....and all through the bank.....not a creature was stirring.....ne'er the ghost of "Old Hank"....

Our investments were placed by the chimney with care in hopes that FED accommodation, continuing and exacerbating years of horrific, politically motivated policy decisions, soon would be there.....Oooppss.....Not happenin' today!

I know, I know....my poetry doesn't exactly flow.....but it's accurate....

Yes, it's that time of year once again. It's that special holiday time when we take a moment or two to reflect on the year's events, set backs and successes. We think about all of the wonderful times, family and friendships we've been blessed with. We rejoice and marvel in how fortunate we've been to somehow skip gleefully, unscathed through the mine field of life, oblivious to the myriad financial disasters lying in wait for us at every turn and round every corner.

Last week, a friend of mine stopped by my office to share some Christmas cheer and, as is the norm with our discussions, our banter eventually morphed from the insurance industry, local business gossip, Holiday events and parties, family, gifts and the Cleveland Browns, to, finally, of course, Chinese Monetary policy.....as nearly all office conversations do nowadays. Typical Yuletide chit chat.

When we were discussing the relative dollar/RMB strength, my (very smart) friend brought up a reference and a few related thoughts that I hadn't considered since I was a wet-behind-the-ears finance student at the University of Wisconsin, many, many years ago. Thus, the genesis of today's post. The term that came up was.... the "Triffin Dilemma".

For those of you who don't recall, or never had the pleasure of meeting Bob, the Triffin Dilemma is a reference to the work and related 1959 Congressional testimony of Yale economist Robert Triffin, who argued, in a nutshell, that if the US Dollar is/was to remain as the preferred currency to settle the world's international trade, the Treasury would be required to supply "the world" with sufficient US Dollar currency to support global trade growth. As global economic activity would grow, specifically, trade transactions where America wasn't a party (but dollars were....think today's Petro Dollar transactions) the United States would have to run increasingly larger Balance of Payments deficits to support these transactions. (i.e. providing a stable reserve currency for the world's trade).

Simply put, continued, increasing, Balance of Payment (Current Account) deficits would be required by the United States if the US Dollar were to be used as the world's reserve currency.

Triffin argued, well ahead of his contemporaries, that the system would eventually become unsustainable ( the "Dilemma") as the amount of currency (backed by gold) required would mandate unfundable, ever increasing Balance of Payments deficits and/or threaten the confidence/stability of the US Dollar's gold backing/guarantee. The Treasury would be forced to starve the world of dollars.

As is most often the case for truly revolutionary, yet painfully obvious economic thinking, Professor Triffin's work was largely ignored by politicians, bankers and business people until 1971 when everything he'd predicted became reality and what we now refer to as the "Nixon Shock", as Triffin expected, materialized. The administration was forced to abandon the Bretton Woods Agreement, taking America off the gold standard, closing the "gold window", leaving the world with the US Dollar as a floating reserve currency. The US Treasury would no longer exchange US Dollars for gold on demand. The world would become a floating, market dependent fiat currency world. The value of every currency would henceforth be determined by market forces (i.e. relative availability relating to supply and demand). In theory, everything would, of course, be just fine.

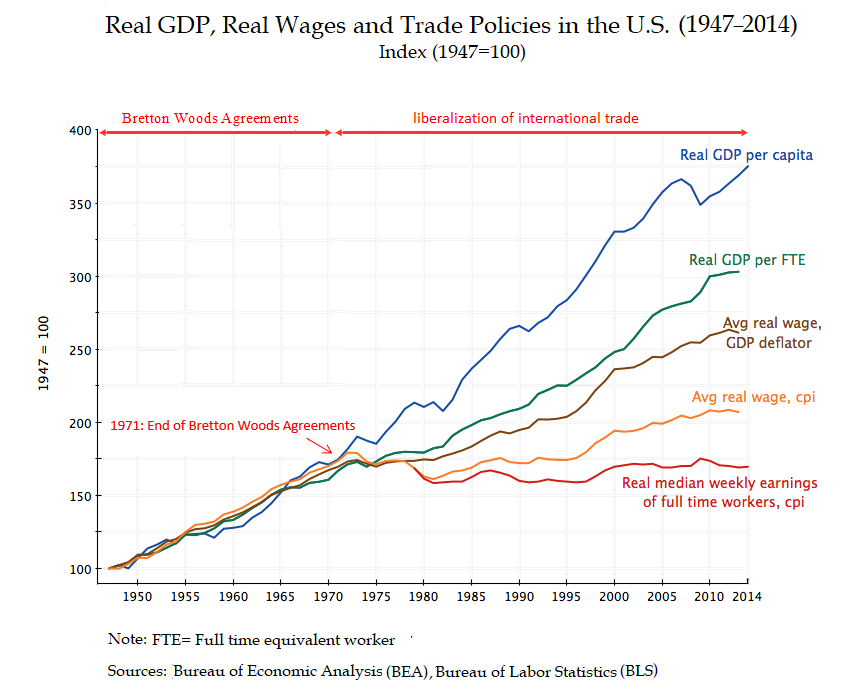

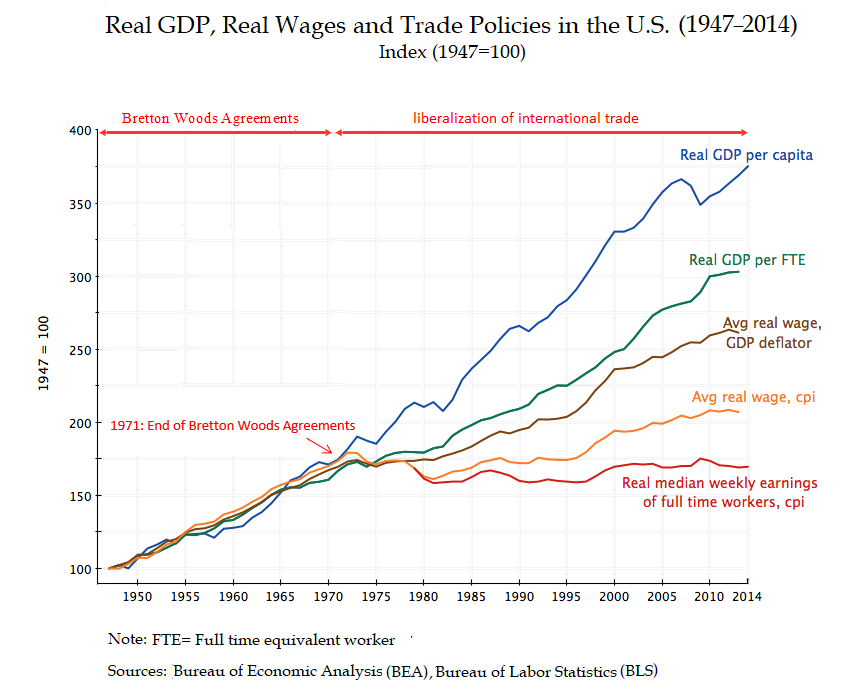

So let's take a look at what's happened to the US Economy since we've dumped Bretton Woods, using one of my favorite charts. (I can't take credit for it....citation below)

Beginning in 1947 (when my dad had just come back from his all-expense-paid French vacation on the beaches of Normandy courtesy of the US Army) up to 1971, we note that the bellwether indicators, Real Wages, inflation and GDP were in relative lockstep. This is of course, before Al Gore invented the Internet, and high tech bankers came up with all sorts of sophisticated banking devices. Once we entered a floating world, we observe that the indicators have diverged dramatically over time. US GDP, both per capita and per FTE have skyrocketed. We also note, to our chagrin, (using the collective "our" here presuming that most folks reading this will have some sort of a "job") that Real Weekly Earnings for full time workers are about the same as they were in 1971, even though Real GDP per capita/FTE has skyrocketed, as an apparent byproduct of productivity, as well as labor and capital seeking both its optimum use and lowest financial price-point/cost. Economies around the world have been set free to export (and import) labor (jobs) capital and technology in competitive pursuit of lower costs and greater efficiencies and profits for the businesses who could navigate the new globalism. The chart below describes the net impact of these monetary and regulatory policies on Western governments over time.

Ooopppsss......Oh Geezzz.....I'm sorry, by bad, that's actually a picture of last week's riots in Paris.....my mistake, I'm sure I'll locate that "productivity" graphic shortly, or at least by the time they put the fires out on the Champs-Élysées.

Anyway, as I was saying, here's the chart I was referring to.....

