.

5.) Chinese FDI will be permanently delisted from US Exchanges based on populist outcry. For example, Alibaba will be gone. By association, Tencent, Altaba and Softbank will also cease to exist as currently constituted.

6.) Based on the above FRED Home Price/Mortgage/Wages chart. We're looking at a secondary (Real Estate driven) financial crisis part deux. When mortgage rates go up and jobs go away it never ends well. US$15 Trillion in American mortgages and the associated mortgage backed securities will need to be repriced with some determined to be permanently underwater. Again, there's that pesky "9% rule of thumb"

Of course, with a sea change of this magnitude, there will be some unexpected consequences. There always are. It will be really interesting, and possibly horrifying to see how these things unfold. I'll leave it up to you, my beloved readers to come up with a few more "unexpected consequences".

USCC Report Recommendations - The Final Disconnect

Executive Summary: There are only a few relevant recommendations in the USCC Report and they are generally toothless. There's no mention of measures to reign in US Investment Banks,address the "pegged" RMB or address any of the risks, issues and festering cataclysm discussed above.

The only Recommendations that the U.S.-CHINA ECONOMIC AND

SECURITY REVIEW COMMISSION made, relating to the financial topics I've discussed today are made on page 29 of the Executive Summary. Feel free to review the full text and details, but the relevant bullet points are "pasted" below. They are:

Andrew Rice at New York Magazine put together a prophetic report on Manhattan real estate describing the emerging tsunami.

"According to data compiled by the firm PropertyShark, since 2008, roughly 30 percent of condo sales in large-scale Manhattan developments have been to purchasers who either listed an overseas address or bought through an entity like a limited-liability corporation, a tactic rarely employed by local homebuyers but favored by foreign investors."

Ryan Cooper followed up with an Op-Ed piece in The Week in November of 2017.

"The flood of outside cash rolling into New York real estate has numerous downsides. Most obviously, it drives up prices for actual New Yorkers who are looking to buy. But it also drives up rents, by keeping many perfectly good apartments empty. Many foreign investor properties are rented out, but many are not. Per the New York article: "The Census Bureau estimates that 30 percent of all apartments in the quadrant from 49th to 70th Streets between Fifth and Park are vacant at least 10 months a year." ....... a great many of the foreign investors and associated shell companies are laundering money."

Now let's take a look at the concentration. The New York Times graphic below illustrates where identifiable Chinese buyers are putting their cash.

To be more specific, Chinese buyers are snapping up property in Manhattan, the Bay Area, Seattle/Redmond/Vancouver, Miami and interestingly enough, Trump projects in Chicago and New Jersey. The Bloomberg video below describes how developers have been using the EB-5 Visa program to finance development projects. Generally speaking, the EB-5 Visa program allows foreign investors to "buy" a visa if they invest a minimum of US$500,000 (but in many cases a $1 million or more) in "job creating" US projects. The program has somehow morphed into "Buy a million dollar luxury condo, get a two year US Visa!" Once they have a visa, Chinese investors can open US Bank and Brokerage Accounts. The EB-5 has become so popular for Chinese Nationals that the State Department has a Mandarin version of the application and instructions on the website. This is pretty handy for wealthy Chinese investors trying to get money out of the country, converting wealth from the inevitably imploding RMB to US Dollars.

As we can see from the chart below, the EB-5 Visa program as been wildly successful and used by Chinese investors to great advantage for years. It's given them the opportunity to buy real estate in all of the hottest markets in America. Roughly 70% of the annual 10,000 Visas available have gone to Chinese investors over the last few years.

We can see from the chart above that roughly 50,900 visas were issued through 2017. If we add the projected 6,000 for FY2018 we get a total on 56,900 issued to Chinese Investors since the inception of the program. If we apply an average $750,000 Investment per application, we can calculate an EB-5 Investment, inception to date, of $42.5 Billion from Chinese Investors. Of course, this doesn't sound like all that much when compared to the US$44 Trillion of OFI Shadow Assets, but to put it in perspective, as an example, the total value (Market Cap) of Ford Motor Company is $38 Billion. Or, to frame it another way, the Market Value of all of the residential real estate in the Cleveland, Ohio Metro Area is $37 Billion. Simply put, Chinese Investors could have paid cash for either the 2nd largest US Car Maker or every house in the Cleveland Ohio Metro Area using the EB-5 Visa Program.