Oh crap.....I screwed this up again....this is actually last month in Venezuela, I guess a little government corruption and "a million percent" inflation, wiping out the life savings of main street folks (they probably didn't get their cash converted to Offshore USD/Euros in time) will rub those poor, pathetic huddled masses the wrong way from time to time. We better get that wall up quickly, the US Southern border is just a few year's walk (maybe six months if they are in good physical shape) for these malnourished, unemployed, starving, "last resort" criminals.....I'll bet they are all members of MS13, or ISIS, or at least being actively recruited....if we could just come up with tear gas that doesn't hurt pregnant women, kids and old people....now that would be a technology worth an IPO!

Ok, now I've got it, here's the chart I was looking for (see below). This chart, although not as graphic as the above photos, should absolutely scare the living-holiday-reindeer-snot out of any highly trained (or barely competent) economist reading it. In economic terms, this chart depicts millions of people on the verge of starvation, going homeless or being shot and/or beaten to death in "real life". Highly trained Economists, as we all know, have a completely different fear threshold than mere mortals.

The chart and table above were constructed based on data from the Financial Stability Board's 2017 Shadow Banking Monitoring report data set (2016 data) and the World Bank Development Indicators Data set (citations below).

The following is the most important statement in this post:

In broad, yet definitive terms, the chart above shows, with clarity, that the US Treasury and the FED have most likely lost control of the US, and by default, the global money/financial system. (Please read that again....it's really important!....I'll wait....go ahead....read that one more time.....let it sink in.)

Ok....take a deep breath.....let's keep going...

A few days ago Janet Yellen discussed the idea that "The FED has no idea what they are doing" as a hypothetical topic (my words not Janet's), in general terms, blaming their "lack of tools", although not fully understanding or acknowledging that her continuation of "Bad Gauges" monetary policy was a major contributor to the gigantic mess we're in today. Basing monetary policy on fudged, sampled, limited domestic metrics when the bulk of the systemic stress relates to foreign monetary policy (China), unregulated (off shore) funds flow, selective dedolarization and the Triffin-esque inability for the US Dollar to remain as the world's reserve currency, has become the undoing of the global financial system as we currently know it.

“I am worried that we are in a deregulatory mode and I see a lot of pressures building in the system to go further to really weaken fundamental safeguards that were created in Dodd-Frank. We are a decade after the financial crisis so that would be worrisome and wrong to do,” Janet Yellen - speaking at the Women in Housing and Finance holiday event (12/12/18).

Hindsight being what it is, all of these "pressures" and off shore capital flight could have been mitigated, at least to some extent, had we begun to normalize interest rates sooner, put in China-style "selective" off shore capital restrictions, both in and out (Caymans, Luxembourg, et al), and taken steps to understand the true origin and exposure to the "brand-spanking-new" US$150+ Trillion in globalized "Fake Money" Financial Assets, destined for default, that US Bankers (read US Taxpayers) will be intimately involved in cleaning up. As usual, the bankers made the mess, the regulators and legislators allowed it to happen....and the taxpayer will pay the bill.

Apparently, the FED has learned little from history, in October 2008, then New York Fed President Timothy Geithner observed that Europe “ran a banking system that was allowed to get very, very big relative to GDP, with huge currency mismatches and with no plans to meet the liquidity needs of their banks in dollars in the event that we face a storm like this.” From the FOMC meeting transcript.

Here's some recent, behind the scenes video of the daily routine at the NY Fed's Open Market desk. Note the sophisticated decision process, based on state of the art data and metrics. The global economy, as we well know, depends on the meticulous execution of FED policy.

It's always been interesting to me that Amazon can track a US$4 parcel, time and date stamped, from Shanghai, to Paramus, to my Cleveland office (knowing virtually everything necessary about the parties involved) and the FED/Treasury can't tell the origin, final destination or purpose (without a court order in a complying jurisdiction) of a $50 Billion, US Dollar, layered wire transfer from Hong Kong to a Cayman Islands Bank. Weird huh?

The FED's ability to manage the US money supply, while other entities are free to create trillions of Off Balance Sheet USD obligations is the equivalent of Amazon trying to do eCommerce without package tracking or inventory control.

Bear in mind that the most recent data (above) is the YE 2016 Data Set. I would suspect that the data has been trending in a similar direction for the past two years. i.e.) it looks much worse today. Based on projected Asset Growth Rates we may have somewhere north of US$370 Trillion of Assets/Obligations on the world's books now, of which a significant chunk could be a tad over valued and poised to default. Of course we won't get the 2018 numbers until the Spring of 2020, which is unfortunate. As always, while the world's economists and politicians are relegated to looking in the rear view mirror, stocks, bonds, debt, derivatives and currencies are being priced in real time.

As you can see (above), I break the data/chart out into two sections, the first is what I call the "Old Money" and the other is what I lovingly refer to as "Fake Money". Old Money is described as that held by established, seasoned, open economies with highly developed transparent, banking, taxation, and monetary systems. Fake Money is best described as money held in jurisdictions where there is less transparency (perhaps a bit of chicanery) with financial asset location/creation and monetary policy, all having little to do with the underlying productivity of the related domestic economies. I've included China, the "usual suspect" Tax Havens (Caymans, Luxembourg, Switzerland, Hong Kong, et. al.) and "Other" (defined as everywhere else) as Fake Money. Before I get bombarded with Greek, Italian, Middle Eastern, etc. emails resulting from my "Other" being defined as "Fake Money" located "everywhere else", keep in mind that as monetary policy goes, and I know you "Other" folks hate to hear this, but you are all along for the monetary ride. Your sovereignty is a wonderful "feel good" convention, but it's largely irrelevant when compared to the Chinese/US/Tax Haven tsunami heading your/our way.

The observations I'd make are as follows, regarding the change in composition from 2008 to 2016:

The "Old Money"

The "Fake Money"

Of course, the rarely discussed corollary to the Triffin Dilemma is what I'll refer to as the "Deep Throat Conundrum".

The Deep Throat Conundrum. simply put, states that, in a floating currency world, an economy which continually runs large Balance of Payments (Current Account) Surpluses, using sufficient currency/capital controls can manage their exchange rate to a pegged value. The "Impossible Trinity" can, for a frightening period of time, become possible.

If said economy (China) so chooses, that economy/country is able to print money and "buy" foreign assets at a whopping discount. (i.e. Today, the PBOC by virtue of accumulated US Dollar reserves, rather than market forces determines the value of the RMB). This "theft by valuation" (e.g. I print money in my basement and you sell me the Waldorf Astoria!....such a deal!) will most likely reset global asset values and topple the global financial system as currently constructed.

The "Conundrum" is only possible because the financial system we've (collectively "the world") developed and accepted is one built on the rationalization of amoral transactions and devices, justified by and in exchange for, significant compensation to the promulgators of same. Carefully crafted legal work, perspective and related legislation directed by special interests, in the name of protecting privacy and promoting free markets has made just about any movement of money both impossible to regulate and "technically" not illegal per se.

Quite a Conundrum indeed.

Our Leadership

Since it looks like we're up against a good old fashioned market meltdown followed by QE money printing the likes of which we've not seen since the Wiemar Republic, enormous debt monitization, an eventual dollar devaluation/crash and an economic contraction of biblical proportions, it's indeed fortunate that we are guided by highly compensated financial professionals, relentless regulators and statesmen whose only concern is the well being of the American people.

Over the last few weeks, as the equity markets have begun to "take a dump" (technical bankers term), Yellen, Clayton, Geithner, Chanos, FED Officials, investors and the talking heads alike have all weighed in, in some form or another, describing in various degrees and terminology that something is a bit "wrong" with the markets. Ray Dalio, a relatively busy guy, actually just took the time to produce a 450 page tome entitled "A Template for Understanding Big Debt Crises". I'm forging through it over the holidays....as you might suspect, it's wonderfully written, but a really a tough read. Lots to absorb and think about. I'd also suspect that, since Ray has always been a big picture, time is of the essence kind of guy, I doubt that while he was writing this, he was thinking that:

"Hey.....everything is fine and dandy right now....perhaps I'll chronicle my concerns about something that could crop up around 2040....I've got nothing better to do.....no time like the present!"

That said, if you recall, back in 2008 "stay the course", "steady as she goes", "no need to panic" and "buy the dip" were all drinking games. Here's just one of the many, many examples of the fantastic, well thought out guidance the US Retail Investor has available at their beck and call on the Internet:

If that's not inspirational enough for you, the video below is an outstanding example of the integrity, truthfulness and transparency that US CEO's have become known for, standing by their decisions, relentlessly, fairly representing the unvarnished truth to their investors regardless of consequences or the impact on their stock price.

Finally, during the Holidays, in this festive time of jubilation, as we share tidings of great joy with our fellow men/women, we must be totally grateful for our political leadership. We are truly blessed to be led by dedicated, compassionate, grounded intellectuals who use their giant "brains" to analyze complex problems, carefully calculating all of the possible permutations, consequences and ramifications of their meticulously crafted bipartisan policy, with their sole concern being the well being of the American people. I, for one, am confident our future is in the best of hands. If anyone can get us through the soon to commence financial crisis, our current leadership can! This administration, working in lockstep with Congress, as our founding fathers had intended, will deftly guide us toward the re-illumination of our shining city on the hill....

Oh Geeezzz.....we are so screwed.....

Oh.....I almost forgot......MERRY CHRISTMAS!

Additional Reading

World Bank Development Indicators

https://datacatalog.worldbank.org/dataset/world-development-indicators

Gross GDP for China

https://fred.stlouisfed.org/series/MKTGDPCNA646NWDB

GDP World

https://fred.stlouisfed.org/series/NYGDPMKTPCDWLD

FSB Shadow Bank Monitoring Report - Excel Dataset

http://www.fsb.org/2018/03/global-shadow-banking-monitoring-report-2017/

Venezuela is in trouble....

https://www.cnbc.com/2016/11/02/venezuelas-problems-get-worse-as-protests-and-riots-become-more-violent.html

China - call for new reserve currency

https://www.ft.com/content/7851925a-17a2-11de-8c9d-0000779fd2ac

The World's Reserve Currency - USD

https://www.thebalance.com/world-currency-3305931

Carnagie Endowment - US Foreign Policy Impact on Middle Class America

https://twitter.com/i/broadcasts/1yoKMjmkLPzGQ

Michael Pettis - Thoughts on China & de-Globalization

https://twitter.com/i/status/1073253716030095360

Jim Chanos - Something wrong.....

https://www.cnbc.com/2018/12/13/jim-chanos-says-theres-something-wrong-with-the-stock-market-when-rates-this-low-cause-panic.html?__source=twitter%7Cmain

US Budget Deficit Widens in November

https://www.bloomberg.com/news/articles/2018-12-13/u-s-budget-deficit-hits-widest-on-record-for-month-of-november

Janet Yellen Comments - Inability of FED Policy to react to the next financial crisis - Market Watch

https://www.marketwatch.com/story/janet-yellen-is-worried-about-the-next-financial-crisis-2018-12-13?mod=mw_share_twitter

BIS - International Credit Markets

https://www.bis.org/ifc/events/ifc_armenia_2018/Tissot.pdf

Really Smart "Brains" are Required

https://www.mediaite.com/online/trump-claims-in-wild-interview-my-gut-tells-me-more-sometimes-than-anybody-elses-brain-can/

McKinsey - A helping hand to authoritarian government

https://www.nytimes.com/2018/12/15/world/asia/mckinsey-china-russia.html

Yardini - Central Bank Balance Sheets

https://www.yardeni.com/pub/peacockfedecbassets.pdf

China's Crumbling Reeducation System - The Onion

(For my Chinese readers out there, this is what's referred to as "Weisenheiming Sarcasm")

https://www.theonion.com/chinese-officials-vow-to-fix-nation-s-crumbling-reeduca-1819577410

The OBOR "dollar problem" - Financial Times

https://ftalphaville.ft.com/2018/12/18/1545130791000/The-Belt-and-Road-s-dollar-problem/

The RMB won't replace the dollar - Financial Times

https://ftalphaville.ft.com/2018/09/19/1537329600000/China-s-currency-will-not-replace-the-US-dollar/

Our investments were placed by the chimney with care in hopes that FED accommodation, continuing and exacerbating years of horrific, politically motivated policy decisions, soon would be there.....Oooppss.....Not happenin' today!

I know, I know....my poetry doesn't exactly flow.....but it's accurate....

Yes, it's that time of year once again. It's that special holiday time when we take a moment or two to reflect on the year's events, set backs and successes. We think about all of the wonderful times, family and friendships we've been blessed with. We rejoice and marvel in how fortunate we've been to somehow skip gleefully, unscathed through the mine field of life, oblivious to the myriad financial disasters lying in wait for us at every turn and round every corner.

Last week, a friend of mine stopped by my office to share some Christmas cheer and, as is the norm with our discussions, our banter eventually morphed from the insurance industry, local business gossip, Holiday events and parties, family, gifts and the Cleveland Browns, to, finally, of course, Chinese Monetary policy.....as nearly all office conversations do nowadays. Typical Yuletide chit chat.

When we were discussing the relative dollar/RMB strength, my (very smart) friend brought up a reference and a few related thoughts that I hadn't considered since I was a wet-behind-the-ears finance student at the University of Wisconsin, many, many years ago. Thus, the genesis of today's post. The term that came up was.... the "Triffin Dilemma".

For those of you who don't recall, or never had the pleasure of meeting Bob, the Triffin Dilemma is a reference to the work and related 1959 Congressional testimony of Yale economist Robert Triffin, who argued, in a nutshell, that if the US Dollar is/was to remain as the preferred currency to settle the world's international trade, the Treasury would be required to supply "the world" with sufficient US Dollar currency to support global trade growth. As global economic activity would grow, specifically, trade transactions where America wasn't a party (but dollars were....think today's Petro Dollar transactions) the United States would have to run increasingly larger Balance of Payments deficits to support these transactions. (i.e. providing a stable reserve currency for the world's trade).

Simply put, continued, increasing, Balance of Payment (Current Account) deficits would be required by the United States if the US Dollar were to be used as the world's reserve currency.

Triffin argued, well ahead of his contemporaries, that the system would eventually become unsustainable ( the "Dilemma") as the amount of currency (backed by gold) required would mandate unfundable, ever increasing Balance of Payments deficits and/or threaten the confidence/stability of the US Dollar's gold backing/guarantee. The Treasury would be forced to starve the world of dollars.

As is most often the case for truly revolutionary, yet painfully obvious economic thinking, Professor Triffin's work was largely ignored by politicians, bankers and business people until 1971 when everything he'd predicted became reality and what we now refer to as the "Nixon Shock", as Triffin expected, materialized. The administration was forced to abandon the Bretton Woods Agreement, taking America off the gold standard, closing the "gold window", leaving the world with the US Dollar as a floating reserve currency. The US Treasury would no longer exchange US Dollars for gold on demand. The world would become a floating, market dependent fiat currency world. The value of every currency would henceforth be determined by market forces (i.e. relative availability relating to supply and demand). In theory, everything would, of course, be just fine.

So let's take a look at what's happened to the US Economy since we've dumped Bretton Woods, using one of my favorite charts. (I can't take credit for it....citation below)

Beginning in 1947 (when my dad had just come back from his all-expense-paid French vacation on the beaches of Normandy courtesy of the US Army) up to 1971, we note that the bellwether indicators, Real Wages, inflation and GDP were in relative lockstep. This is of course, before Al Gore invented the Internet, and high tech bankers came up with all sorts of sophisticated banking devices. Once we entered a floating world, we observe that the indicators have diverged dramatically over time. US GDP, both per capita and per FTE have skyrocketed. We also note, to our chagrin, (using the collective "our" here presuming that most folks reading this will have some sort of a "job") that Real Weekly Earnings for full time workers are about the same as they were in 1971, even though Real GDP per capita/FTE has skyrocketed, as an apparent byproduct of productivity, as well as labor and capital seeking both its optimum use and lowest financial price-point/cost. Economies around the world have been set free to export (and import) labor (jobs) capital and technology in competitive pursuit of lower costs and greater efficiencies and profits for the businesses who could navigate the new globalism. The chart below describes the net impact of these monetary and regulatory policies on Western governments over time.

Ooopppsss......Oh Geezzz.....I'm sorry, by bad, that's actually a picture of last week's riots in Paris.....my mistake, I'm sure I'll locate that "productivity" graphic shortly, or at least by the time they put the fires out on the Champs-Élysées.

Anyway, as I was saying, here's the chart I was referring to.....

Oh crap.....I screwed this up again....this is actually last month in Venezuela, I guess a little government corruption and "a million percent" inflation, wiping out the life savings of main street folks (they probably didn't get their cash converted to Offshore USD/Euros in time) will rub those poor, pathetic huddled masses the wrong way from time to time. We better get that wall up quickly, the US Southern border is just a few year's walk (maybe six months if they are in good physical shape) for these malnourished, unemployed, starving, "last resort" criminals.....I'll bet they are all members of MS13, or ISIS, or at least being actively recruited....if we could just come up with tear gas that doesn't hurt pregnant women, kids and old people....now that would be a technology worth an IPO!