Could you imagine what Chinese Investors could do with US$44 Trillion?

My Favorite Building!

I visit Chicago often, and I have to say that one of my favorite places to have a beer is on the 16th floor Terrace of 401 N. Wabash. Great views of the city and they have this large format, pear flavored Weiss beer (I can't remember the name of it...a few of my friends refer to it as "girly beer"). I like to pound down a few on a nice summer day...or any season really. Since this is one of my favorite buildings in Chicago I thought I'd take a look at how the EB-5 Program might have impacted the financing of this project. So I went to the Cook County Assessors Office to see what I might come up with.

401 N. Wabash is a 92 story luxury hotel complex which is home to 487 very cool Condominium Residences (floors 29 thru 85 with some really expensive penthouses on floors 86 thru 89) , a 339 room hotel (floors 12 thru 27), a Conference Center and all kinds of amenities that the world's rich and famous would find appealing.....like pear flavored Weiss beer.

Interestingly, the Cook County records seem to be incomplete. Of the 486 Residential Units, only 197 are listed on the Assessors Office, along with 203 parking spaces owned by building residents. I've got an email request out the the Assessors office to see why the ownership records of 289 of the units don't appear on the website. Here are the bullet points of what I can make out of the records provided.

- The total Market Value of the 197 Units is $241 Million.

- The average Market Value per unit is $1.2 Million.

- Parking Spaces have a Market Value of $75,000.

- The Penthouse on the 89th floor sold for $17 million in December of 2014 (Marked down from $32 Million....such a deal!)

- There are 203 Parking Spaces listed on the Assessors Website.

- There are no Units listed above the 49th floor on the Assessors Website, even thought there are 254 Units shown on the floor plan.

- 11 Investors own two or more Units.

- 33 Units (17%) are owned by an LLC or a Trust.

- 16 Units (8%) are owned by 401 N. Wabash LLC, the holding company for the building. (The seller)

- 56 Units (28%) have owners with Russian or Asian surnames.

- 8 of the 10 Units (80%) on the 29th floor are listed on the Assessors Website..

- 106 of the 132 units (80%) on floors 30 thru 40 are listed on the Assessors Website.

- 82 of the 90 units (91%) on floors 41 thru 49 are listed on the Assessors Website.

- We also note that none of the 339 "Hotel Condominium" units owned as investments by individual purchasers, as described in a 2014 Lawsuit, are listed on the Assessors website either. The purchase price of the two units in question was $2.2 Million ($1.1 Million each).

I guess the question I'd have to ask, and I'm hoping the Assessors Office can add some clarity, is: "what's so top secret about the ownership of the 254 Units listed above the 49th floor?....and why are none of the 339 'Hotel Condominium' Units listed either as residential or commercial?" A spreadsheet listing the data from the Cook County Assessor is listed below in "Exhibit T" below. I wonder how many of these owners (or the owners of the unlisted properties) are benefactors of the EB-5 Program? My understanding, per Bloomberg, is that this program has been an incredible boon to luxury property developers. Again, I'd emphasize that nobody is doing anything wrong here. Clever developers and business people have simply come up with a wonderful plan to help struggling foreign millionaires/billionaires park their money. Everybody wins! ....as they say.

The other odd piece of trivia I'd mention is that the EB-5 Visa program isn't mentioned at all in the USCC report. Not once. I find it hard to believe that a program which gives Chinese Investors this type of access ($42.6 Billion) to US Assets isn't even discussed as a topic for strategic review. You'd also think that the Administration must be aware of the program, after all, many of the folks working in the White House have at least some familiarity with luxury residential real estate. Weird....I can't believe they missed this.

What Happens When Buyers Suddenly Leave The Market?