Ok, now I've got it, here's the chart I was looking for (see below). This chart, although not as graphic as the above photos, should absolutely scare the living-holiday-reindeer-snot out of any highly trained (or barely competent) economist reading it. In economic terms, this chart depicts millions of people on the verge of starvation, going homeless or being shot and/or beaten to death in "real life". Highly trained Economists, as we all know, have a completely different fear threshold than mere mortals.

The chart and table above were constructed based on data from the Financial Stability Board's 2017 Shadow Banking Monitoring report data set (2016 data) and the World Bank Development Indicators Data set (citations below).

The following is the most important statement in this post:

In broad, yet definitive terms, the chart above shows, with clarity, that the US Treasury and the FED have most likely lost control of the US, and by default, the global money/financial system. (Please read that again....it's really important!....I'll wait....go ahead....read that one more time.....let it sink in.)

Ok....take a deep breath.....let's keep going...

A few days ago Janet Yellen discussed the idea that "The FED has no idea what they are doing" as a hypothetical topic (my words not Janet's), in general terms, blaming their "lack of tools", although not fully understanding or acknowledging that her continuation of "Bad Gauges" monetary policy was a major contributor to the gigantic mess we're in today. Basing monetary policy on fudged, sampled, limited domestic metrics when the bulk of the systemic stress relates to foreign monetary policy (China), unregulated (off shore) funds flow, selective dedolarization and the Triffin-esque inability for the US Dollar to remain as the world's reserve currency, has become the undoing of the global financial system as we currently know it.

“I am worried that we are in a deregulatory mode and I see a lot of pressures building in the system to go further to really weaken fundamental safeguards that were created in Dodd-Frank. We are a decade after the financial crisis so that would be worrisome and wrong to do,” Janet Yellen - speaking at the Women in Housing and Finance holiday event (12/12/18).

Hindsight being what it is, all of these "pressures" and off shore capital flight could have been mitigated, at least to some extent, had we begun to normalize interest rates sooner, put in China-style "selective" off shore capital restrictions, both in and out (Caymans, Luxembourg, et al), and taken steps to understand the true origin and exposure to the "brand-spanking-new" US$150+ Trillion in globalized "Fake Money" Financial Assets, destined for default, that US Bankers (read US Taxpayers) will be intimately involved in cleaning up. As usual, the bankers made the mess, the regulators and legislators allowed it to happen....and the taxpayer will pay the bill.

Apparently, the FED has learned little from history, in October 2008, then New York Fed President Timothy Geithner observed that Europe “ran a banking system that was allowed to get very, very big relative to GDP, with huge currency mismatches and with no plans to meet the liquidity needs of their banks in dollars in the event that we face a storm like this.” From the FOMC meeting transcript.

Here's some recent, behind the scenes video of the daily routine at the NY Fed's Open Market desk. Note the sophisticated decision process, based on state of the art data and metrics. The global economy, as we well know, depends on the meticulous execution of FED policy.

It's always been interesting to me that Amazon can track a US$4 parcel, time and date stamped, from Shanghai, to Paramus, to my Cleveland office (knowing virtually everything necessary about the parties involved) and the FED/Treasury can't tell the origin, final destination or purpose (without a court order in a complying jurisdiction) of a $50 Billion, US Dollar, layered wire transfer from Hong Kong to a Cayman Islands Bank. Weird huh?

The FED's ability to manage the US money supply, while other entities are free to create trillions of Off Balance Sheet USD obligations is the equivalent of Amazon trying to do eCommerce without package tracking or inventory control.

Bear in mind that the most recent data (above) is the YE 2016 Data Set. I would suspect that the data has been trending in a similar direction for the past two years. i.e.) it looks much worse today. Based on projected Asset Growth Rates we may have somewhere north of US$370 Trillion of Assets/Obligations on the world's books now, of which a significant chunk could be a tad over valued and poised to default. Of course we won't get the 2018 numbers until the Spring of 2020, which is unfortunate. As always, while the world's economists and politicians are relegated to looking in the rear view mirror, stocks, bonds, debt, derivatives and currencies are being priced in real time.

As you can see (above), I break the data/chart out into two sections, the first is what I call the "Old Money" and the other is what I lovingly refer to as "Fake Money". Old Money is described as that held by established, seasoned, open economies with highly developed transparent, banking, taxation, and monetary systems. Fake Money is best described as money held in jurisdictions where there is less transparency (perhaps a bit of chicanery) with financial asset location/creation and monetary policy, all having little to do with the underlying productivity of the related domestic economies. I've included China, the "usual suspect" Tax Havens (Caymans, Luxembourg, Switzerland, Hong Kong, et. al.) and "Other" (defined as everywhere else) as Fake Money. Before I get bombarded with Greek, Italian, Middle Eastern, etc. emails resulting from my "Other" being defined as "Fake Money" located "everywhere else", keep in mind that as monetary policy goes, and I know you "Other" folks hate to hear this, but you are all along for the monetary ride. Your sovereignty is a wonderful "feel good" convention, but it's largely irrelevant when compared to the Chinese/US/Tax Haven tsunami heading your/our way.

The observations I'd make are as follows, regarding the change in composition from 2008 to 2016:

The "Old Money"

- Since the financial crisis the "World" has created additional financial assets (obligations) of US$81 Trillion (31% increase).

- During the same period, Reported Global GDP has increased US$12.5 Trillion (19% Increase or about 2% at a compound rate) This figure is several US$ Trillion less if you adjust for China's PGDP overstatement.

- Financial Assets housed in the UK, France and Germany have actually declined by 17%. No wonder Paris is burning and Brexit is either happening or not based on the hourly headlines. btw - Do you own any Deutsche Bank stock?

- Financial Assets housed in the Developed "Old Money" jurisdictions (US, UK, Germany, France & Japan) have increased a modest US$12.5 Trillion (7.4% increase or a 1% compound increase)

- The "Old Money" increase, offsetting the decline in the UK, German and France Financial Assets primarily took place in the United States ($22.4 Trillion or a 33% increase) presumably due to "Reserve Currency" obligations (i.e. the Triffin requirement)

The "Fake Money"

- If you've been reading this blog, or any other economic journals, papers or publications for that matter, you won't be shocked to hear that there's a sizable group of us who believe that the Chinese Communist Party has been cooking their books on reported GDP, Debt Levels, Currency, financial statements, transactions, NPL's, Asset Values, SEC filings, etc. etc. and virtually every economic statistic they've published over the last few decades. Shocking....I know...but It's truly bordering on the absurd now. (Luckily this blog is blocked on the Mainland and the CCP probably isn't reading this, so there's little/no chance that I'll be included in the Wanzhou Meng prisoner exchange package....I hope...) Anyway.....

- The "Off Shore" money is comprised of financial assets housed in the Cayman Islands, Luxembourg, the Netherlands, Ireland, Hong Kong, Singapore and Switzerland. (US$51.7 Trillion) In 2016 "Off Shore" assets were approximately the equivalent of all financial assets housed in the UK, France and Germany combined. There is little/no "GDP" directly associated with these Assets. They are "Somebody else's money". But whose?

- The same holds true for "Other". i.e.) Every economy outside of the "Off Shore" Money, the US, China, Japan, the UK, France & Germany...the "rest of the World", houses the equivalent financial assets (US$57 Trillion). Again, this "Other" figure is about the same, in big round numbers, as that of the UK, France and Germany.

- Chinese domiciled financial assets increased from US$13.2 Trillion in 2008 to US$49.1 Trillion in 2016. A 257% increase, or at about a 20% compound rate. (again...not a typo)

- Even though the USD is currently the world's reserve currency, the currency of choice in most trade and global financial transactions, NEARLY ALL of the US$81 Trillion increase in Financial Assets took place in Fake Money jurisdictions.

During the same period (2008 to 2016) Global GDP grew at a compound growth rate of just over 2%. An eyeballing of the figures would suggest that the world didn't require an additional US$81 Trillion of financial assets to create this meager growth. More likely, this relatively large increase in Financial Assets (Generally $6 of assets per year for every $1 of GDP) was a byproduct of capital misallocation, kicking the can down the road, as Central Bankers attempted to stem the inevitable tide of defaults.

In the chart below we examine selected M3 from December 2008 thru August of 2018. We also note that M3 generally tracks the asset growth in the Old Money/Fake Money chart above, with a few notable divergences....I would emphasize, that in the history of economics, we've never seen Money Supply growth/management like this in mature, industrialized economies. Never. We, for emphasis, now have to look at the world's monetary policy through Banana Republic spectacles. That's where we're at.

From the figures, we immediately note that the Eurozone M3 (Including the UK) has increased a whopping 54% (a 5.5% compound rate) while the Financial Assets of Germany, France and the UK have actually been on the decline (see above). The ECB has been funding/carrying under-performing EU economies to the detriment of fiscally responsible economies for a decade. Unfortunately, Mario's amusement park is about to close.

Chinese M3 growth has been, well, I don't know that there's a word for it, a historic outlier perhaps? The Chinese money supply has been growing at a compound rate of 20% (again, that's not a typo either). Also note that China's M3 has declined slightly since the spring of 2018 when it surpassed US$28 Trillion. As we all are well aware, China's fake GDP target has long been 7%-ish. Productive GDP (PGDP) is probably about 4% +/-. A 20% compound increase in M3 and related Financial Asset Values (loans/debt) should be frightening to any economist when compared to a PGDP that low. What could possibly go wrong?

Moving ahead, the world's dollar denominated obligations/assets today are truly unknown. In the "good old days", financial assets in a specific jurisdiction were largely denominated in the domestic currency. Foreign currency was electronically sent "back to where it came from" since domestic markets had little use for it. Italian Citizens didn't own US Treasuries. Russian Oligarchs didn't buy NYC penthouses through shell companies in the Caymans. Chinese "entrepreneurs" didn't put "the world's biggest IPO" on the NYSE. Now they do. Today, there are roughly 200 currencies on the planet and about half of them (my guess) are pegged in some way to the US dollar. Foreign Banks and businesses routinely take (and hold) USDs for domestic transactions, perhaps hedging the currency risk with creative domestic financial products or perhaps not. Per the BIS, there is roughly US$110 Trillion in debt out there now (about a third of all financial assets), about double from 2005. International Debt Securities comprise about US$23 Trillion of that. Of course, most international debt is issued in or pegged to USDs.

We also know that Dollar Loans (i.e. debt that must be serviced and repaid in USD) made to Non-US, Non-Bank Borrowers is about US$10 Trillion now. Note the growth of same....

Today, particularly in the Tax Haven Jurisdictions, we have no way of knowing (at least that I'm aware of) the composition, by currency, of the financial assets (and hence, obligations) held. (Tim Geithner's concerns from the above FED FOMC minutes coming home to roost.) We know that 90%+/- of the FOREX transactions around the globe have the US Dollar on one side of the trade. There must be a reason for that, don't you think?

Anyway, the point of all of this is that all sorts of organizations, businesses and governments, outside the jurisdiction of the FED and the US Treasury, are issuing obligations in US Dollars. Everyone seems to be making promises in US Dollars that, by definition (since access to US Dollars is at least theoretically, at the discretion of the US Financial System, FED/Treasury) they may not be able to keep.

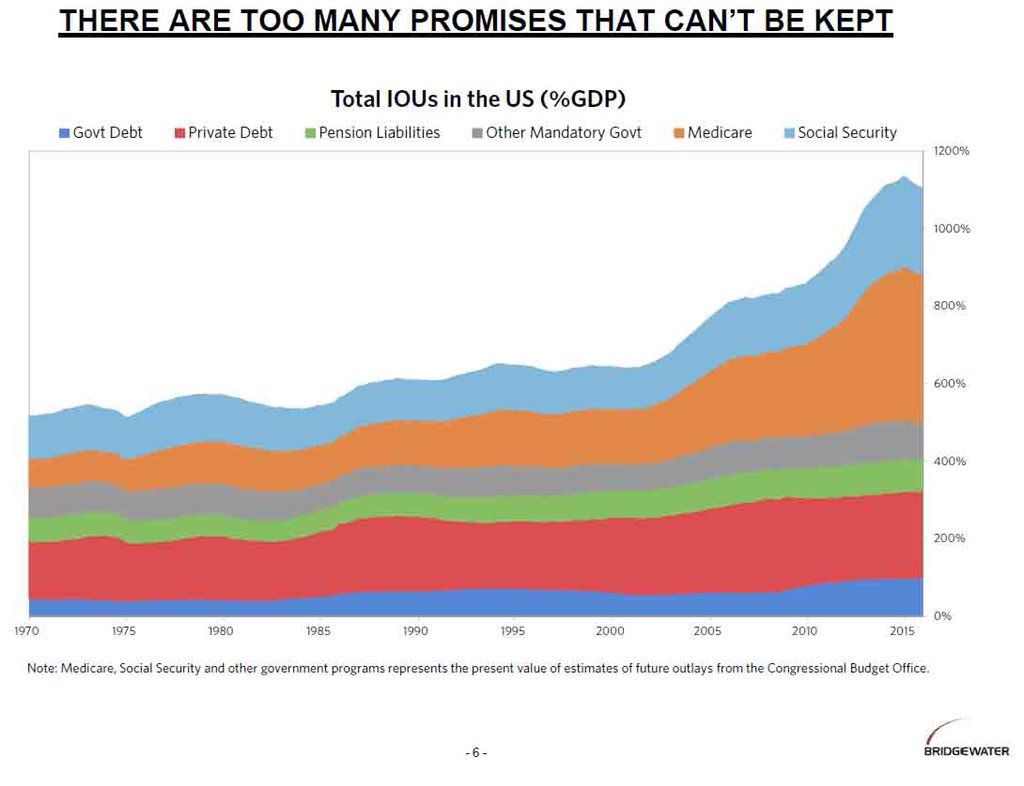

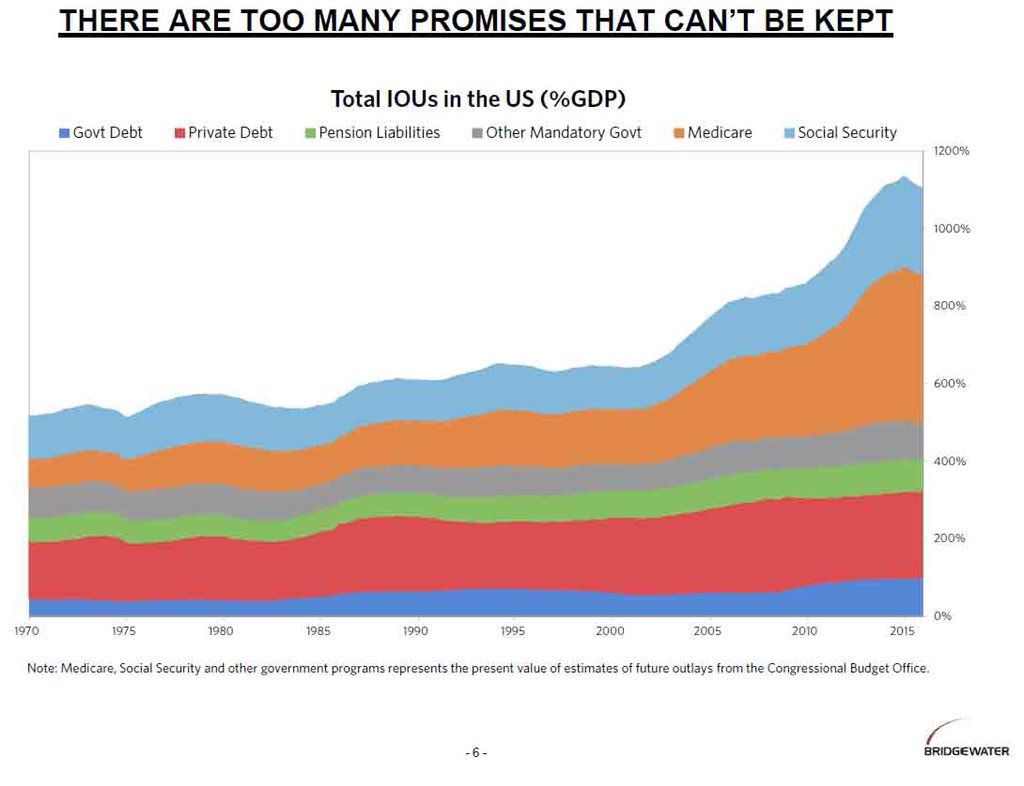

Speaking of "promises" here's a Bridgewater chart from the The Long View @HayekAndKeynes I particularly liked:

The chart is yet another example of the burgeoning obligations being forced, or some would say, self-inflicted, on the US financial system. Some/many of these promises, either foreign or domestic, won't be kept. The only remaining question is which ones and when?

The Changing World.....

The point of all of the above is that the world and the way we finance it has changed significantly since 2008.....the waters are complex and muddied....let's sum it up:

In the chart below we examine selected M3 from December 2008 thru August of 2018. We also note that M3 generally tracks the asset growth in the Old Money/Fake Money chart above, with a few notable divergences....I would emphasize, that in the history of economics, we've never seen Money Supply growth/management like this in mature, industrialized economies. Never. We, for emphasis, now have to look at the world's monetary policy through Banana Republic spectacles. That's where we're at.