Executive Summary: In this section we discuss the ramifications of the "dump" aspect of Xi's "Pump and Dump" as it related to US Real Estate Markets.

What happens when all of the Chinese property owners decide, rather than buying luxury real estate, they want to start selling it off? Right now, especially in the "hot" markets there's a growing divergence between the price of residential real estate, the leverage that buyers are willing to assume and their ability to service the debt. The FRED (St. Louis FED) Chart below tells the tale.

The chart above describes the indexed values (1/1/2005 = 100) for US Mortgage Debt (Red Line) Residential Property Prices (Black Line) and "Full Time Wages" for all workers (Blue Line). We see that as of Q2 2018:

The other odd piece of trivia I'd mention is that the EB-5 Visa program isn't mentioned at all in the USCC report. Not once. I find it hard to believe that a program which gives Chinese Investors this type of access ($42.6 Billion) to US Assets isn't even discussed as a topic for strategic review. You'd also think that the Administration must be aware of the program, after all, many of the folks working in the White House have at least some familiarity with luxury residential real estate. Weird....I can't believe they missed this.

What Happens When Buyers Suddenly Leave The Market?

Executive Summary: In this section we discuss the ramifications of the "dump" aspect of Xi's "Pump and Dump" as it related to US Real Estate Markets.

What happens when all of the Chinese property owners decide, rather than buying luxury real estate, they want to start selling it off? Right now, especially in the "hot" markets there's a growing divergence between the price of residential real estate, the leverage that buyers are willing to assume and their ability to service the debt. The FRED (St. Louis FED) Chart below tells the tale.

The chart above describes the indexed values (1/1/2005 = 100) for US Mortgage Debt (Red Line) Residential Property Prices (Black Line) and "Full Time Wages" for all workers (Blue Line). We see that as of Q2 2018:

- Mortgage Debt is the highest it's ever been $15.8 Trillion (140% of 2005 levels).

- Real Full Time Wages are 104% of 2005 levels. (about the same)

- Real Estate Values are at 90% of 2005 Levels. Up a bit from the 2012 bottom of 65% of 2005 levels but not fully recovered, or anywhere near the all time high of 2006.

The reason I'm bringing up is that we're starting to see signs that, as described above, Chinese buyers are still out there, but now they are applying some leverage to the transactions. All cash deals are declining. We're starting to see the "hot" markets cool off.

My favorite quote from a recent (September 21st) Bloomberg article is from Grant Long, senior economist at StreetEasy, when describing the number of NYC listings that took price cuts as "the most for any seven-day period in data going back to 2006".

“We’re at a period in the sales market where sellers have been incredibly ambitious with the prices they’re asking. They’re having to come down and bring prices to where demand actually exists.”

My favorite quote from a recent (September 21st) Bloomberg article is from Grant Long, senior economist at StreetEasy, when describing the number of NYC listings that took price cuts as "the most for any seven-day period in data going back to 2006".

“We’re at a period in the sales market where sellers have been incredibly ambitious with the prices they’re asking. They’re having to come down and bring prices to where demand actually exists.”

As a financial person, I've always felt that the asking price should be somewhere close to "where demand actually exists"....but hey, that's just me.

As all mortgage bankers are well aware, in a hard market, it's really important to loosen up underwriting guidelines in order to keep getting the deals done, the pipeline filled and the business rolling in. A guy's gotta make a buck! In another recent The Real Deal article (August 2018), Meenal Vamburkar describes the wonderful accommodations bankers are beginning to extend in order to continue to make loans to new, inexperienced millennial buyers. As every realtor knows, millennials, particularly those working in banking, finance and technology, are particularly attractive targets, since they believe they are invincible, have never been through a bear market and believe that if they "lose everything" a couple of times that they are still young enough to recover. Besides, the property they're bidding on is sure to double in value in five years so it doesn't matter how much equity they have. The important thing is to get the deal done.....at least that's what their realtor and banker are telling them. (For you Chinese Bankers out there, reading this blog for the first time, this last paragraph was, what we refer to in America, as "dripping with sarcasm")

Here are a few of my favorite lines from the article:

With nonbank lenders, some guidelines can be more flexible, said Alan Rosenbaum, CEO of Guardhill Financial. Even if a customer doesn’t fully meet requirements related to income, debt and reserves, lenders are willing to look at deals on a case-by-case basis, he said. In part, that’s a loosening up of rules set in place after the financial crisis — which some deemed too strict. “We’re seeing a more realistic, more common-sense approach to underwriting,” said Rosenbaum.