From the figures, we immediately note that the Eurozone M3 (Including the UK) has increased a whopping 54% (a 5.5% compound rate) while the Financial Assets of Germany, France and the UK have actually been on the decline (see above). The ECB has been funding/carrying under-performing EU economies to the detriment of fiscally responsible economies for a decade. Unfortunately, Mario's amusement park is about to close.

Chinese M3 growth has been, well, I don't know that there's a word for it, a historic outlier perhaps? The Chinese money supply has been growing at a compound rate of 20% (again, that's not a typo either). Also note that China's M3 has declined slightly since the spring of 2018 when it surpassed US$28 Trillion. As we all are well aware, China's fake GDP target has long been 7%-ish. Productive GDP (PGDP) is probably about 4% +/-. A 20% compound increase in M3 and related Financial Asset Values (loans/debt) should be frightening to any economist when compared to a PGDP that low. What could possibly go wrong?

Moving ahead, the world's dollar denominated obligations/assets today are truly unknown. In the "good old days", financial assets in a specific jurisdiction were largely denominated in the domestic currency. Foreign currency was electronically sent "back to where it came from" since domestic markets had little use for it. Italian Citizens didn't own US Treasuries. Russian Oligarchs didn't buy NYC penthouses through shell companies in the Caymans. Chinese "entrepreneurs" didn't put "the world's biggest IPO" on the NYSE. Now they do. Today, there are roughly 200 currencies on the planet and about half of them (my guess) are pegged in some way to the US dollar. Foreign Banks and businesses routinely take (and hold) USDs for domestic transactions, perhaps hedging the currency risk with creative domestic financial products or perhaps not. Per the BIS, there is roughly US$110 Trillion in debt out there now (about a third of all financial assets), about double from 2005. International Debt Securities comprise about US$23 Trillion of that. Of course, most international debt is issued in or pegged to USDs.

We also know that Dollar Loans (i.e. debt that must be serviced and repaid in USD) made to Non-US, Non-Bank Borrowers is about US$10 Trillion now. Note the growth of same....

Today, particularly in the Tax Haven Jurisdictions, we have no way of knowing (at least that I'm aware of) the composition, by currency, of the financial assets (and hence, obligations) held. (Tim Geithner's concerns from the above FED FOMC minutes coming home to roost.) We know that 90%+/- of the FOREX transactions around the globe have the US Dollar on one side of the trade. There must be a reason for that, don't you think?

Anyway, the point of all of this is that all sorts of organizations, businesses and governments, outside the jurisdiction of the FED and the US Treasury, are issuing obligations in US Dollars. Everyone seems to be making promises in US Dollars that, by definition (since access to US Dollars is at least theoretically, at the discretion of the US Financial System, FED/Treasury) they may not be able to keep.

Speaking of "promises" here's a Bridgewater chart from the The Long View @HayekAndKeynes I particularly liked:

The chart is yet another example of the burgeoning obligations being forced, or some would say, self-inflicted, on the US financial system. Some/many of these promises, either foreign or domestic, won't be kept. The only remaining question is which ones and when?

The Changing World.....

The point of all of the above is that the world and the way we finance it has changed significantly since 2008.....the waters are complex and muddied....let's sum it up:

"Money" is leaving the "Old Money" Domiciles and showing up in Off Shore Tax Havens at an unprecedented rate. The impact here is two fold: First, the fleeing money largely escapes taxation in the originating, home domicile (or anywhere), causing domestic tax revenue shortfalls and increasing budget deficits. Infrastructure and government services become underfunded/unfundable as a result of the capital flight and declining tax base. Second, when this money moves offshore it's rarely used to fund "main street" economic growth anywhere. It's not used to build businesses, bridges, roads or pay wages. It's not spent, it's saved. The money stays in financial products seeking/chasing a higher yield. It creates bubbles and the cycle continues.

We can observe the same thing about Chinese Money, but to a much greater degree. I've written ad nauseam about China's pegged Exchange Rate. Chinese newly printed fake money and related influence is splattered all over the planet now, from Luxembourg to the OBOR participants, to the US$2.733 Trillion (Feb 2018) silly/fake IPO's on US exchanges, to a good chunk of luxury real estate in NYC, Vancouver, Silicon Valley and the Bay Area, etc. etc. With the Chinese Money Supply growing at a 20% compounded clip since 2008, it should not be remotely possible for the exchange rate to remain constant (within a range) when compared to every other major currency, as described in the FRED Chart below (RED Line is the RMB), yet the condition continues to exist. The Chinese Communist Party has managed to "print" trillions of dollars and buy up Western Assets at a huge discount. I've said this often....this was brilliant!

Per the Triffin effect, the FED is left with two options, the first is to provide sufficient (ever increasing) dollar funding as globalization increases, putting tremendous pressure on the dollar and effectively monetizing US financial obligations (this might actually happen "by accident"). Under the current model, as global trade grows, more, cheaper dollars would be required by "the world". Alternatively, the US could tighten (as is happening ever so slightly now), taking dollars out of the system, forcing the world to get by with fewer dollars and/or force a deglobalization/dedollarization, where everyone takes their political & monetary balls and bats and goes home. We're actually starting to see this now e.g. Bop! Zonk! Splat!....it's "Tariff Man!".

(The Long View @HayekAndKeynes)

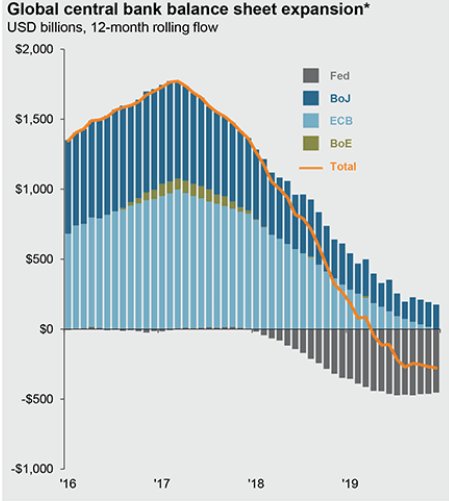

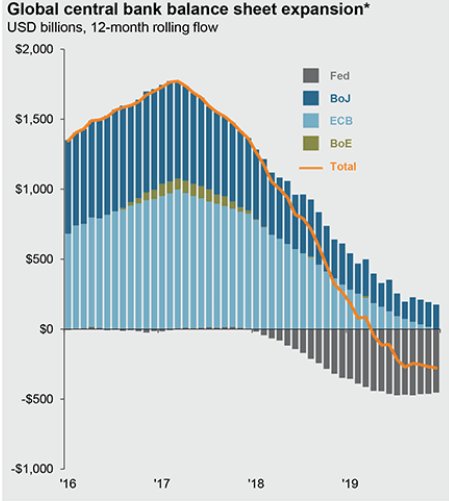

The graphic below is from the December 17th, 2018 Yardini Research briefing. Total Central Bank Assets (FED, ECB, BOJ, PBOC) declining (tightening) by roughly US$1 Trillion since earlier this year to US$19.4 Trillion at the end of November. I discussed these concepts and consequences in a 2016 post entitled: The Theory of Financial Relativity.... The conclusion at the time was "this can go on....until it can't". After reviewing recent central bank activity, it looks like the clock is about to strike "can't".

Central Banks are beginning to shut off the printing presses, shrink balance sheets and tighten. It's the equivalent of "taking away the punch bowl", however, not when the party just gets started, but after a two week bender in Vegas. Remember all of those dollar bonds? Global interest rates are finally (hopefully ever-so slowly and carefully) going up. Remember my 9% rule? For every 1% increase in interest rates, the value of a long bond drops by 9%? That math is going to become painfully relevant again.

If the rest of the world is going to keep "trading", and globalization is going to continue, the "world" will need to come up with a substitute reserve currency, payment system or hybrid. We need some sort of Utopian "floating" world with no cross border exchange restrictions for the dollar to be supplanted. Since, we've come too far down the fiat currency path to go back (cryptos, pork bellies, bologna futures, oil, Glenn Beck's "doomsday" gold coins, or just about any surrogate "hard" assets, are all insufficient in both quantity and infrastructure to support the US$370 Trillion in current financial assets) the most probable course would be, believe it or not, that we continue down the same foolish, special interest supported, meandering path that we've been on, causing all sorts of senseless disruption.

I'd also suggest that today's political environment makes it impossible to solve this problem in a painless fashion. "Cooperation" is a dirty word. Cheating is in vogue. Interestingly, history shows that horrific economic decisions are self correcting over time, although the results can be a bit unpredictable. A heavily armed insurrection or two somewhere wouldn't be out of the question if this spins horribly out of control. History also shows that the Dictators, Kings, Emperors, Imperial Grand Poobahs, El Presidentes' and their regimes rarely thrive when the commoners successfully storm the castle, so we can also expect some relatively radical changes in the way the world works coming to a Twitter feed near you. Civilizations rise and fall based on monetary and economic policy....so let's hope and pray in the spirit of the holidays that this all somehow works out.

We're starting to see fragmented evidence of this "accidental accelerated deglobalization" already.

The "Deep Throat Conundrum" or "Theft by Valuation"

We can observe the same thing about Chinese Money, but to a much greater degree. I've written ad nauseam about China's pegged Exchange Rate. Chinese newly printed fake money and related influence is splattered all over the planet now, from Luxembourg to the OBOR participants, to the US$2.733 Trillion (Feb 2018) silly/fake IPO's on US exchanges, to a good chunk of luxury real estate in NYC, Vancouver, Silicon Valley and the Bay Area, etc. etc. With the Chinese Money Supply growing at a 20% compounded clip since 2008, it should not be remotely possible for the exchange rate to remain constant (within a range) when compared to every other major currency, as described in the FRED Chart below (RED Line is the RMB), yet the condition continues to exist. The Chinese Communist Party has managed to "print" trillions of dollars and buy up Western Assets at a huge discount. I've said this often....this was brilliant!

Per the Triffin effect, the FED is left with two options, the first is to provide sufficient (ever increasing) dollar funding as globalization increases, putting tremendous pressure on the dollar and effectively monetizing US financial obligations (this might actually happen "by accident"). Under the current model, as global trade grows, more, cheaper dollars would be required by "the world". Alternatively, the US could tighten (as is happening ever so slightly now), taking dollars out of the system, forcing the world to get by with fewer dollars and/or force a deglobalization/dedollarization, where everyone takes their political & monetary balls and bats and goes home. We're actually starting to see this now e.g. Bop! Zonk! Splat!....it's "Tariff Man!".

(The Long View @HayekAndKeynes)

The graphic below is from the December 17th, 2018 Yardini Research briefing. Total Central Bank Assets (FED, ECB, BOJ, PBOC) declining (tightening) by roughly US$1 Trillion since earlier this year to US$19.4 Trillion at the end of November. I discussed these concepts and consequences in a 2016 post entitled: The Theory of Financial Relativity.... The conclusion at the time was "this can go on....until it can't". After reviewing recent central bank activity, it looks like the clock is about to strike "can't".

Central Banks are beginning to shut off the printing presses, shrink balance sheets and tighten. It's the equivalent of "taking away the punch bowl", however, not when the party just gets started, but after a two week bender in Vegas. Remember all of those dollar bonds? Global interest rates are finally (hopefully ever-so slowly and carefully) going up. Remember my 9% rule? For every 1% increase in interest rates, the value of a long bond drops by 9%? That math is going to become painfully relevant again.

If the rest of the world is going to keep "trading", and globalization is going to continue, the "world" will need to come up with a substitute reserve currency, payment system or hybrid. We need some sort of Utopian "floating" world with no cross border exchange restrictions for the dollar to be supplanted. Since, we've come too far down the fiat currency path to go back (cryptos, pork bellies, bologna futures, oil, Glenn Beck's "doomsday" gold coins, or just about any surrogate "hard" assets, are all insufficient in both quantity and infrastructure to support the US$370 Trillion in current financial assets) the most probable course would be, believe it or not, that we continue down the same foolish, special interest supported, meandering path that we've been on, causing all sorts of senseless disruption.

I'd also suggest that today's political environment makes it impossible to solve this problem in a painless fashion. "Cooperation" is a dirty word. Cheating is in vogue. Interestingly, history shows that horrific economic decisions are self correcting over time, although the results can be a bit unpredictable. A heavily armed insurrection or two somewhere wouldn't be out of the question if this spins horribly out of control. History also shows that the Dictators, Kings, Emperors, Imperial Grand Poobahs, El Presidentes' and their regimes rarely thrive when the commoners successfully storm the castle, so we can also expect some relatively radical changes in the way the world works coming to a Twitter feed near you. Civilizations rise and fall based on monetary and economic policy....so let's hope and pray in the spirit of the holidays that this all somehow works out.

We're starting to see fragmented evidence of this "accidental accelerated deglobalization" already.

- Global asset values are beginning to correct. Asset prices, real estate, equities, etc. will seek their economically supportable values over time, as they always do. The DJIA swinging down 900 points today (24,057 down to 23,162 in response to a 1/4 point FED rate increase and some guidance) would be one small indicator that this process is underway.

- Current agreements, alliances and "promises" will be broken, NAFTA, TPP, the EU, the WTO, IMF, ACA, NATO, WTF, etc. etc.

- There will be a rush to alliances between global trade partners and financiers based on perceived equitable relationships. The operative word is "perceived" the less astute will be taken advantage of. e.g..) The Chinese will "own" sub Saharan Africa, Venezuela, Pakistan, etc. etc. and all of the issues that go with these nations. We're already beginning to see this with bilateral currency/swap agreements, OBOR, investment commitments, etc. (Recent update)

- There will be a fitful, fragmented, fruitless movement toward a standard global, universal currency, perhaps based on an IMF/SDR concept as is resurrected by the CCP, as you'd expect, from time to time. The PBOC has to do something to prevent the RMB from seeking its true value as they run out of options. Per the IMF and SWIFT today the RMB is used in roughly 2% of global payments. The RMB comprises only about 2% of Global Central Bank reserves. To be blunt, the idea that a propped currency which Chinese citizens feel compelled to stuff in their underwear as they board a plane, just so they can convert it to anything but RMB, might somehow become a "reserve currency" is delusional. My guess is that, again based on the current political environment, all of this effort would be unworkable and the current IMF/SDR framework will simply erode or become non-functional over time. Again, we'll see more trading partners leaving the sandbox as others get burned. The Chinese will blame America and the Americans will blame the Chinese. So it goes.

- Enthusiasm for cross border listings is, of course, on the decline. The SEC actually came out with a recent statement, inexplicably complaining about insufficient audits on Chinese companies that they, oddly enough, are responsible for regulating and chose to approve to list on US Exchanges. Saying in their statement: "224 companies listed on U.S. exchanges, with a combined market capitalization of more than $1.8 trillion, have auditors located in countries that prohibit PCAOB inspections, most of them member firms of the Big 4 global audit networks. Almost all of the audit firms are in China or Hong Kong." To reiterate, the figure I calculated was US$2.733 Trillion in February of 2018 so based on current price declines, US Investors are already down US$900 Billion this year because of these shams. Only US$1.8 Trillion to go..... Nice work Jay!

The "Deep Throat Conundrum" or "Theft by Valuation"

Of course, the rarely discussed corollary to the Triffin Dilemma is what I'll refer to as the "Deep Throat Conundrum".

The Deep Throat Conundrum. simply put, states that, in a floating currency world, an economy which continually runs large Balance of Payments (Current Account) Surpluses, using sufficient currency/capital controls can manage their exchange rate to a pegged value. The "Impossible Trinity" can, for a frightening period of time, become possible.

If said economy (China) so chooses, that economy/country is able to print money and "buy" foreign assets at a whopping discount. (i.e. Today, the PBOC by virtue of accumulated US Dollar reserves, rather than market forces determines the value of the RMB). This "theft by valuation" (e.g. I print money in my basement and you sell me the Waldorf Astoria!....such a deal!) will most likely reset global asset values and topple the global financial system as currently constructed.

The "Conundrum" is only possible because the financial system we've (collectively "the world") developed and accepted is one built on the rationalization of amoral transactions and devices, justified by and in exchange for, significant compensation to the promulgators of same. Carefully crafted legal work, perspective and related legislation directed by special interests, in the name of protecting privacy and promoting free markets has made just about any movement of money both impossible to regulate and "technically" not illegal per se.

Quite a Conundrum indeed.

Our Leadership

Since it looks like we're up against a good old fashioned market meltdown followed by QE money printing the likes of which we've not seen since the Wiemar Republic, enormous debt monitization, an eventual dollar devaluation/crash and an economic contraction of biblical proportions, it's indeed fortunate that we are guided by highly compensated financial professionals, relentless regulators and statesmen whose only concern is the well being of the American people.

Over the last few weeks, as the equity markets have begun to "take a dump" (technical bankers term), Yellen, Clayton, Geithner, Chanos, FED Officials, investors and the talking heads alike have all weighed in, in some form or another, describing in various degrees and terminology that something is a bit "wrong" with the markets. Ray Dalio, a relatively busy guy, actually just took the time to produce a 450 page tome entitled "A Template for Understanding Big Debt Crises". I'm forging through it over the holidays....as you might suspect, it's wonderfully written, but a really a tough read. Lots to absorb and think about. I'd also suspect that, since Ray has always been a big picture, time is of the essence kind of guy, I doubt that while he was writing this, he was thinking that:

"Hey.....everything is fine and dandy right now....perhaps I'll chronicle my concerns about something that could crop up around 2040....I've got nothing better to do.....no time like the present!"