At the same time, the share of nonbank mortgage lending is increasing in the city. Last year, 29 percent of home purchase loans in New York were made by nonbank lenders, up from 22 percent in 2013

For some borrowers, stock options have been necessary to qualify for a prime rate loan, said Mira Dick, senior managing director at Luxury Mortgage Corp. One, for example, was a customer who worked in the tech industry. Without stock option income, their debt ratio would’ve been 46 percent, too high to qualify for a prime rate loan. Adding stock option income based on a 24 month average brought the debt ratio down 10 percent — allowing them to qualify

(Referring to stock options included in the denominator of the debt/income ratio) The most important consideration is whether a borrower can liquidate the asset and how quickly, said mortgage broker Melissa Cohn.

Pithy BST Commentary: Yes.... that's exactly what young millennials should do to start their professional lives off on the right foot, take on a seven figure loan, based on a the inflated value of stock options that could vaporize overnight. New buyers need to be able to quickly monetize (cash out) all of their other assets in order to make their mortgage payments on a condo that's under water. Luckily, the market will come back...it always does. What could possibly go wrong?

According to Bloomberg, Independent mortgage companies are making almost half of new home loans in the U.S. now, mirroring lending practices from the subprime crisis.

"Non-banks, more loosely regulated than large banks such as JPMorgan Chase, dominate the market for providing loans to borrowers with weak credit and lower incomes" Bloomberg reported.

Non-bank debt now accounts for nearly 80 percent of government-insured loans, according to the same report.

The more things change, the more they stay the same.

Non-bank debt now accounts for nearly 80 percent of government-insured loans, according to the same report.

The more things change, the more they stay the same.

A Little Out Of Step with the Big Picture...

Executive Summary: We discuss how US Investment Banks are continuing full speed ahead in global underwriting efforts, specifically the "Dollar Bond" market, despite the concerns of the USCC. We discuss the likely outcomes of a deleveraging in Dollar Bonds and the probability of a "Gap Up" in interest rates.

Years ago when I was a younger man just cutting my teeth in finance, a crotchety old treasurer, (who I really miss now that he's left this world) often recited a variation of:

"If they can't or won't pay you back, terms and interest rates are irrelevant...."

Apparently the big US Investment Banks haven't got the message or haven't been following the tone of the USCC Report. It looks like they've been full speed ahead, making sure that blue chip, or any fake foreign business for that matter, has access to cheap US capital. JP Morgan, Goldman, Citi, Morgan Stanley, Bank of America, etc. have all been developing global Dollar Bond Markets at a head spinning pace, for some handsome fees, of course.

For those of you unaware of the magnitude of this operation, over the last few years Chinese businesses and even the Chinese government (as well as businesses and governments all over the world) have been borrowing money (issuing bonds) denominated in US Dollars, paying interest denominated in US dollars, and eventually, these same businesses will have to pay off (or refinance) these bonds/ debts in US dollars. Last July Bloomberg published a nice little piece discussing the $500 Billion Market that the World Never Thought it Would See... The piece chronicles the development of the Dollar Bond Market since the financial crisis and describes the fake/silly reasons, posed by biased industry experts, that cash strapped mainland property developers, with no discernible need for dollar financing, are finding it advantageous to issue Dollar Bonds. I guess if you are going to default, you might as well default on a bondholder who will have a tough time collecting.

Wolf Richter also did a nice analysis entitled "De-Dolarization Not Now" on the topic a year ago (October of 2017) describing the phenomenon. I want to take a minute to re-post a chart I thought was relevant at the time and even more so now.