That said, if you recall, back in 2008 "stay the course", "steady as she goes", "no need to panic" and "buy the dip" were all drinking games. Here's just one of the many, many examples of the fantastic, well thought out guidance the US Retail Investor has available at their beck and call on the Internet:

If that's not inspirational enough for you, the video below is an outstanding example of the integrity, truthfulness and transparency that US CEO's have become known for, standing by their decisions, relentlessly, fairly representing the unvarnished truth to their investors regardless of consequences or the impact on their stock price.

Finally, during the Holidays, in this festive time of jubilation, as we share tidings of great joy with our fellow men/women, we must be totally grateful for our political leadership. We are truly blessed to be led by dedicated, compassionate, grounded intellectuals who use their giant "brains" to analyze complex problems, carefully calculating all of the possible permutations, consequences and ramifications of their meticulously crafted bipartisan policy, with their sole concern being the well being of the American people. I, for one, am confident our future is in the best of hands. If anyone can get us through the soon to commence financial crisis, our current leadership can! This administration, working in lockstep with Congress, as our founding fathers had intended, will deftly guide us toward the re-illumination of our shining city on the hill....

Oh Geeezzz.....we are so screwed.....

Oh.....I almost forgot......MERRY CHRISTMAS!

Additional Reading

World Bank Development Indicators

https://datacatalog.worldbank.org/dataset/world-development-indicators

Gross GDP for China

https://fred.stlouisfed.org/series/MKTGDPCNA646NWDB

GDP World

https://fred.stlouisfed.org/series/NYGDPMKTPCDWLD

FSB Shadow Bank Monitoring Report - Excel Dataset

http://www.fsb.org/2018/03/global-shadow-banking-monitoring-report-2017/

Venezuela is in trouble....

https://www.cnbc.com/2016/11/02/venezuelas-problems-get-worse-as-protests-and-riots-become-more-violent.html

China - call for new reserve currency

https://www.ft.com/content/7851925a-17a2-11de-8c9d-0000779fd2ac

The World's Reserve Currency - USD

https://www.thebalance.com/world-currency-3305931

Carnagie Endowment - US Foreign Policy Impact on Middle Class America

https://twitter.com/i/broadcasts/1yoKMjmkLPzGQ

Michael Pettis - Thoughts on China & de-Globalization

https://twitter.com/i/status/1073253716030095360

Jim Chanos - Something wrong.....

https://www.cnbc.com/2018/12/13/jim-chanos-says-theres-something-wrong-with-the-stock-market-when-rates-this-low-cause-panic.html?__source=twitter%7Cmain

US Budget Deficit Widens in November

https://www.bloomberg.com/news/articles/2018-12-13/u-s-budget-deficit-hits-widest-on-record-for-month-of-november

Janet Yellen Comments - Inability of FED Policy to react to the next financial crisis - Market Watch

https://www.marketwatch.com/story/janet-yellen-is-worried-about-the-next-financial-crisis-2018-12-13?mod=mw_share_twitter

BIS - International Credit Markets

https://www.bis.org/ifc/events/ifc_armenia_2018/Tissot.pdf

Really Smart "Brains" are Required

https://www.mediaite.com/online/trump-claims-in-wild-interview-my-gut-tells-me-more-sometimes-than-anybody-elses-brain-can/

McKinsey - A helping hand to authoritarian government

https://www.nytimes.com/2018/12/15/world/asia/mckinsey-china-russia.html

Yardini - Central Bank Balance Sheets

https://www.yardeni.com/pub/peacockfedecbassets.pdf

China's Crumbling Reeducation System - The Onion

(For my Chinese readers out there, this is what's referred to as "Weisenheiming Sarcasm")

https://www.theonion.com/chinese-officials-vow-to-fix-nation-s-crumbling-reeduca-1819577410

The OBOR "dollar problem" - Financial Times

https://ftalphaville.ft.com/2018/12/18/1545130791000/The-Belt-and-Road-s-dollar-problem/

The RMB won't replace the dollar - Financial Times

https://ftalphaville.ft.com/2018/09/19/1537329600000/China-s-currency-will-not-replace-the-US-dollar/

Thanks for all the work you put into this blog, which I enjoy reading very much. Every new lengthy piece you post feels like Christmas. Keep at it!

ReplyDeleteJust going to throw this out there, I agree with all your analysis, and it jives quite well with what Jeff Snyder has been writing about for years regarding the malfunctioning eurodollar system (as he calls it). I responded to your post in October mentioning to look at commodity charts. Commodities in a way are somewhat representative of this offshore dollar expansion, since the offshore dollar creation is used to finance things that require commodities to be purchased (copper for example, which is used heavily in Chinese construction as well as collateral).

ReplyDeleteDollar-linked commodities (that's all commodities, but some more than others) started crashing in 2012, 2014, and have re-started that again in 2018. This is likely a product of this dollar bubble coming unwound as eurodollar dealers step back from the dollar creation business. A proper unwind of this offshore dollar bubble implies that gold would go back to around 400-500 dollars per ounce, copper goes back to approximately 1$ per ounce, oil crashes even further, etc.

I totally agree that the rest of the world wants to de-dollarize, but it's only because they've gorged themselves on all these dollar-based obligations. These countries' and companies' efforts to de-dollarize is a function of liquidity, they're doing it because there is little to no liquidity in this system, and they're desperate to cut the amount of dollars flowing out of the system so they can still repay their obligations. Now that lenders aren't lending as much in dollars (which is essentially a synthetic short on the dollar, and why we got the commodity bubble int he first place) the dollar is rising, and that alone is putting a heavy squeeze on everyone's ability to repay their dollar-based commitments.

So aside from just adding personal commentary and observation, my only thought is that I don't see how the world is going to de-dollarize. They want to do this, but it's only because they've borrowed more than they can afford and don't want to pay back what's owed. Until there is a viable alternative, the biggest risk to the global financial system is going to be the unwind of this eurodollar credit bubble, which first showed how nasty it can be when liquidity dries up back in 2008. There have been (failed) attempts at an alternative, but any real transition is going to take a LOT of compromise, a lot of time, and we'll likely need a global crisis to get people to actually realize how big of an issue this is.

Until then, in my opinion, the dollar should head higher, and commodities should continue to get crushed in the long run. The only solution here is to delay the dollar unwinding by re-starting the dollar lending machine, which just puts more long-term strain on the system, but can temporarily push the dollar lower (which is likely what we saw in 2016-2017).

All they have to do is revalue a certain asset on CB balance sheets and all the dollars needed will be available w/o the liabilities.

Deletemarket meltdown followed by $ crash and money printing ala Wiemar - so how you will get prepared for a scenario like this? Pay down debt? go off grid? because this painful adjustment of biblical proportions to a lot of people might make some crazy/desperate. Safety (food, shelter, personal safety, basic needs) becomes a priority in order to survive, can it get to that point you think? Thank you for well written analysis, eyeopening. And Merry Christmas to you and your loved ones, and a Happy and Healthy New Year.

ReplyDeleteI just.. love your work. I work as an Analyst covering Tech and your blog was the catalyst for me to dig way further into the Chinese plan than I would have otherwise, and I've staked my reputation on the views I developed and executed on. I can't thank you enough, my popcorn (and positions) is ready and watching for what is next.

ReplyDeleteStumbled upon your blog from a link in Jesse's (AC's) "Matieres d' Reflexion". Thoughtful, wonderfully sarcastic, and interesting. I'll be back for more food for thought.

ReplyDeleteIt used to be that the US & old money was the hot money, particularly in foreign markets. Over the past few years, I came to the assumption that China and offshore is the new hot money. It will be interesting to see where it tries to find comfort /survival during the next downturn.

The imbalances in China are probably worse than even some of the most pessimistic estimates. In that respect, even with potentially 1/3 of US GDP imaginary thanks to the creeping share of hedonic adjustments, the US is still one of the better houses on the proverial bad street - I hope. Regards, LM

Loved reading this. Thank you for spending the time writing up your thoughts and observations like this. I must admit, I have a lot to learn to really understand this.

ReplyDeleteThat being said, wouldn't the USD do well when sh*t hits the fan? If so many obligations are USD denominated, and the Fed is reducing the supply of USDs, won't demand for USD go UP? Pardon the dumb question... I must be missing something.

This comment has been removed by the author.

ReplyDelete