We can see from the chart that, since the financial crisis, the "world" has created roughly US$6 Trillion of US Loans (Money) outside of the US Banking System. If you or I "print US money" in our basements it's a felony, but when Investment Banks "print US money" and loan it to anonymous foreign borrowers it's "globalization"...again, for a hefty commission.

Foreign borrowers, courtesy of the "good old American Ingenuity" of US Investment Banks have somehow created legal obligations (bonds) funded by (and eventually repayable in) US Dollars which in aggregate are now approaching the equivalent of US M3 (US$14 Trillion). To fully put this in perspective, as another point of reference, Total (Aggregate) US Commercial Bank Assets (loans) are now just about US$16 Trillion. (See below compared to China M3 of nearly US$26 Trillion at current exchange rates....note that pesky little "dip" that I referenced in the Crescat Capital Bank Asset chart earlier in this post.) In other words, loans (bonds), the equivalent of nearly the entire US Broad Money Supply have been sold, underwritten and must eventually be refinanced or repaid in US Dollars.

Now let's take a look at "the dip" in Chinese M3. Here's a close up of the FRED data above, focusing on M3 growth from January 2016 to current. The chart below shows PBOC reported M3 in terms of US$ (converted using the then current exchange rate). As we observe, China's money supply had been on a relentless upward trajectory peaking at nearly US$ 28 Trillion until, for the first time in more than a decade, it abruptly reversed course in April of 2018....when it began to "dip". Again, we'll discuss this "dip" shortly.....I just want to keep emphasizing the importance of "the dip" to build what I'll call "overly-dramatic economic suspense" culminating in my upcoming grand finale of monetary analysis. Your patience, as always, is appreciated.

Moving ahead, since Wolf's analysis is more than a year old, I thought I'd go back to the BIS Data (Bank of International Settlements) drill down and update key data relevant to China's contribution to the dollar bond phenomenon. The table below describes the US Dollar Bond Amounts and growth attributable to Chinese issuers. i.e.) Chinese Bonds issued, serviced and to be repaid in US Dollars.

https://www.bis.org/statistics/index.htm

http://stats.bis.org/statx/srs/table/c3?c=CN&p=20134

We note the following from the above:

- Dollar Bonds issued by Chinese entities have grown nearly five fold in less than 5 years.

- Dollar Bonds issued by Chinese entities have increased to nearly US$1 Trillion or by comparison, to roughly 1/12th of US Domestic M3. (Or 1/26th of China's Domestic M3)

- Dollar Bonds issued by Chinese entities are roughly 1/12th of all Dollar Bonds issued, and 1/3rd of all Dollar Bonds issued by developing countries.

- My understanding is that many of these issues are junk rated. (I'm working on zeroing in on that number/percentage.)

It should also be noted that Chinese property developers have been the unlikely benefactors of these bond issues. Per Bloomberg:

Among corporate issuers, property developers have been particularly aggressive in selling dollar debt. Although without dollar revenue of their own, builders eagerly tapped the dollar-bond market in an environment of a stable exchange rate and lower yields offshore than at home. They ramped up issuance 300 percent in 2017 from the previous year, to $42 billion, according to data compiled by Australia & New Zealand Banking Group Ltd.

BST Translation: Debt laden property Developers don't need US$'s for operations but they borrow the money to speculate on other US$ Financial Assets. I wonder how much of this money somehow finds its way back into US Luxury Real Estate through the Caymans?

BST Translation: Debt laden property Developers don't need US$'s for operations but they borrow the money to speculate on other US$ Financial Assets. I wonder how much of this money somehow finds its way back into US Luxury Real Estate through the Caymans?

Just last week, the Chinese government announced that they were issuing another $3 Billion in US dollar denominated sovereign debt. Perhaps I'm showing my ignorance here, but two questions immediately jump to mind:

1.) Why would the Chinese government be borrowing US Dollars? I don't see the FED, the BOJ or the ECB selling RMB denominated debt?